Car subscription services offer flexible, short-term access to vehicles with maintenance and insurance included, contrasting with traditional car leasing that typically requires longer commitments and separate handling of upkeep costs. Subscription models allow users to switch cars more frequently without the hassle of long-term contracts, ideal for those seeking convenience and variety. Traditional leasing remains advantageous for individuals wanting lower monthly payments over extended terms and eventual ownership options.

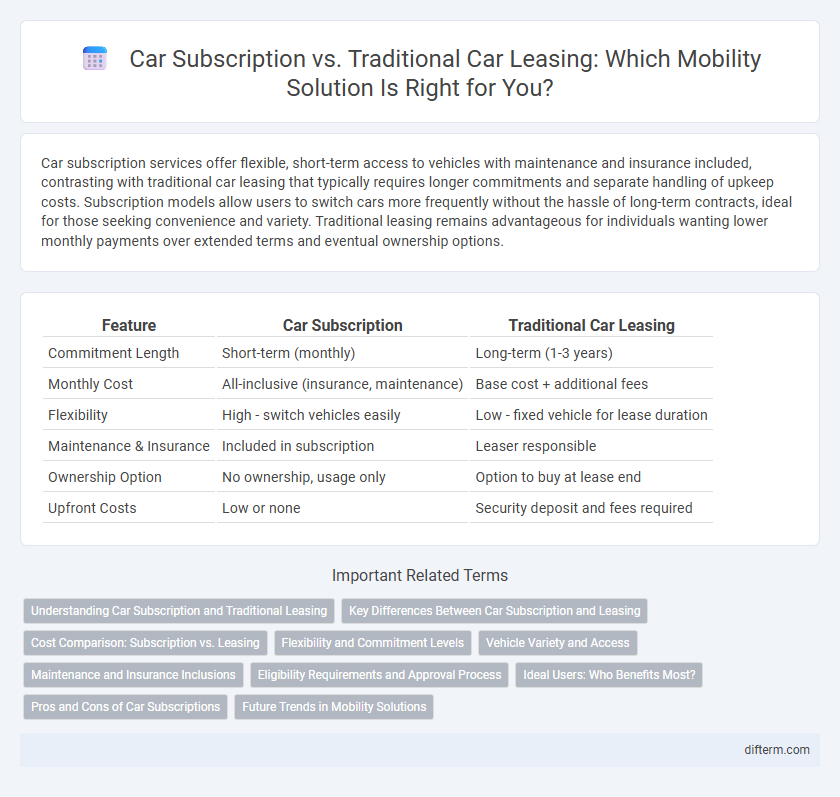

Table of Comparison

| Feature | Car Subscription | Traditional Car Leasing |

|---|---|---|

| Commitment Length | Short-term (monthly) | Long-term (1-3 years) |

| Monthly Cost | All-inclusive (insurance, maintenance) | Base cost + additional fees |

| Flexibility | High - switch vehicles easily | Low - fixed vehicle for lease duration |

| Maintenance & Insurance | Included in subscription | Leaser responsible |

| Ownership Option | No ownership, usage only | Option to buy at lease end |

| Upfront Costs | Low or none | Security deposit and fees required |

Understanding Car Subscription and Traditional Leasing

Car subscription services offer flexible, short-term vehicle access with all-inclusive fees covering insurance, maintenance, and roadside assistance, contrasting traditional car leasing's fixed long-term contracts that separate these costs. Subscription models prioritize convenience and flexibility, allowing users to switch vehicles or cancel subscriptions with minimal penalties, while leasing typically involves commitment periods of two to four years with penalties for early termination. Understanding these distinctions highlights subscription services as ideal for urban drivers seeking variety and hassle-free management, whereas leasing suits those desiring lower monthly payments and long-term vehicle retention.

