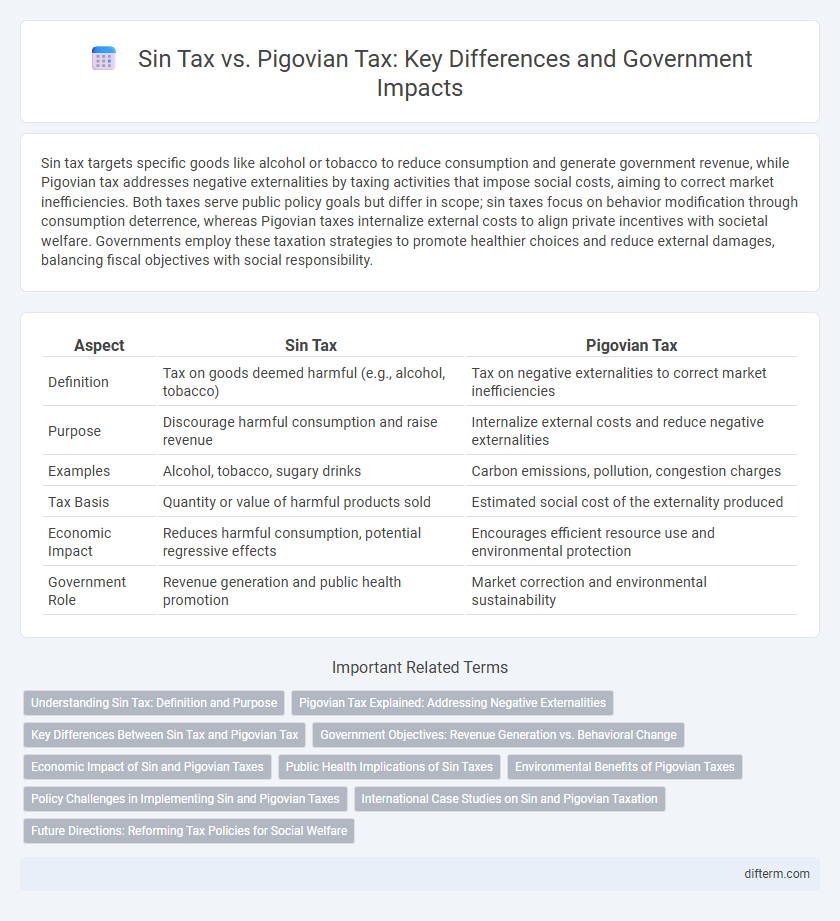

Sin tax targets specific goods like alcohol or tobacco to reduce consumption and generate government revenue, while Pigovian tax addresses negative externalities by taxing activities that impose social costs, aiming to correct market inefficiencies. Both taxes serve public policy goals but differ in scope; sin taxes focus on behavior modification through consumption deterrence, whereas Pigovian taxes internalize external costs to align private incentives with societal welfare. Governments employ these taxation strategies to promote healthier choices and reduce external damages, balancing fiscal objectives with social responsibility.

Table of Comparison

| Aspect | Sin Tax | Pigovian Tax |

|---|---|---|

| Definition | Tax on goods deemed harmful (e.g., alcohol, tobacco) | Tax on negative externalities to correct market inefficiencies |

| Purpose | Discourage harmful consumption and raise revenue | Internalize external costs and reduce negative externalities |

| Examples | Alcohol, tobacco, sugary drinks | Carbon emissions, pollution, congestion charges |

| Tax Basis | Quantity or value of harmful products sold | Estimated social cost of the externality produced |

| Economic Impact | Reduces harmful consumption, potential regressive effects | Encourages efficient resource use and environmental protection |

| Government Role | Revenue generation and public health promotion | Market correction and environmental sustainability |

Understanding Sin Tax: Definition and Purpose

Sin tax is a government-imposed levy on goods and services deemed harmful, such as tobacco, alcohol, and sugary beverages, designed to reduce consumption and generate public revenue. Its primary purpose is to discourage unhealthy behaviors while offsetting the social costs associated with these products, like healthcare expenses. By increasing prices, sin tax aims to influence consumer choices and improve public health outcomes.

