Digital wallets in retail pet stores enable seamless payment processing and loyalty program integration, enhancing the overall shopping experience. Mobile wallets, typically accessed via smartphones, offer added convenience by allowing instant payments and digital coupons directly at the point of sale. Both technologies drive increased customer engagement and streamline transactions in the pet retail industry.

Table of Comparison

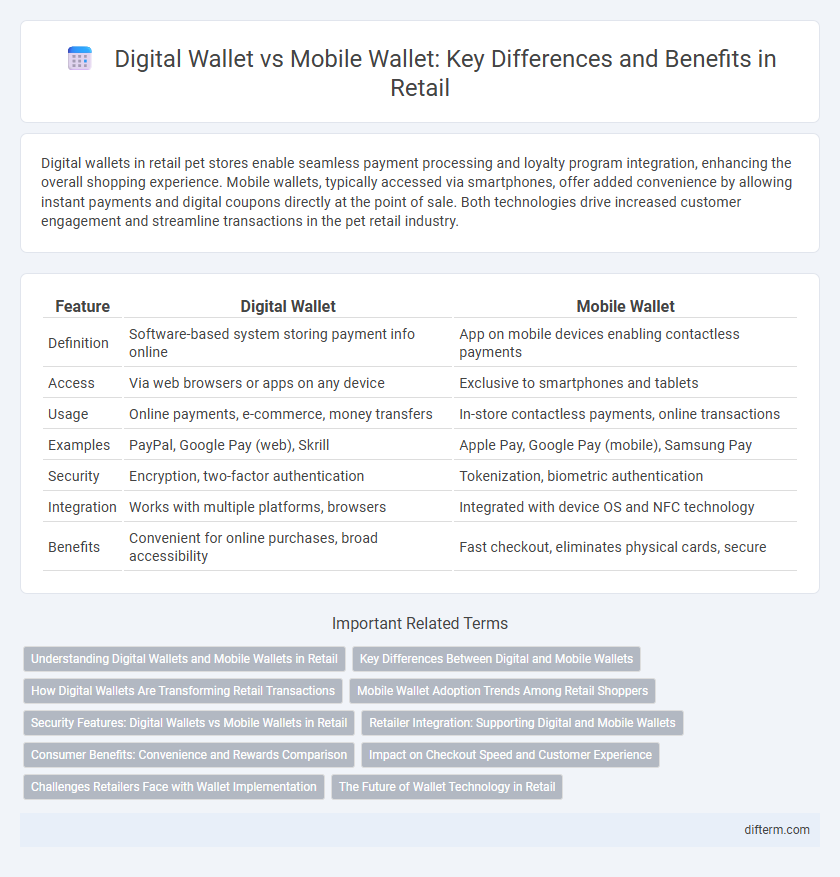

| Feature | Digital Wallet | Mobile Wallet |

|---|---|---|

| Definition | Software-based system storing payment info online | App on mobile devices enabling contactless payments |

| Access | Via web browsers or apps on any device | Exclusive to smartphones and tablets |

| Usage | Online payments, e-commerce, money transfers | In-store contactless payments, online transactions |

| Examples | PayPal, Google Pay (web), Skrill | Apple Pay, Google Pay (mobile), Samsung Pay |

| Security | Encryption, two-factor authentication | Tokenization, biometric authentication |

| Integration | Works with multiple platforms, browsers | Integrated with device OS and NFC technology |

| Benefits | Convenient for online purchases, broad accessibility | Fast checkout, eliminates physical cards, secure |

Understanding Digital Wallets and Mobile Wallets in Retail

Digital wallets store payment information electronically, enabling secure transactions in retail environments, while mobile wallets specifically refer to apps on smartphones that facilitate contactless payments and loyalty programs. Retailers benefit from both by enhancing customer convenience and streamlining checkout processes through NFC technology and QR codes. The integration of digital and mobile wallets improves data-driven marketing and personalized shopping experiences, driving increased sales and customer retention.

