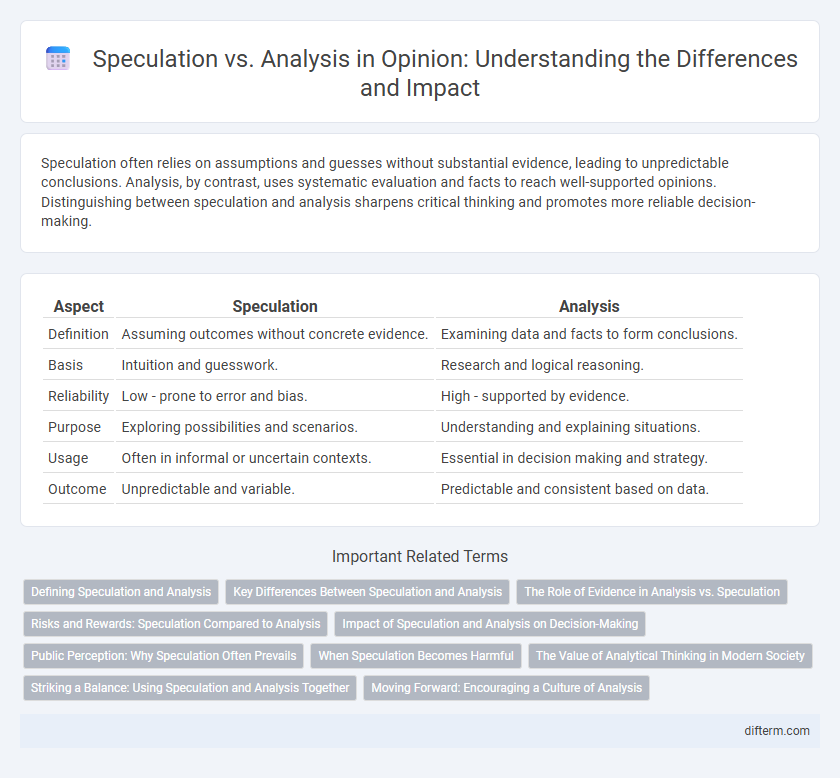

Speculation often relies on assumptions and guesses without substantial evidence, leading to unpredictable conclusions. Analysis, by contrast, uses systematic evaluation and facts to reach well-supported opinions. Distinguishing between speculation and analysis sharpens critical thinking and promotes more reliable decision-making.

Table of Comparison

| Aspect | Speculation | Analysis |

|---|---|---|

| Definition | Assuming outcomes without concrete evidence. | Examining data and facts to form conclusions. |

| Basis | Intuition and guesswork. | Research and logical reasoning. |

| Reliability | Low - prone to error and bias. | High - supported by evidence. |

| Purpose | Exploring possibilities and scenarios. | Understanding and explaining situations. |

| Usage | Often in informal or uncertain contexts. | Essential in decision making and strategy. |

| Outcome | Unpredictable and variable. | Predictable and consistent based on data. |

Defining Speculation and Analysis

Speculation involves forming opinions or predictions based on incomplete information and intuition, often driven by market sentiment and future possibilities. Analysis relies on systematic evaluation of data, evidence, and logical reasoning to make informed decisions or conclusions. Understanding the distinction between speculation and analysis is crucial for risk management and strategic planning in finance and decision-making contexts.

Key Differences Between Speculation and Analysis

Speculation involves making predictions based on incomplete information and intuition, often driven by assumptions or market sentiment without rigorous evidence. Analysis relies on systematic examination of data, facts, and trends to draw informed conclusions supported by logical reasoning and empirical evidence. Understanding these key differences helps investors distinguish between risky guesses and well-founded strategies in decision-making processes.

The Role of Evidence in Analysis vs. Speculation

Evidence anchors analysis, providing verifiable data and factual information that supports logical conclusions and informed decision-making. Speculation, conversely, relies on assumptions and hypothetical scenarios without concrete proof, increasing the risk of bias and error. Robust analysis distinguishes itself by systematically evaluating evidence, whereas speculation often bypasses critical validation processes.

Risks and Rewards: Speculation Compared to Analysis

Speculation involves higher risk due to reliance on quick, less researched decisions, often leading to volatile rewards that can fluctuate dramatically. Analysis, grounded in thorough data evaluation and historical trends, typically minimizes risk by providing a more stable foundation for investment choices. Balancing speculation's potential for rapid gains with analysis's focus on long-term value helps investors manage risks while pursuing sustainable rewards.

Impact of Speculation and Analysis on Decision-Making

Speculation often leads to impulsive decisions fueled by assumptions rather than facts, increasing the risk of errors and financial losses. In contrast, thorough analysis grounds decision-making in data-driven insights, enhancing accuracy and strategic planning. Emphasizing analysis over speculation improves long-term outcomes and fosters confidence among stakeholders.

Public Perception: Why Speculation Often Prevails

Speculation often prevails in public perception because it feeds emotional responses and simplifies complex topics into easily digestible narratives. Analysis requires a deeper understanding and critical thinking, which many avoid in favor of sensational or speculative content that spreads quickly on social media. This preference for speculation over informed analysis can distort public understanding and hinder rational decision-making.

When Speculation Becomes Harmful

Speculation becomes harmful when it distorts market values and fuels irrational decision-making among investors, leading to increased volatility and financial bubbles. Unlike rigorous analysis grounded in data and methodology, speculation often relies on unfounded rumors or emotional reactions, undermining market stability. The consequences include misallocation of resources and erosion of investor confidence, which can have lasting economic impacts.

The Value of Analytical Thinking in Modern Society

Analytical thinking drives informed decision-making by breaking down complex problems into manageable components, enhancing accuracy beyond mere speculation. In modern society, relying on data-driven analysis fosters innovation, reduces cognitive biases, and supports critical evaluation across disciplines like finance, healthcare, and technology. Cultivating analytical skills empowers individuals and organizations to navigate uncertainty with clarity and precision.

Striking a Balance: Using Speculation and Analysis Together

Striking a balance between speculation and analysis enhances decision-making by combining creative foresight with evidence-based reasoning. Speculation fuels innovative ideas and exploring possibilities, while analysis grounds those ideas in data and logical evaluation. Integrating both approaches cultivates well-rounded perspectives that are adaptable and deeply informed.

Moving Forward: Encouraging a Culture of Analysis

Emphasizing analysis over speculation fosters informed decision-making and mitigates risks associated with assumptions. Cultivating a culture that values data-driven insights and critical thinking enhances organizational effectiveness and promotes sustainable growth. Encouraging continuous learning and evidence-based evaluation empowers teams to adapt strategically in dynamic environments.

speculation vs analysis Infographic

difterm.com

difterm.com