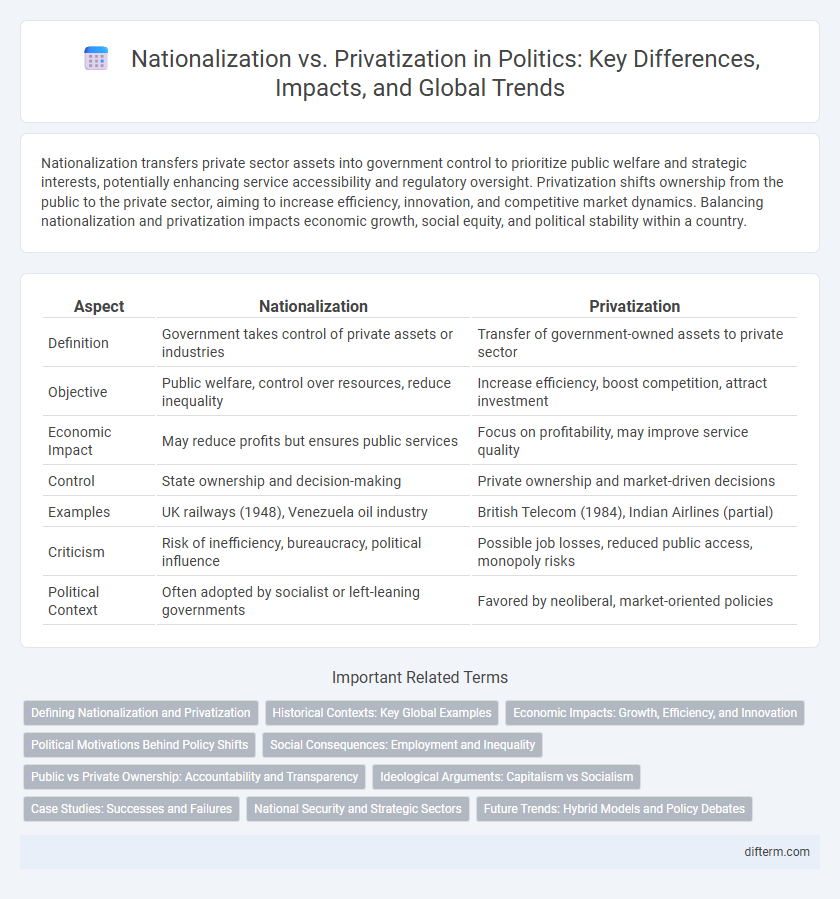

Nationalization transfers private sector assets into government control to prioritize public welfare and strategic interests, potentially enhancing service accessibility and regulatory oversight. Privatization shifts ownership from the public to the private sector, aiming to increase efficiency, innovation, and competitive market dynamics. Balancing nationalization and privatization impacts economic growth, social equity, and political stability within a country.

Table of Comparison

| Aspect | Nationalization | Privatization |

|---|---|---|

| Definition | Government takes control of private assets or industries | Transfer of government-owned assets to private sector |

| Objective | Public welfare, control over resources, reduce inequality | Increase efficiency, boost competition, attract investment |

| Economic Impact | May reduce profits but ensures public services | Focus on profitability, may improve service quality |

| Control | State ownership and decision-making | Private ownership and market-driven decisions |

| Examples | UK railways (1948), Venezuela oil industry | British Telecom (1984), Indian Airlines (partial) |

| Criticism | Risk of inefficiency, bureaucracy, political influence | Possible job losses, reduced public access, monopoly risks |

| Political Context | Often adopted by socialist or left-leaning governments | Favored by neoliberal, market-oriented policies |

Defining Nationalization and Privatization

Nationalization refers to the process by which a government takes control of private assets or industries, transferring ownership to the public sector to achieve broader economic or social goals. Privatization involves transferring ownership and management of state-owned enterprises or services to the private sector, aiming to increase efficiency and stimulate competition. Both approaches significantly impact economic policy, public welfare, and the allocation of resources within a nation.

Historical Contexts: Key Global Examples

Nationalization in the 20th century was prominently exemplified by the British coal industry post-World War II, where the government aimed to stabilize the economy and ensure public welfare. Conversely, privatization surged during the 1980s under leaders like Margaret Thatcher in the UK and Ronald Reagan in the US, emphasizing market efficiency and reducing state control. These historical shifts reflect contrasting political ideologies influencing economic policies worldwide, shaping national development paths and public sector roles.

Economic Impacts: Growth, Efficiency, and Innovation

Nationalization often leads to increased government control over key industries, which can result in stable growth but may hinder efficiency due to bureaucratic management. Privatization tends to boost economic efficiency and innovation by fostering competition and attracting private investment, driving productivity improvements. However, the impact on growth varies depending on sector-specific dynamics and regulatory frameworks.

Political Motivations Behind Policy Shifts

Political motivations behind nationalization often include asserting state control over key industries to protect national interests and reduce foreign dependency. Privatization policies are frequently driven by the desire to increase efficiency, attract foreign investment, and reduce government fiscal burdens. Political ideologies, electoral promises, and pressure from international organizations significantly influence the shift between these economic strategies.

Social Consequences: Employment and Inequality

Nationalization often leads to increased employment through the expansion of public sector jobs, providing greater job security and reducing income inequality by promoting wage parity. Privatization, while potentially boosting efficiency and innovation, may result in significant job cuts and exacerbate income disparities due to market-driven wage structures. The social consequences of these policies critically influence workforce stability and economic equality within nations.

Public vs Private Ownership: Accountability and Transparency

Public ownership typically ensures higher accountability and transparency due to government regulation and public scrutiny, which mandates disclosure of operations and financial activities. Private ownership often prioritizes efficiency and profitability, potentially limiting transparency as companies may protect proprietary information and reduce public oversight. Balancing these factors is crucial in determining whether nationalization or privatization best serves public interest in sectors like utilities or transportation.

Ideological Arguments: Capitalism vs Socialism

Nationalization aligns with socialism by advocating collective ownership of key industries to promote economic equality and public welfare, emphasizing state control to reduce market inequalities. Privatization reflects capitalist ideals, prioritizing individual ownership, market competition, and efficiency, which proponents argue drive innovation and economic growth. The ideological divide centers on whether economic resources should serve public interests under government oversight or private interests through free-market mechanisms.

Case Studies: Successes and Failures

Nationalization in countries like Norway with Statoil demonstrates how state control of resources can generate sustained public wealth, whereas failures like Venezuela's oil industry highlight risks of inefficiency and corruption. Privatization examples such as British Telecom in the UK showcase increased efficiency and innovation, but the collapse of Argentina's privatized utilities underscores potential pitfalls of underinvestment and regulatory failure. Comparative analysis reveals that effective governance and regulatory frameworks are critical determinants of success or failure in both nationalization and privatization models.

National Security and Strategic Sectors

Nationalization of strategic sectors such as defense, energy, and telecommunications strengthens national security by ensuring government control over critical infrastructure and resources. State ownership minimizes risks of foreign interference, data breaches, and sabotage in essential industries that underpin national sovereignty. Privatization in these sectors can lead to vulnerabilities by exposing sensitive operations to profit-driven entities with potential conflicts of interest or foreign stakeholders.

Future Trends: Hybrid Models and Policy Debates

Hybrid models combining nationalization and privatization are emerging as a dominant trend in future economic policies, aiming to balance government control with private sector efficiency. Policymakers debate these models' potential to enhance public service delivery while fostering innovation and competition. Data from recent reforms indicate increased public support for mixed ownership structures that promote accountability and sustainable growth.

nationalization vs privatization Infographic

difterm.com

difterm.com