Key Differences Between Digital and Mobile Wallets

Digital wallets store payment information securely on cloud-based platforms accessible via multiple devices, while mobile wallets are specifically apps installed on smartphones or tablets for in-store and online transactions. Digital wallets support broader functionalities, including integration with loyalty programs and peer-to-peer payments, whereas mobile wallets primarily facilitate contactless payments using NFC or QR codes. Security features differ as digital wallets often use tokenization and multi-factor authentication, while mobile wallets rely heavily on device-level security such as biometrics and PINs.

How Digital Wallets Are Transforming Retail Transactions

Digital wallets streamline retail transactions by enabling consumers to make secure, contactless payments using encrypted data instead of physical cards, significantly reducing checkout times. Integration with loyalty programs and personalized promotions enhances customer engagement and drives repeat purchases by leveraging purchase history and behavior analytics. Retailers benefit from real-time transaction tracking and reduced fraud risk, optimizing inventory management and sales strategies through data-driven insights.

Mobile Wallet Adoption Trends Among Retail Shoppers

Mobile wallet adoption among retail shoppers has surged, driven by seamless in-store payments, loyalty integration, and personalized offers. Retailers leveraging NFC technology and secure biometric authentication report increased transaction speed and customer satisfaction. Data indicates a 40% year-over-year growth in mobile wallet usage at point-of-sale terminals, reflecting shifting consumer preferences toward contactless payment solutions.

Security Features: Digital Wallets vs Mobile Wallets in Retail

Digital wallets and mobile wallets both offer encrypted transactions and multi-factor authentication to protect user data in retail environments. Digital wallets typically provide enhanced security through tokenization and biometric verification, reducing the risk of fraud during online purchases. Mobile wallets integrate device-specific security features such as Secure Element and Trusted Execution Environment, ensuring secure payment processing at physical retail points of sale.

Retailer Integration: Supporting Digital and Mobile Wallets

Retailers integrate digital wallets and mobile wallets to streamline payment processes and enhance customer experience, enabling seamless transactions via NFC, QR codes, or app-based solutions. Supporting both digital wallets, which store various payment methods and loyalty cards, and mobile wallets, embedded directly in smartphones, allows retailers to cater to diverse consumer preferences and increase checkout speed. Advanced POS systems equipped with APIs facilitate easy integration, ensuring compatibility with major wallet providers like Apple Pay, Google Wallet, and Samsung Pay, ultimately driving higher customer engagement and sales.

Consumer Benefits: Convenience and Rewards Comparison

Digital wallets streamline retail transactions by securely storing multiple payment methods, enabling faster checkouts and reducing the need for physical cards. Mobile wallets, integrated within smartphones, offer enhanced convenience through biometric authentication, location-based deals, and seamless integration with loyalty programs, resulting in greater personalized rewards for consumers. Both technologies drive consumer engagement, but mobile wallets provide a more dynamic and interactive shopping experience with real-time promotions and digital receipts.

Impact on Checkout Speed and Customer Experience

Digital wallets streamline checkout by securely storing payment information, enabling one-tap transactions that significantly reduce wait times in retail environments. Mobile wallets, integrated with smartphones, offer enhanced convenience through features like contactless payments and loyalty rewards, elevating overall customer experience. Both technologies drive faster, frictionless checkouts while boosting customer satisfaction and repeat business.

Challenges Retailers Face with Wallet Implementation

Retailers encounter challenges integrating digital wallets and mobile wallets due to varied platform compatibility issues and security concerns that hinder seamless transactions. Consumer adoption rates fluctuate, influenced by trust factors and the complexity of wallet setup, affecting overall sales performance. Ensuring compliance with evolving payment regulations and maintaining data privacy standards further complicate wallet implementation strategies.

The Future of Wallet Technology in Retail

Digital wallets and mobile wallets are transforming retail by enabling seamless, contactless payments that enhance customer experience and drive faster transactions. Retailers adopting wallet technology report increased sales conversion rates and improved customer loyalty through personalized promotions and streamlined checkout processes. The future of wallet technology in retail will leverage AI-driven security features and integration with loyalty programs to create more engaging, secure, and efficient shopping experiences.

digital wallet vs mobile wallet Infographic

difterm.com

difterm.com