Trip cancellation insurance provides coverage if you need to cancel your travel plans before departure due to covered reasons such as illness or emergencies, allowing you to recover non-refundable expenses. Trip interruption insurance covers costs incurred when your trip is unexpectedly cut short after it has begun, including return travel and unused accommodations. Understanding the distinctions helps travelers protect their investment and ensure they receive compensation for disruptions at different stages of their journey.

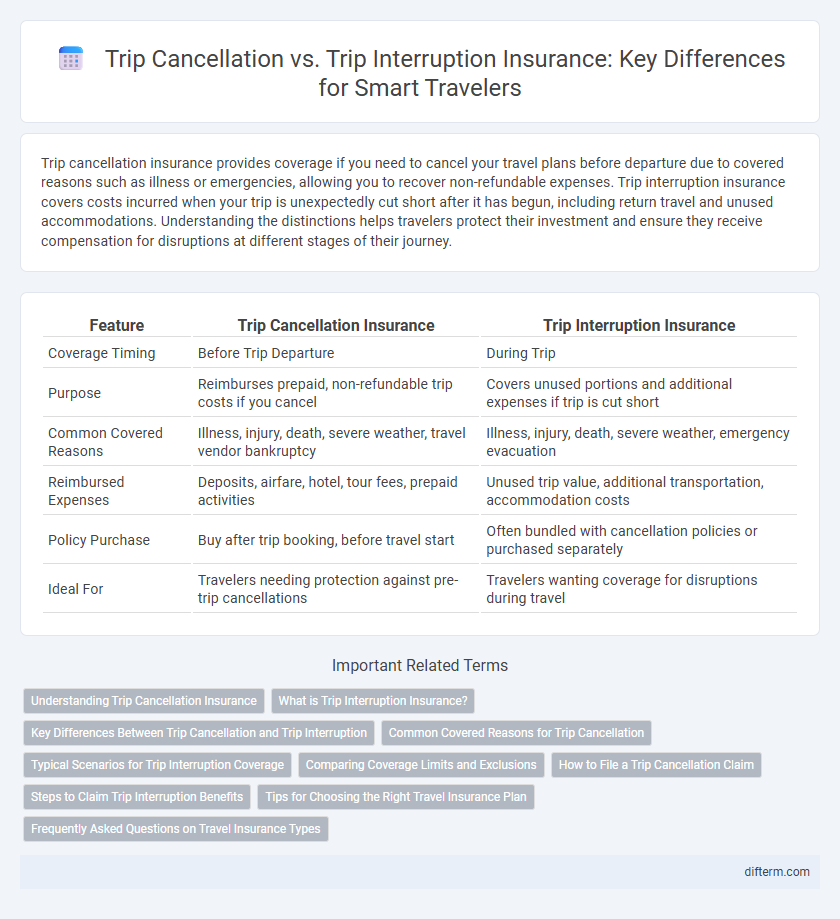

Table of Comparison

| Feature | Trip Cancellation Insurance | Trip Interruption Insurance |

|---|---|---|

| Coverage Timing | Before Trip Departure | During Trip |

| Purpose | Reimburses prepaid, non-refundable trip costs if you cancel | Covers unused portions and additional expenses if trip is cut short |

| Common Covered Reasons | Illness, injury, death, severe weather, travel vendor bankruptcy | Illness, injury, death, severe weather, emergency evacuation |

| Reimbursed Expenses | Deposits, airfare, hotel, tour fees, prepaid activities | Unused trip value, additional transportation, accommodation costs |

| Policy Purchase | Buy after trip booking, before travel start | Often bundled with cancellation policies or purchased separately |

| Ideal For | Travelers needing protection against pre-trip cancellations | Travelers wanting coverage for disruptions during travel |

Understanding Trip Cancellation Insurance

Trip cancellation insurance reimburses non-refundable expenses if you must cancel your trip due to covered reasons such as illness, severe weather, or travel provider bankruptcy. This coverage protects prepaid costs like airfare, hotel reservations, and tours when cancellation occurs before departure. Understanding policy terms and covered causes is essential for effective financial protection against unexpected trip cancellations.

