Regulatory capture occurs when government agencies tasked with regulating industries become dominated by the interests they are meant to oversee, leading to decisions that favor businesses over the public. Rent seeking involves individuals or companies lobbying for special privileges or subsidies to increase their own wealth without creating new value, often resulting in inefficient allocation of resources. Both phenomena undermine effective governance by distorting market competition and weakening regulatory objectives.

Table of Comparison

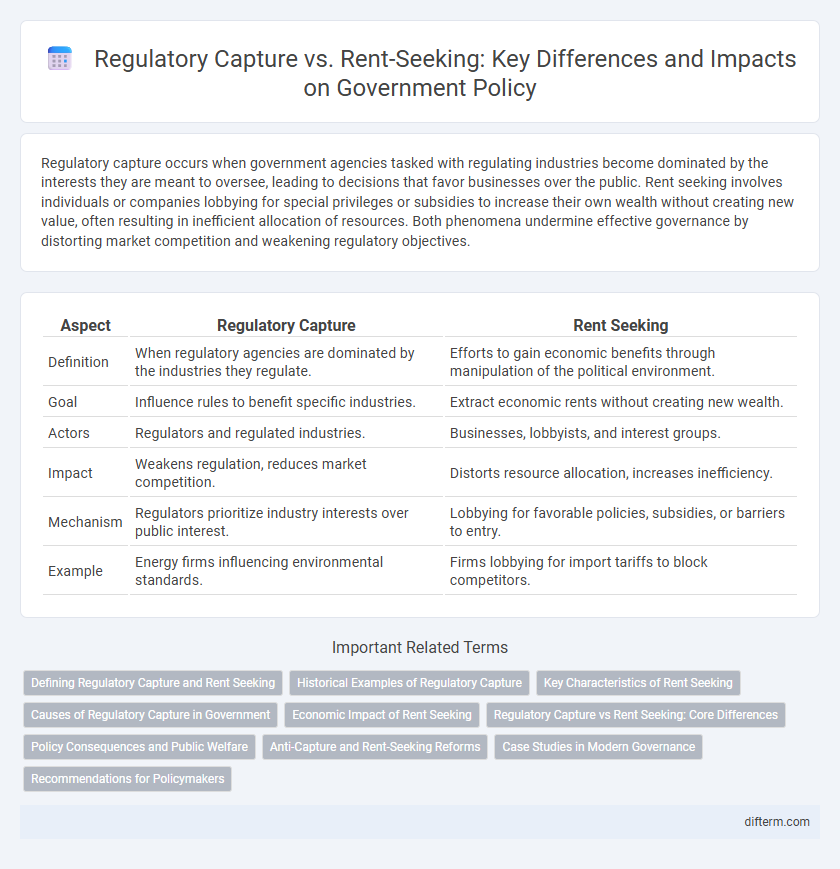

| Aspect | Regulatory Capture | Rent Seeking |

|---|---|---|

| Definition | When regulatory agencies are dominated by the industries they regulate. | Efforts to gain economic benefits through manipulation of the political environment. |

| Goal | Influence rules to benefit specific industries. | Extract economic rents without creating new wealth. |

| Actors | Regulators and regulated industries. | Businesses, lobbyists, and interest groups. |

| Impact | Weakens regulation, reduces market competition. | Distorts resource allocation, increases inefficiency. |

| Mechanism | Regulators prioritize industry interests over public interest. | Lobbying for favorable policies, subsidies, or barriers to entry. |

| Example | Energy firms influencing environmental standards. | Firms lobbying for import tariffs to block competitors. |

Defining Regulatory Capture and Rent Seeking

Regulatory capture occurs when regulatory agencies prioritize the interests of the industries they regulate over the public good, leading to biased policies that favor established businesses. Rent seeking involves individuals or firms trying to gain economic benefits through manipulation or exploitation of the regulatory environment without creating new wealth. Both concepts illustrate how government regulations can be subverted to serve private interests rather than promote fair competition and efficiency.

