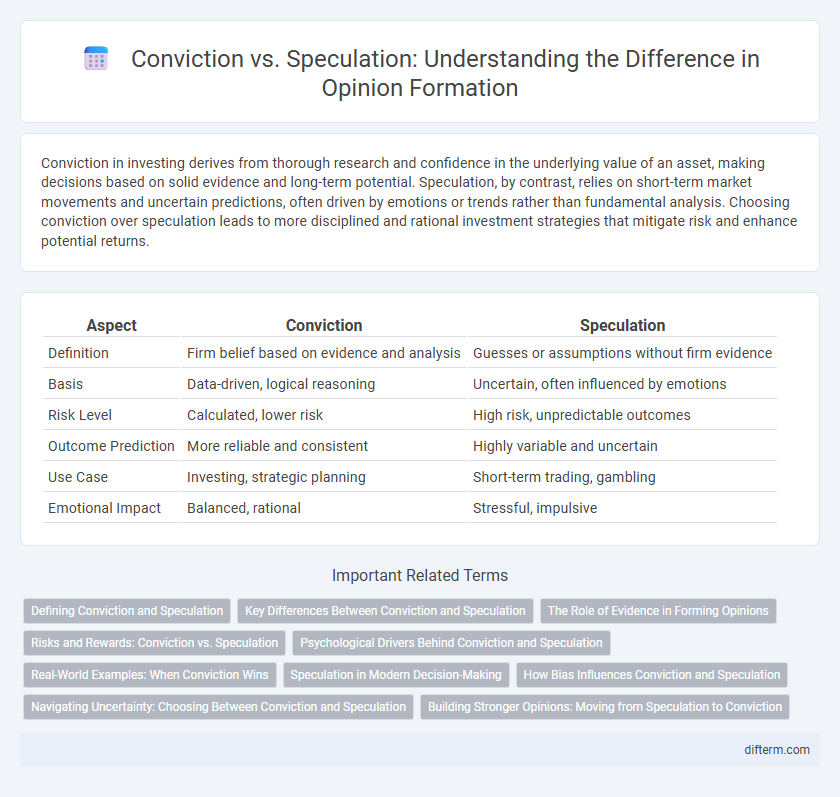

Conviction in investing derives from thorough research and confidence in the underlying value of an asset, making decisions based on solid evidence and long-term potential. Speculation, by contrast, relies on short-term market movements and uncertain predictions, often driven by emotions or trends rather than fundamental analysis. Choosing conviction over speculation leads to more disciplined and rational investment strategies that mitigate risk and enhance potential returns.

Table of Comparison

| Aspect | Conviction | Speculation |

|---|---|---|

| Definition | Firm belief based on evidence and analysis | Guesses or assumptions without firm evidence |

| Basis | Data-driven, logical reasoning | Uncertain, often influenced by emotions |

| Risk Level | Calculated, lower risk | High risk, unpredictable outcomes |

| Outcome Prediction | More reliable and consistent | Highly variable and uncertain |

| Use Case | Investing, strategic planning | Short-term trading, gambling |

| Emotional Impact | Balanced, rational | Stressful, impulsive |

Defining Conviction and Speculation

Conviction is anchored in well-researched evidence and firm belief, driving confident decision-making supported by factual data and consistent outcomes. Speculation relies on assumptions and unpredictable variables, often based on limited information or market trends without substantial analytical backing. Understanding this distinction helps investors and analysts prioritize informed strategies over risky guesses.

Key Differences Between Conviction and Speculation

Conviction is grounded in strong evidence, thorough analysis, and confidence derived from factual information, whereas speculation relies on guesswork, assumptions, and the anticipation of uncertain outcomes. Conviction manifests as a well-informed belief or decision supported by data, while speculation operates in the realm of hypothesis without definitive proof. Understanding the distinction between conviction and speculation is crucial for effective decision-making and risk management in fields like investment, science, and strategic planning.

The Role of Evidence in Forming Opinions

Evidence plays a crucial role in forming well-grounded opinions by providing verifiable facts that support conclusions and reduce bias. Convictions rooted in strong evidence tend to be more reliable and durable, whereas speculation relies on assumptions without concrete data, often leading to uncertain or misleading viewpoints. Prioritizing empirical evidence over speculation enhances critical thinking and fosters more informed decision-making processes.

Risks and Rewards: Conviction vs. Speculation

Conviction involves making investment decisions based on strong, well-researched beliefs, offering potential for steady, long-term rewards while minimizing risks through thorough analysis. Speculation relies on short-term market movements and guesses, which can yield quick gains but expose investors to heightened volatility and greater losses. Assessing risk tolerance and investment goals is crucial to balancing the disciplined approach of conviction with the high-risk nature of speculation.

Psychological Drivers Behind Conviction and Speculation

Conviction arises from deep cognitive biases such as confirmation bias and the need for cognitive closure, driving individuals to firmly hold beliefs despite contradictory evidence. Speculation, fueled by uncertainty tolerance and the human attraction to risk, often leads to fluctuating opinions influenced by emotional responses and perceived rewards. Understanding these psychological drivers reveals how conviction provides mental stability while speculation embraces ambiguity, shaping decision-making processes in complex environments.

Real-World Examples: When Conviction Wins

Conviction-driven investing often outperforms speculation in real-world cases like Warren Buffett's long-term bets on undervalued companies, generating substantial wealth. Firms like Amazon demonstrated that strong conviction in innovative business models can disrupt markets and create dominant positions, unlike speculative hype that fades quickly. Historical market crashes reveal that speculative bubbles burst rapidly, whereas conviction-backed investments tend to provide sustained growth and resilience through volatility.

Speculation in Modern Decision-Making

Speculation in modern decision-making drives innovation by encouraging risk-taking and exploration beyond existing data, enabling businesses and individuals to anticipate market shifts and emerging trends. Unlike conviction, which relies on firm beliefs and established facts, speculation embraces uncertainty and leverages predictive models, scenario analysis, and probabilistic reasoning to navigate complex environments. This dynamic approach allows organizations to adapt swiftly in volatile markets, capitalizing on opportunities that rigid conviction-based strategies might overlook.

How Bias Influences Conviction and Speculation

Bias significantly shapes conviction and speculation by coloring the interpretation of evidence and data, often leading individuals to favor information that confirms preexisting beliefs. This cognitive distortion intensifies conviction when selective attention amplifies certainty, whereas it skews speculation by rooting guesses in subjective perspectives rather than objective probabilities. Recognizing and mitigating bias is crucial for maintaining analytical rigor and fostering balanced decision-making processes.

Navigating Uncertainty: Choosing Between Conviction and Speculation

Navigating uncertainty requires balancing conviction, grounded in evidence and experience, with speculation, which embraces risks and possibilities without firm proof. Conviction provides clarity and direction, essential for decisive actions, while speculation allows flexibility and adaptation amid incomplete information. Effective decision-making involves discerning when to rely on tested beliefs versus exploring uncertain opportunities to optimize outcomes.

Building Stronger Opinions: Moving from Speculation to Conviction

Building stronger opinions requires grounding ideas in verified facts and logical reasoning rather than assumptions. Conviction emerges from critical analysis, consistent evidence evaluation, and open-minded reflection, which transform uncertain speculation into informed belief. Cultivating this approach enhances decision-making accuracy and fosters intellectual confidence.

conviction vs speculation Infographic

difterm.com

difterm.com