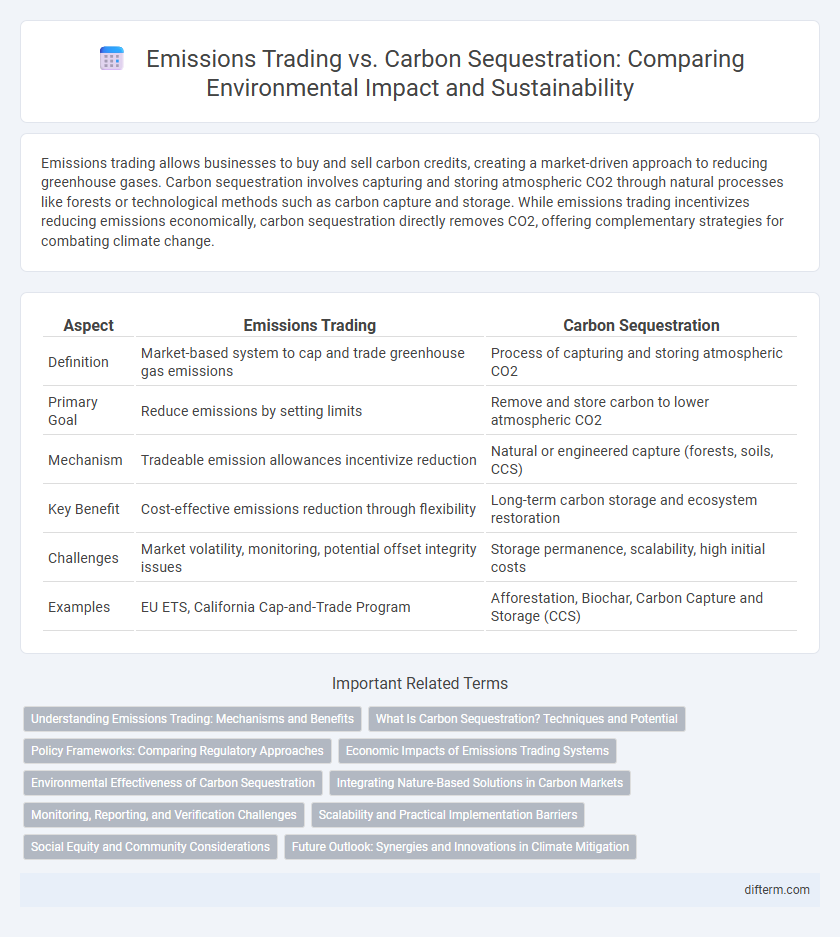

Emissions trading allows businesses to buy and sell carbon credits, creating a market-driven approach to reducing greenhouse gases. Carbon sequestration involves capturing and storing atmospheric CO2 through natural processes like forests or technological methods such as carbon capture and storage. While emissions trading incentivizes reducing emissions economically, carbon sequestration directly removes CO2, offering complementary strategies for combating climate change.

Table of Comparison

| Aspect | Emissions Trading | Carbon Sequestration |

|---|---|---|

| Definition | Market-based system to cap and trade greenhouse gas emissions | Process of capturing and storing atmospheric CO2 |

| Primary Goal | Reduce emissions by setting limits | Remove and store carbon to lower atmospheric CO2 |

| Mechanism | Tradeable emission allowances incentivize reduction | Natural or engineered capture (forests, soils, CCS) |

| Key Benefit | Cost-effective emissions reduction through flexibility | Long-term carbon storage and ecosystem restoration |

| Challenges | Market volatility, monitoring, potential offset integrity issues | Storage permanence, scalability, high initial costs |

| Examples | EU ETS, California Cap-and-Trade Program | Afforestation, Biochar, Carbon Capture and Storage (CCS) |

Understanding Emissions Trading: Mechanisms and Benefits

Emissions trading, also known as cap-and-trade, establishes a market-based mechanism that limits total greenhouse gas emissions by allocating emission permits to companies, which can be bought or sold depending on their emission levels. This system incentivizes businesses to reduce emissions cost-effectively while promoting innovation in cleaner technologies. The flexibility of emissions trading helps achieve national and international climate targets more efficiently compared to direct regulation.