Historical Examples of Regulatory Capture

Historical examples of regulatory capture are evident in the 20th-century U.S. Interstate Commerce Commission, which was influenced by railroad companies to enact favorable policies limiting competition. Similarly, the 1980s savings and loan crisis exposed how financial institutions shaped regulatory frameworks to permit risky behaviors that ultimately required government bailouts. These cases highlight how entrenched industry interests can dominate regulatory bodies, undermining public welfare and effective governance.

Key Characteristics of Rent Seeking

Rent seeking involves individuals or organizations using political influence to secure economic gains without reciprocating benefits to society, often through lobbying or manipulating regulations. It is characterized by efforts to obtain exclusive rights, subsidies, or tariffs that limit competition and create inefficiencies in markets. Unlike regulatory capture, which entails agencies serving industry interests, rent seeking focuses on extracting value without producing new wealth.

Causes of Regulatory Capture in Government

Regulatory capture occurs when government agencies tasked with overseeing industries become dominated by the very entities they regulate, often due to close relationships, lobbying, and revolving door employment. Economic dependencies, information asymmetry favoring regulated firms, and limited agency resources further contribute to the capture by reducing regulatory independence and enforcement rigor. This dynamic undermines public interest by shifting policy outcomes toward special interest groups rather than broad societal benefits.

Economic Impact of Rent Seeking

Rent seeking leads to economic inefficiencies by redirecting resources towards lobbying and political influence rather than productive activities, increasing costs for businesses and consumers. Regulatory capture often results in policies that favor incumbent firms, reducing competition and stifling innovation in the market. The economic impact includes distorted market signals, reduced investment incentives, and overall slower economic growth.

Regulatory Capture vs Rent Seeking: Core Differences

Regulatory capture occurs when regulatory agencies are dominated by the industries or interests they are supposed to regulate, leading to decisions that benefit private interests over public welfare. Rent seeking involves individuals or companies using resources to gain economic advantages through manipulation of the regulatory environment rather than through productive economic activities. The core difference lies in regulatory capture being a systemic issue where regulators are influenced or controlled, while rent seeking is a strategic behavior by market participants aiming to extract economic rents.

Policy Consequences and Public Welfare

Regulatory capture occurs when regulatory agencies advance the interests of the industries they are supposed to oversee, leading to weakened policy enforcement and increased market inefficiencies that harm public welfare. Rent seeking involves individuals or firms exploiting the political process to obtain economic gains without reciprocal benefits to society, resulting in resource misallocation and reduced overall economic growth. Both phenomena undermine effective governance by distorting policy outcomes, increasing corruption risks, and diminishing social trust in public institutions.

Anti-Capture and Rent-Seeking Reforms

Effective anti-capture and rent-seeking reforms in government require enhancing transparency and accountability mechanisms to prevent regulatory agencies from favoring special interest groups. Implementing strict lobbying regulations and promoting competitive markets reduces opportunities for rent-seeking behaviors that distort policy outcomes and resource allocation. Strengthening institutional frameworks through independent oversight bodies and public participation ensures regulatory decisions serve the broader public interest rather than narrow private gains.

Case Studies in Modern Governance

Regulatory capture occurs when regulatory agencies advance the interests of the industries they regulate, as evidenced by the U.S. Federal Aviation Administration's relationship with major airlines, leading to relaxed safety oversight. Rent seeking manifests in cases like the 2008 financial crisis, where banks lobbied for favorable policies that prioritized profits over public welfare, distorting economic outcomes. Comparative analysis of governance in the European Union and India highlights how different institutional frameworks influence the prevalence and impact of regulatory capture and rent seeking in policy formulation.

Recommendations for Policymakers

Policymakers should strengthen transparency measures and enhance regulatory oversight to prevent regulatory capture by entrenched interests. Implementing strict conflict-of-interest rules and promoting competitive market entry can mitigate rent-seeking behavior. Continuous monitoring and independent audits are essential to maintain the integrity of regulatory frameworks and ensure public welfare.

Regulatory Capture vs Rent Seeking Infographic

difterm.com

difterm.com