Smart mobility cards offer dedicated access to multiple transit systems with stored value and travel benefits, providing convenience without needing a smartphone. Contactless payment enables quick fare transactions via credit or debit cards and mobile wallets, enhancing flexibility for occasional travelers. Both methods streamline boarding but differ in technology integration and user experience.

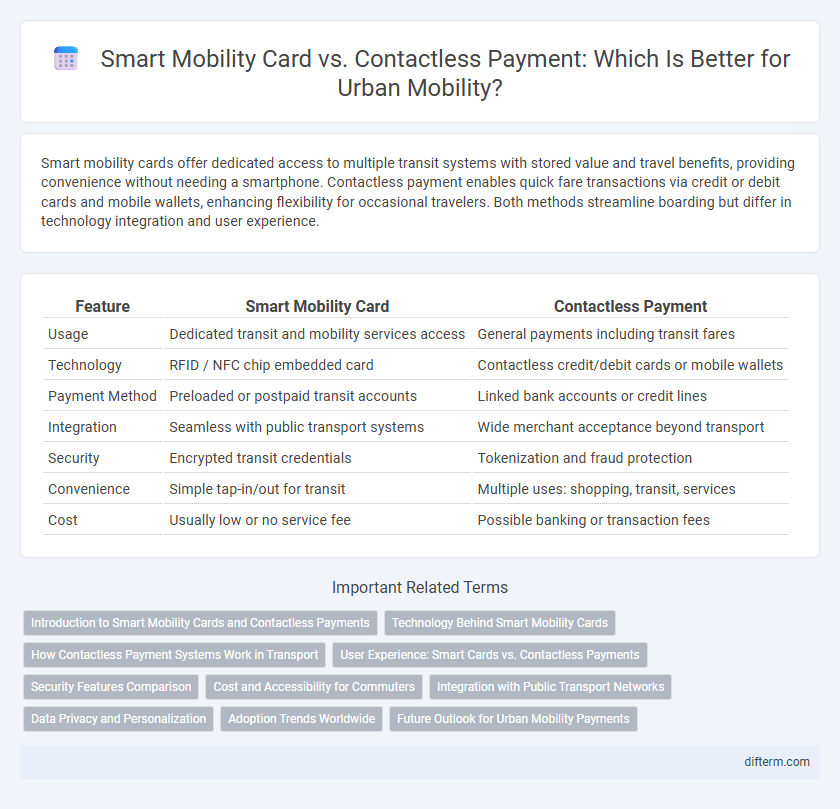

Table of Comparison

| Feature | Smart Mobility Card | Contactless Payment |

|---|---|---|

| Usage | Dedicated transit and mobility services access | General payments including transit fares |

| Technology | RFID / NFC chip embedded card | Contactless credit/debit cards or mobile wallets |

| Payment Method | Preloaded or postpaid transit accounts | Linked bank accounts or credit lines |

| Integration | Seamless with public transport systems | Wide merchant acceptance beyond transport |

| Security | Encrypted transit credentials | Tokenization and fraud protection |

| Convenience | Simple tap-in/out for transit | Multiple uses: shopping, transit, services |

| Cost | Usually low or no service fee | Possible banking or transaction fees |

Introduction to Smart Mobility Cards and Contactless Payments

Smart mobility cards offer a dedicated, secure method for accessing diverse transportation services, enabling seamless travel across buses, trains, and bike-sharing systems with a single, reusable card. Contactless payments leverage NFC technology embedded in smartphones or credit cards, allowing quick, tap-and-go transactions without the need for physical tickets or separate fare cards. Both solutions enhance user convenience and reduce transaction times but differ in integration scope and device dependency within smart city mobility ecosystems.

Technology Behind Smart Mobility Cards

Smart mobility cards leverage embedded RFID and NFC technologies to enable secure, offline transactions and multi-modal transport access, enhancing user convenience and data privacy. Unlike generic contactless payments that rely on broader EMV standards, smart cards integrate tightly with transport operators' back-end systems for real-time fare validation and customer-specific features such as travel history and loyalty rewards. The specialized chip technology in smart mobility cards supports encrypted data exchange and rapid authentication, reducing transaction times and operational costs in urban mobility networks.

How Contactless Payment Systems Work in Transport

Contactless payment systems in transport utilize RFID or NFC technology embedded in cards or mobile devices to enable quick, secure fare transactions by simply tapping on a reader. These systems communicate with the transport operator's backend in real-time to validate and deduct fares, reducing boarding times and improving operational efficiency. Integration with multiple transport modes and automated fare capping enhances user convenience and promotes seamless urban mobility.

User Experience: Smart Cards vs. Contactless Payments

Smart mobility cards provide a streamlined user experience with dedicated transit features, such as balance tracking and fare capping, tailored specifically for daily commuters. Contactless payments offer convenience by integrating transit fare payment into everyday banking cards or mobile wallets, reducing the need to carry multiple cards. However, smart cards often deliver faster validation at transit gates, minimizing delays during peak travel times compared to contactless payment methods.

Security Features Comparison

Smart mobility cards offer enhanced security features such as encrypted data storage and multi-factor authentication, reducing the risk of unauthorized access compared to contactless payment methods. Contactless payments rely heavily on tokenization and secure element chips, but remain vulnerable to relay attacks and card cloning. Advanced biometric verification integrated into smart mobility cards further strengthens identity confirmation, providing superior protection in urban transportation systems.

Cost and Accessibility for Commuters

Smart mobility cards offer lower transaction fees and stable pricing structures compared to contactless payment methods, reducing overall commuting costs. They provide enhanced accessibility by supporting offline usage and tailored fare options for frequent travelers, whereas contactless payments depend on internet connectivity and standard bank charges. For commuters seeking budget-friendly and reliable access to public transport, smart mobility cards deliver greater financial efficiency and convenience.

Integration with Public Transport Networks

Smart mobility cards offer seamless integration with public transport networks by enabling unified access across buses, trains, and trams through a single, dedicated card system. Contactless payment methods, such as NFC-enabled bank cards or smartphones, provide flexible payment options but may face limitations in fare capping and multi-modal transfers within complex transit systems. Transport authorities often prefer smart mobility cards for their ability to support tailored fare structures and real-time data collection, enhancing overall system efficiency and passenger convenience.

Data Privacy and Personalization

Smart mobility cards offer enhanced data privacy by storing travel information securely within the card's chip, minimizing exposure to external networks. In contrast, contactless payment methods often involve third-party payment gateways that collect extensive user data, raising concerns about data privacy. Personalization in smart mobility cards allows tailored travel benefits and usage limits based on individual commuting patterns, whereas contactless payments provide limited personalization focused mainly on payment preferences.

Adoption Trends Worldwide

Smart mobility cards demonstrate higher adoption rates in urban centers across Asia and Europe, driven by integrated transit networks and government initiatives promoting seamless travel. Contactless payment methods, fueled by widespread smartphone use and NFC technology, see rapid growth in North America and parts of Europe, especially for occasional riders and tourists. Data from global transit authorities reveal a steady increase in combined usage, indicating a trend towards multimodal payment solutions that enhance user convenience and system interoperability.

Future Outlook for Urban Mobility Payments

Smart mobility cards and contactless payments are transforming urban mobility by enabling seamless, cashless transactions across multiple transportation modes. The future outlook emphasizes integrated platforms combining mobility cards with mobile wallets, facilitating real-time fare adjustments and personalized travel options. Advanced technologies like NFC, blockchain, and AI-driven analytics will further enhance security, user convenience, and data-driven urban planning.

Smart mobility card vs Contactless payment Infographic

difterm.com

difterm.com