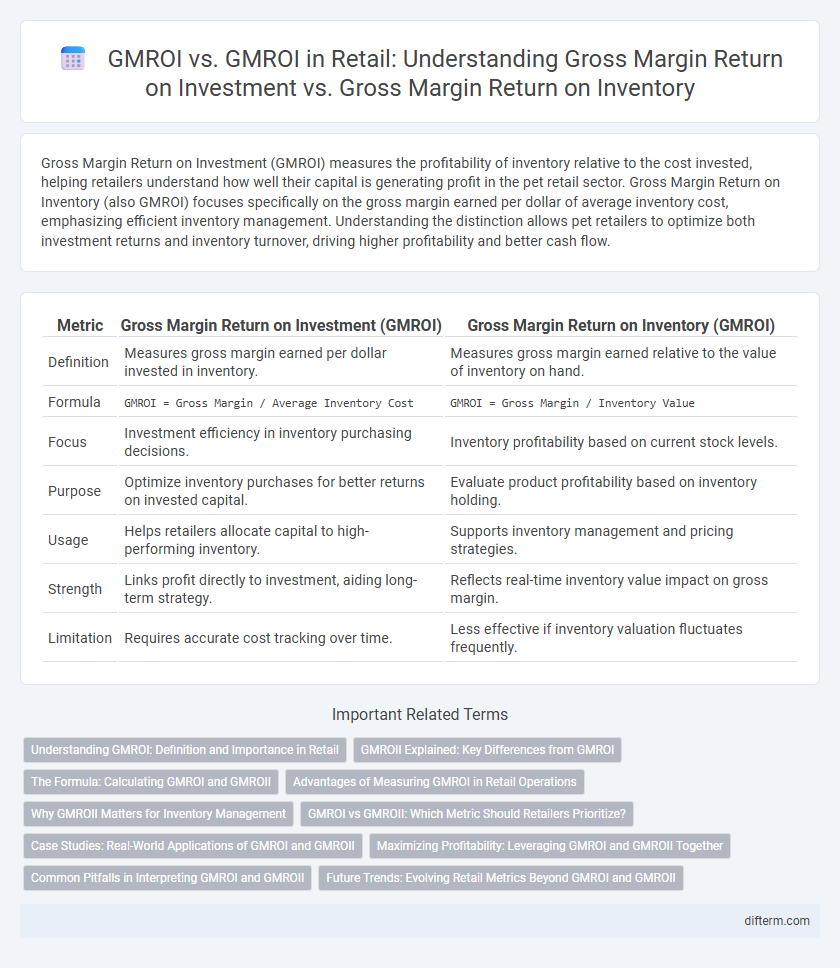

Gross Margin Return on Investment (GMROI) measures the profitability of inventory relative to the cost invested, helping retailers understand how well their capital is generating profit in the pet retail sector. Gross Margin Return on Inventory (also GMROI) focuses specifically on the gross margin earned per dollar of average inventory cost, emphasizing efficient inventory management. Understanding the distinction allows pet retailers to optimize both investment returns and inventory turnover, driving higher profitability and better cash flow.

Table of Comparison

| Metric | Gross Margin Return on Investment (GMROI) | Gross Margin Return on Inventory (GMROI) |

|---|---|---|

| Definition | Measures gross margin earned per dollar invested in inventory. | Measures gross margin earned relative to the value of inventory on hand. |

| Formula | GMROI = Gross Margin / Average Inventory Cost |

GMROI = Gross Margin / Inventory Value |

| Focus | Investment efficiency in inventory purchasing decisions. | Inventory profitability based on current stock levels. |

| Purpose | Optimize inventory purchases for better returns on invested capital. | Evaluate product profitability based on inventory holding. |

| Usage | Helps retailers allocate capital to high-performing inventory. | Supports inventory management and pricing strategies. |

| Strength | Links profit directly to investment, aiding long-term strategy. | Reflects real-time inventory value impact on gross margin. |

| Limitation | Requires accurate cost tracking over time. | Less effective if inventory valuation fluctuates frequently. |

Understanding GMROI: Definition and Importance in Retail

Gross Margin Return on Investment (GMROI) measures the profitability of inventory by calculating the gross margin earned for every dollar invested in inventory, providing retailers with critical insights into how efficiently their capital is generating profit. Unlike Gross Margin Return on Inventory, which focuses solely on inventory value, GMROI incorporates the cost of merchandise to balance profitability and inventory cost, making it a vital metric for inventory management strategies. Retailers use GMROI to optimize stock levels, improve product assortment, and increase overall financial performance by identifying high-performing inventory items.

