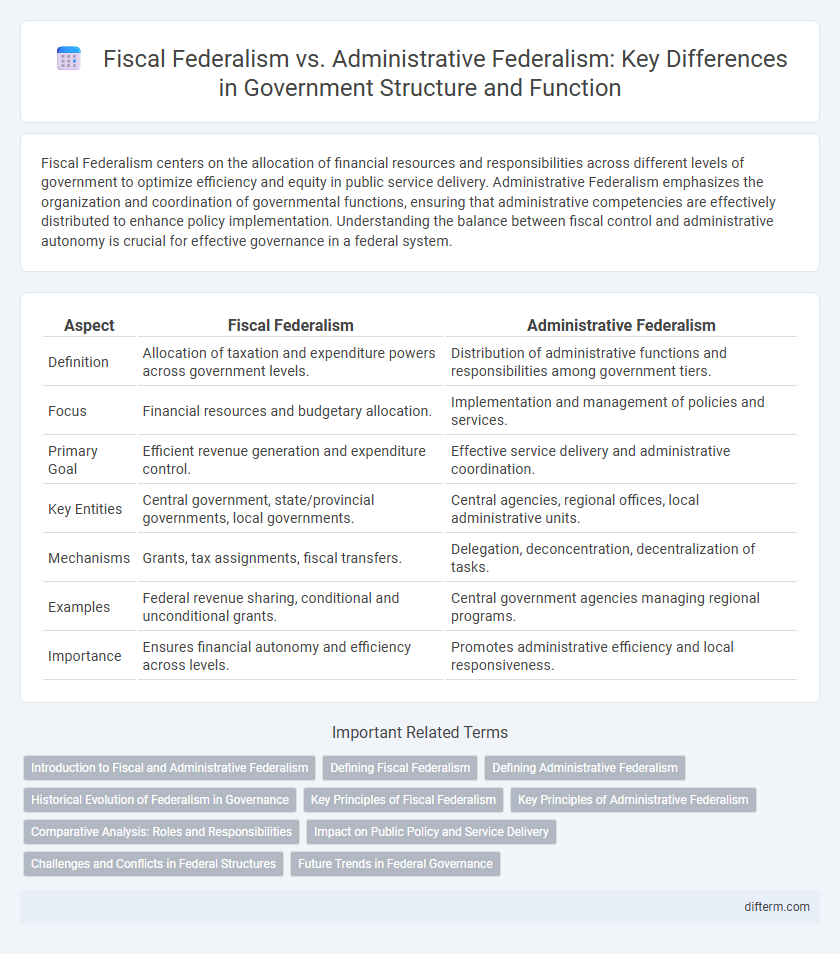

Fiscal Federalism centers on the allocation of financial resources and responsibilities across different levels of government to optimize efficiency and equity in public service delivery. Administrative Federalism emphasizes the organization and coordination of governmental functions, ensuring that administrative competencies are effectively distributed to enhance policy implementation. Understanding the balance between fiscal control and administrative autonomy is crucial for effective governance in a federal system.

Table of Comparison

| Aspect | Fiscal Federalism | Administrative Federalism |

|---|---|---|

| Definition | Allocation of taxation and expenditure powers across government levels. | Distribution of administrative functions and responsibilities among government tiers. |

| Focus | Financial resources and budgetary allocation. | Implementation and management of policies and services. |

| Primary Goal | Efficient revenue generation and expenditure control. | Effective service delivery and administrative coordination. |

| Key Entities | Central government, state/provincial governments, local governments. | Central agencies, regional offices, local administrative units. |

| Mechanisms | Grants, tax assignments, fiscal transfers. | Delegation, deconcentration, decentralization of tasks. |

| Examples | Federal revenue sharing, conditional and unconditional grants. | Central government agencies managing regional programs. |

| Importance | Ensures financial autonomy and efficiency across levels. | Promotes administrative efficiency and local responsiveness. |

Introduction to Fiscal and Administrative Federalism

Fiscal federalism involves the allocation of taxation powers and expenditure responsibilities across different levels of government to optimize resource use and enhance public service delivery. Administrative federalism focuses on the organization, coordination, and management of government agencies within the federal system to ensure efficient policy implementation and intergovernmental relations. Both frameworks address the division of functions, financial resources, and administrative authority to promote fiscal discipline and effective governance in a multi-level government structure.