Key Differences Between Car Subscription and Leasing

Car subscription services offer flexible, short-term access to multiple vehicles with insurance and maintenance included in a single monthly fee, contrasting with traditional leasing which typically involves long-term contracts and limited vehicle options. Leasing requires upfront fees, fixed mileage limits, and potential penalties for wear and tear, while subscriptions provide hassle-free swapping and lower commitment. The convenience and all-inclusive pricing of subscriptions cater to urban drivers seeking versatility, whereas leasing suits those preferring ownership-like terms with predictable monthly payments.

Cost Comparison: Subscription vs. Leasing

Car subscriptions often present higher monthly fees compared to traditional leasing but include insurance, maintenance, and roadside assistance, reducing overall out-of-pocket expenses. Leasing typically demands a lower monthly payment but involves additional costs for insurance, maintenance, and potential penalties for excess mileage or wear. Evaluating total cost of ownership reveals subscriptions offer pricing transparency and flexibility, while leasing may provide better long-term savings for drivers with stable, predictable usage.

Flexibility and Commitment Levels

Car subscription services offer greater flexibility with short-term, customizable plans compared to traditional car leasing, which typically involves long-term contracts and fixed terms. Subscription models often include insurance, maintenance, and the option to swap vehicles, reducing commitment levels and financial uncertainty. Leasing requires a multi-year contractual obligation, limiting the ability to adapt to changing needs or preferences during the contract period.

Vehicle Variety and Access

Car subscription services offer greater vehicle variety and flexible access compared to traditional car leasing by allowing customers to switch between different models or types of vehicles within a single subscription period. Traditional leasing typically locks users into a specific vehicle for the lease term, limiting flexibility and choice. Subscription models also provide hassle-free access without long-term commitments, making them ideal for drivers seeking adaptability and frequent changes in vehicle preferences.

Maintenance and Insurance Inclusions

Car subscription services typically include comprehensive maintenance and insurance coverage within a single monthly fee, eliminating unexpected repair costs and insurance paperwork for subscribers. Traditional car leasing often requires separate contracts for insurance and maintenance, which can lead to higher overall expenses and administrative complexity. Subscription models offer convenience and cost predictability by bundling routine services and full insurance protection, enhancing user experience compared to traditional leasing agreements.

Eligibility Requirements and Approval Process

Car subscription services typically have more flexible eligibility requirements, often requiring only a valid driver's license and proof of insurance, whereas traditional car leasing demands strong credit scores, steady income verification, and comprehensive background checks. Subscription platforms streamline the approval process with minimal paperwork and faster decision times, contrasting with the lengthy credit assessments and financial evaluations customary in leasing agreements. This flexibility and speed make car subscriptions more accessible to a broader range of consumers, especially those with less established credit histories.

Ideal Users: Who Benefits Most?

Car subscription services benefit urban professionals and frequent travelers who seek flexibility without long-term commitments, as they offer easy vehicle swaps and inclusive maintenance. Traditional car leasing suits individuals or businesses needing a consistent, long-term vehicle solution with lower monthly payments and potential tax advantages. Fleet managers and motorists with predictable usage patterns gain more value from leasing, while dynamic lifestyles favor subscription models.

Pros and Cons of Car Subscriptions

Car subscriptions offer flexibility with short-term commitments and inclusive maintenance, insurance, and roadside assistance, making them ideal for users seeking hassle-free mobility without long-term contracts. However, they typically come at higher monthly costs compared to traditional car leasing, which may limit affordability for budget-conscious consumers. Limited vehicle options and mileage restrictions in subscriptions can also reduce customization and freedom relative to conventional leasing agreements.

Future Trends in Mobility Solutions

Car subscription services are reshaping future mobility trends by offering flexible, all-inclusive access to vehicles without long-term contracts or ownership burdens, contrasting sharply with traditional car leasing's fixed terms and limited customization. Emerging technologies and consumer preferences emphasize convenience, sustainability, and seamless digital experiences, driving growth in subscription models integrated with electric and autonomous vehicles. Market analysts predict that by 2030, car subscriptions could capture a significant share of urban mobility solutions, reflecting a broader shift towards mobility-as-a-service (MaaS) ecosystems.

car subscription vs traditional car leasing Infographic

difterm.com

difterm.com