What is Trip Interruption Insurance?

Trip interruption insurance covers unexpected disruptions during your journey, reimbursing non-refundable expenses when you must cut your trip short due to emergencies like illness, natural disasters, or transportation failures. Unlike trip cancellation insurance, which protects prepaid costs before departure, trip interruption insurance provides financial protection for events occurring after the trip has begun. This coverage ensures travelers recover costs for unused accommodations, missed tours, and unexpected return travel expenses.

Key Differences Between Trip Cancellation and Trip Interruption

Trip cancellation insurance reimburses prepaid, non-refundable trip costs if you cancel before departure due to covered reasons like illness or emergencies. Trip interruption insurance covers unused portions of the trip and additional expenses if you must cut your trip short or change plans after it has begun. Understanding these key differences helps travelers choose the right coverage based on whether coverage is needed before or during the trip.

Common Covered Reasons for Trip Cancellation

Trip cancellation insurance typically covers unexpected events such as illness, injury, or death of the traveler or a family member, severe weather conditions, or travel supplier bankruptcy that force the cancellation of a trip before departure. Common covered reasons also include jury duty, military deployment, or natural disasters impacting the destination. Understanding these specific coverage scenarios is essential for travelers to protect their prepaid expenses and avoid financial loss.

Typical Scenarios for Trip Interruption Coverage

Typical scenarios for trip interruption coverage include unexpected events such as natural disasters, airline strikes, or medical emergencies that force travelers to cut their trips short. This insurance reimburses non-refundable expenses and additional transportation costs to return home early or continue the journey. Unlike trip cancellation insurance, which covers pre-departure losses, trip interruption coverage protects travelers after the trip has started.

Comparing Coverage Limits and Exclusions

Trip cancellation insurance primarily covers non-refundable expenses if you cancel your trip before departure due to covered reasons, with coverage limits often tied to the total prepaid trip cost; exclusions commonly include changes in travel plans or pre-existing conditions not disclosed. Trip interruption insurance reimburses unused portions of a trip and additional expenses if a trip is cut short due to covered events, with limits varying but generally encompassing lodging, transportation, and meals; exclusions frequently involve factors like strikes, financial defaults, or events deemed avoidable. Understanding the specific coverage limits and common exclusions for both policies is crucial to selecting the appropriate protection based on travel plans and potential risks.

How to File a Trip Cancellation Claim

To file a trip cancellation claim, promptly notify your insurance provider and submit a detailed claim form including your original trip itinerary, proof of payment, and evidence of the reason for cancellation such as a medical certificate or airline cancellation notice. Retain all receipts and documentation related to non-refundable expenses and any communications with service providers. Follow up with the insurance company for claim status and provide any additional information requested to expedite processing under trip cancellation or trip interruption insurance policies.

Steps to Claim Trip Interruption Benefits

To claim trip interruption insurance benefits, promptly notify your insurer with your policy details and the reason for interruption, supported by documentation such as medical reports or travel advisories. Submit all required forms, including proof of expenses incurred due to the interruption, such as receipts for additional accommodations or transportation. Keep detailed records of communication and expenses to ensure a smooth reimbursement process for non-refundable trip costs and unexpected return travel expenses.

Tips for Choosing the Right Travel Insurance Plan

Evaluate your travel plans and risks to determine whether trip cancellation or trip interruption insurance offers better coverage for your needs. Prioritize policies with clear refund terms, comprehensive coverage for unforeseen events, and minimal exclusions related to health or travel disruptions. Compare insurer reputations, claim processing times, and customer reviews to ensure reliable support during emergencies.

Frequently Asked Questions on Travel Insurance Types

Trip cancellation insurance reimburses prepaid, non-refundable expenses if you cancel your trip before departure due to covered reasons such as illness or emergencies. Trip interruption insurance covers costs incurred if your trip is cut short or interrupted after you've started traveling, including unused portions of your trip and additional transportation expenses. Understanding the differences helps travelers choose coverage that best protects their investment against unforeseen disruptions.

trip cancellation vs trip interruption insurance Infographic

difterm.com

difterm.com