Defining Fiscal Federalism

Fiscal federalism refers to the division of governmental functions and financial relations among levels of government, where central, state, and local authorities allocate resources and responsibilities to optimize economic efficiency and equity. It involves intergovernmental transfers, tax assignments, and expenditure responsibilities designed to balance regional disparities and ensure efficient public service delivery. This concept underpins decentralized fiscal decision-making, enabling subnational governments to tailor policies to local needs while maintaining national cohesion.

Defining Administrative Federalism

Administrative Federalism refers to the distribution of administrative responsibilities and functions between national, state, and local governments, emphasizing the delegation of tasks to ensure efficient governance. It focuses on the management of public programs, policy implementation, and coordination among various government levels rather than the allocation of financial resources. Unlike Fiscal Federalism, which centers on revenue sharing and budgetary autonomy, Administrative Federalism prioritizes bureaucratic organization and intergovernmental collaboration to deliver public services effectively.

Historical Evolution of Federalism in Governance

Fiscal federalism emerged during the early 20th century as governments sought efficient revenue distribution and financial accountability between federal and subnational units. Administrative federalism evolved with the expansion of bureaucratic institutions, emphasizing decentralized implementation of policies and local public service delivery. Both models reflect historical shifts in governance aimed at balancing central authority with regional autonomy in managing resources and administrative functions.

Key Principles of Fiscal Federalism

Fiscal Federalism centers on the allocation of taxing and spending powers among various levels of government to promote efficiency, equity, and macroeconomic stability. Key principles include the assignment of revenue sources to the government levels best suited to collect them, vertical fiscal imbalance management, and fiscal autonomy to enable subnational governments to tailor policies to local preferences. This framework contrasts with Administrative Federalism, which emphasizes the distribution of administrative responsibilities and service delivery rather than fiscal powers.

Key Principles of Administrative Federalism

Administrative Federalism centers on the delegation of authority from the central government to regional or local administrations to improve policy execution and public service delivery. Key principles include decentralized decision-making, intergovernmental coordination, and clearly defined roles and responsibilities to ensure accountability and efficiency in governance. This approach emphasizes administrative autonomy within the framework of the broader federal system, enhancing responsiveness to local needs while maintaining national cohesion.

Comparative Analysis: Roles and Responsibilities

Fiscal federalism delineates the allocation of financial resources and tax authority among different government tiers, emphasizing revenue distribution and expenditure responsibilities. Administrative federalism centers on the implementation of policies and public services, highlighting coordination mechanisms and regulatory functions across federal, state, and local levels. Comparative analysis reveals fiscal federalism prioritizes economic autonomy and budgetary control, while administrative federalism focuses on efficient governance, intergovernmental relations, and service delivery optimization.

Impact on Public Policy and Service Delivery

Fiscal federalism significantly influences public policy and service delivery by determining the allocation of financial resources and taxing powers among different government levels, enabling tailored regional policies and efficient funding of public services. Administrative federalism shapes the implementation and coordination of policies through decentralized bureaucratic structures, promoting responsiveness and adaptability in service provision to meet local needs. Both frameworks impact governance effectiveness, with fiscal federalism concentrating on resource distribution and administrative federalism focusing on operational management and policy execution.

Challenges and Conflicts in Federal Structures

Fiscal federalism faces challenges such as intergovernmental fiscal imbalances and inefficiencies arising from unequal resource distribution across states or regions, leading to conflicts over revenue-sharing and expenditure responsibilities. Administrative federalism encounters difficulties in coordination and policy implementation due to overlapping jurisdictions, bureaucratic fragmentation, and inconsistent regulatory frameworks among federal, state, and local governments. Both models struggle with balancing autonomy and central control, resulting in tensions that influence governance effectiveness and service delivery across federal systems.

Future Trends in Federal Governance

Future trends in federal governance emphasize increased fiscal autonomy for regional governments under Fiscal Federalism, promoting tailored economic policies and efficient resource allocation. Administrative Federalism is evolving toward enhanced intergovernmental collaboration and digital integration to streamline service delivery and policy implementation. Advances in technology and the growing demand for accountability are driving reforms that balance centralized oversight with decentralized administrative innovation.

Fiscal Federalism vs Administrative Federalism Infographic

difterm.com

difterm.com