What Is Carbon Sequestration? Techniques and Potential

Carbon sequestration involves capturing and storing atmospheric carbon dioxide to mitigate climate change by reducing greenhouse gas levels. Techniques include biological methods like afforestation and soil carbon enhancement, as well as technological approaches such as carbon capture and storage (CCS) at industrial sites. The potential of carbon sequestration lies in its ability to offset emissions from sectors difficult to decarbonize, contributing significantly to achieving net-zero targets.

Policy Frameworks: Comparing Regulatory Approaches

Emissions trading schemes establish market-based regulatory frameworks that set cap limits on greenhouse gas emissions while allowing trading of emission permits to incentivize reductions. Carbon sequestration policies prioritize regulatory measures that support natural or technological methods to capture and store atmospheric carbon dioxide, such as afforestation mandates or carbon capture and storage incentives. Comparing these approaches reveals emissions trading focuses on flexible compliance and cost-effectiveness, whereas carbon sequestration emphasizes direct removal and long-term carbon storage under targeted regulatory oversight.

Economic Impacts of Emissions Trading Systems

Emissions trading systems (ETS) create economic incentives by assigning a market price to carbon emissions, encouraging companies to reduce their carbon footprint efficiently. These systems stimulate innovation and investment in low-carbon technologies by allowing firms to trade emission permits, thereby optimizing costs across sectors. While emissions trading can generate government revenue through permit auctions, it also poses risks of market volatility and uneven cost distribution among industries and consumers.

Environmental Effectiveness of Carbon Sequestration

Carbon sequestration enhances environmental effectiveness by directly reducing atmospheric CO2 levels through natural processes like afforestation and soil carbon storage. Unlike emissions trading, which allows continued pollution by enabling carbon credit trading, sequestration targets the removal and long-term storage of greenhouse gases, leading to more stable climate mitigation. This approach supports biodiversity preservation and soil health, amplifying its ecological benefits beyond mere carbon reduction.

Integrating Nature-Based Solutions in Carbon Markets

Integrating nature-based solutions in carbon markets enhances emissions trading by incorporating carbon sequestration through forests, wetlands, and soil restoration. These approaches create verified carbon credits, promoting sustainable land management and biodiversity conservation while providing economic incentives for climate action. Expanding nature-based projects within emissions trading systems supports global carbon reduction targets by leveraging natural processes to absorb atmospheric CO2.

Monitoring, Reporting, and Verification Challenges

Emissions trading systems face significant Monitoring, Reporting, and Verification (MRV) challenges due to the need for precise, transparent, and continuous data on emission sources to ensure accurate credit allocation and market integrity. Carbon sequestration projects encounter complex MRV issues related to quantifying stored carbon over extended periods, detecting leakage, and verifying permanence against natural disturbances. Advanced technologies like remote sensing and blockchain are increasingly deployed to improve MRV accuracy and stakeholder trust in both approaches.

Scalability and Practical Implementation Barriers

Emissions trading offers scalability through market-based incentives, enabling large-scale carbon reduction by allowing companies to buy and sell emission permits efficiently. Carbon sequestration faces practical implementation barriers such as high costs, technological complexity, and land availability constraints, limiting its rapid deployment. Scalability of carbon sequestration is further challenged by monitoring requirements and permanence concerns, making emissions trading more adaptable for broad environmental policies.

Social Equity and Community Considerations

Emissions trading systems often raise concerns about social equity as they can disproportionately impact low-income communities by allowing wealthier polluters to buy emission allowances instead of reducing pollution locally. Carbon sequestration projects, particularly nature-based solutions like reforestation, provide more direct community benefits such as job creation and ecosystem services, yet may risk land rights conflicts if not managed inclusively. Ensuring community participation and equitable benefit-sharing is critical in both strategies to address environmental justice and prevent exacerbating social inequalities.

Future Outlook: Synergies and Innovations in Climate Mitigation

Emissions trading markets are expected to evolve with enhanced integration of carbon sequestration projects, creating hybrid approaches that optimize both carbon pricing and long-term storage solutions. Innovations in monitoring technologies, such as satellite-based verification systems and blockchain for transparent accounting, will enable more accurate tracking of carbon credits tied to sequestration efforts. Synergistic policies promoting joint investments in emissions reductions and natural carbon sinks will drive scalable climate mitigation strategies crucial for meeting global net-zero targets.

emissions trading vs carbon sequestration Infographic

difterm.com

difterm.com