Pigovian Tax Explained: Addressing Negative Externalities

Pigovian tax targets negative externalities by imposing costs equivalent to the social damage caused by certain activities, effectively correcting market inefficiencies. It incentivizes producers and consumers to reduce harmful behaviors like pollution or tobacco consumption by aligning private costs with public costs. Unlike sin taxes, which primarily generate revenue and discourage specific goods for moral reasons, Pigovian taxes are grounded in economic theory to internalize external costs and promote social welfare.

Key Differences Between Sin Tax and Pigovian Tax

Sin tax specifically targets goods deemed harmful, such as tobacco, alcohol, and sugary drinks, to reduce consumption and generate revenue. Pigovian tax is a broader economic tool designed to correct negative externalities by internalizing social costs associated with activities like pollution or traffic congestion. While sin taxes focus on health-related behaviors, Pigovian taxes address any external cost impacting societal welfare.

Government Objectives: Revenue Generation vs. Behavioral Change

Sin taxes primarily target revenue generation by imposing higher costs on goods like tobacco and alcohol, helping governments fund public projects and healthcare systems. Pigovian taxes aim to correct negative externalities by incentivizing behavioral change, such as reducing pollution or unhealthy consumption. Governments often balance these taxes to both increase public funds and promote social welfare through altered consumer behaviors.

Economic Impact of Sin and Pigovian Taxes

Sin taxes and Pigovian taxes both aim to address negative externalities by discouraging harmful behaviors, yet they differ in scope and economic impact. Sin taxes primarily target products like tobacco, alcohol, and sugary drinks, generating government revenue while reducing consumption and associated health costs. Pigovian taxes extend beyond sin goods to internalize broader societal costs from pollution or congestion, promoting resource efficiency and long-term welfare improvements.

Public Health Implications of Sin Taxes

Sin taxes, imposed on products like tobacco, alcohol, and sugary beverages, aim to reduce consumption and improve public health by discouraging harmful behaviors. Evidence shows that higher sin tax rates correlate with decreased smoking rates and lower alcohol-related health issues, leading to reduced healthcare costs and improved community well-being. Unlike broader Pigovian taxes that internalize externalities across various industries, sin taxes specifically target health-damaging goods, directly influencing public health outcomes.

Environmental Benefits of Pigovian Taxes

Pigovian taxes, designed to internalize negative externalities, effectively reduce environmental harm by directly targeting pollution and resource depletion with financial incentives. Unlike sin taxes, which primarily focus on curbing harmful behaviors like smoking and alcohol consumption, Pigovian taxes impose costs proportional to the environmental damage caused, encouraging businesses and individuals to adopt sustainable practices. Empirical evidence from carbon pricing and emission trading systems demonstrates significant reductions in greenhouse gas emissions, showcasing the environmental benefits of Pigovian tax policies in promoting greener economies.

Policy Challenges in Implementing Sin and Pigovian Taxes

Implementing sin taxes and Pigovian taxes faces policy challenges such as accurately quantifying externalities to set optimal tax rates, avoiding regressive impacts on low-income populations, and preventing tax evasion or illicit markets. Government agencies must balance revenue generation goals with public health objectives while ensuring transparent administration and compliance mechanisms. Political resistance and lobbying by affected industries often complicate the adoption and enforcement of these corrective taxation policies.

International Case Studies on Sin and Pigovian Taxation

International case studies reveal diverse applications of sin and Pigovian taxes targeting public health and environmental externalities. Countries like Mexico implemented sin taxes on sugary beverages, resulting in significant reductions in consumption and obesity rates. Meanwhile, Pigovian taxes on carbon emissions in Sweden and British Columbia have effectively curbed greenhouse gas outputs while funding sustainable initiatives.

Future Directions: Reforming Tax Policies for Social Welfare

Sin taxes, levied on goods harmful to public health like tobacco and alcohol, and Pigovian taxes, designed to correct negative externalities, are pivotal tools for government revenue and social welfare enhancement. Future reforms must integrate dynamic pricing models that reflect real-time health and environmental costs, ensuring equitable burden distribution and incentivizing positive behavior changes. Leveraging data analytics and behavioral economics can optimize tax structures to maximize public health benefits and minimize socioeconomic disparities.

Sin Tax vs Pigovian Tax Infographic

difterm.com

difterm.com