GMROII Explained: Key Differences from GMROI

Gross Margin Return on Inventory Investment (GMROII) measures profitability by comparing gross margin to the average inventory cost, highlighting inventory efficiency, while Gross Margin Return on Investment (GMROI) assesses gross margin relative to total inventory investment including carrying costs. GMROII places stronger emphasis on inventory turnover and cost control, making it more precise for retail inventory management. Understanding GMROII helps retailers optimize stock levels and improve profitability beyond what traditional GMROI indicates.

The Formula: Calculating GMROI and GMROII

Gross Margin Return on Investment (GMROI) is calculated by dividing gross margin by average inventory cost, emphasizing profitability relative to investment. Gross Margin Return on Inventory Investment (GMROII) refines this by using average inventory retail value instead of cost, providing insight into sales efficiency per inventory dollar. Both formulas serve as key performance indicators in retail, aiding in inventory management and profitability analysis.

Advantages of Measuring GMROI in Retail Operations

Measuring Gross Margin Return on Investment (GMROI) in retail operations provides a precise evaluation of inventory profitability by correlating gross margin with the actual investment in stock, enabling better capital allocation and inventory management. GMROI highlights the efficiency of inventory turnover and profit generation, helping retailers optimize product assortment and reduce carrying costs. This metric offers actionable insights that drive informed pricing strategies and enhance overall financial performance compared to simply assessing gross margin return on inventory.

Why GMROII Matters for Inventory Management

GMROII (Gross Margin Return On Inventory Investment) is crucial for retail inventory management because it measures the profitability of inventory relative to its cost, providing insights into how effectively inventory dollars generate profit. Unlike GMROI, which focuses on gross margin relative to average inventory cost, GMROII incorporates the investment aspect, enabling retailers to optimize stock levels and maximize returns on each dollar invested in inventory. This metric drives strategic purchasing decisions, reduces excess stock, and improves cash flow by identifying high-performing products with strong sales velocity and profit margins.

GMROI vs GMROII: Which Metric Should Retailers Prioritize?

GMROI (Gross Margin Return on Investment) measures profitability by comparing gross margin to inventory cost, while GMROII (Gross Margin Return on Inventory Investment) relates gross margin to average inventory cost, emphasizing inventory efficiency. Retailers prioritizing GMROI focus on profit relative to capital invested, beneficial for capital-intensive sectors, whereas GMROII highlights inventory turnover and sales efficiency, crucial for fast-moving retail segments. Selecting between GMROI and GMROII depends on balancing capital investment with inventory management goals to optimize overall retail margin performance.

Case Studies: Real-World Applications of GMROI and GMROII

Case studies reveal that GMROI effectively measures profitability by relating gross margin to inventory cost, aiding retailers in optimizing stock purchases for enhanced returns. In contrast, GMROII evaluates gross margin relative to average inventory investment cost, providing deeper insights into inventory turnover efficiency and capital utilization. Retailers leveraging GMROII in real-world applications often achieve higher inventory profitability by balancing sales velocity with margin performance.

Maximizing Profitability: Leveraging GMROI and GMROII Together

Maximizing profitability in retail requires leveraging both Gross Margin Return on Investment (GMROI) and Gross Margin Return on Inventory Investment (GMROII) to optimize financial performance. GMROI measures profit generated per dollar invested in inventory, while GMROII focuses on profit relative to actual inventory levels over time, offering complementary insights. Combining GMROI's investment efficiency with GMROII's turnover analysis enables retailers to strategically balance inventory costs and sales velocity, driving higher overall margins.

Common Pitfalls in Interpreting GMROI and GMROII

Common pitfalls in interpreting GMROI and GMROII arise from overlooking that GMROI measures profit return relative to inventory cost, while GMROII factors in inventory selling price, leading to skewed profitability assessments if mixed. Confusing these metrics can result in poor inventory investment decisions by failing to account for markdown impacts or varying cost structures. Accurate interpretation requires a clear distinction between cost-based and price-based inventory evaluations to optimize retail profitability.

Future Trends: Evolving Retail Metrics Beyond GMROI and GMROII

Future retail analytics emphasize integrated metrics beyond traditional GMROI and GMROII, incorporating real-time data on consumer behavior, inventory turnover, and omnichannel sales performance. Advanced AI-driven tools enable retailers to optimize capital allocation by assessing product profitability alongside supply chain efficiency and dynamic pricing strategies. Predictive analytics and machine learning models increasingly drive decision-making, prioritizing customer lifetime value and personalized marketing ROI over conventional gross margin measurements.

gross margin return on investment (GMROI) vs gross margin return on inventory (GMROI) Infographic

difterm.com

difterm.com