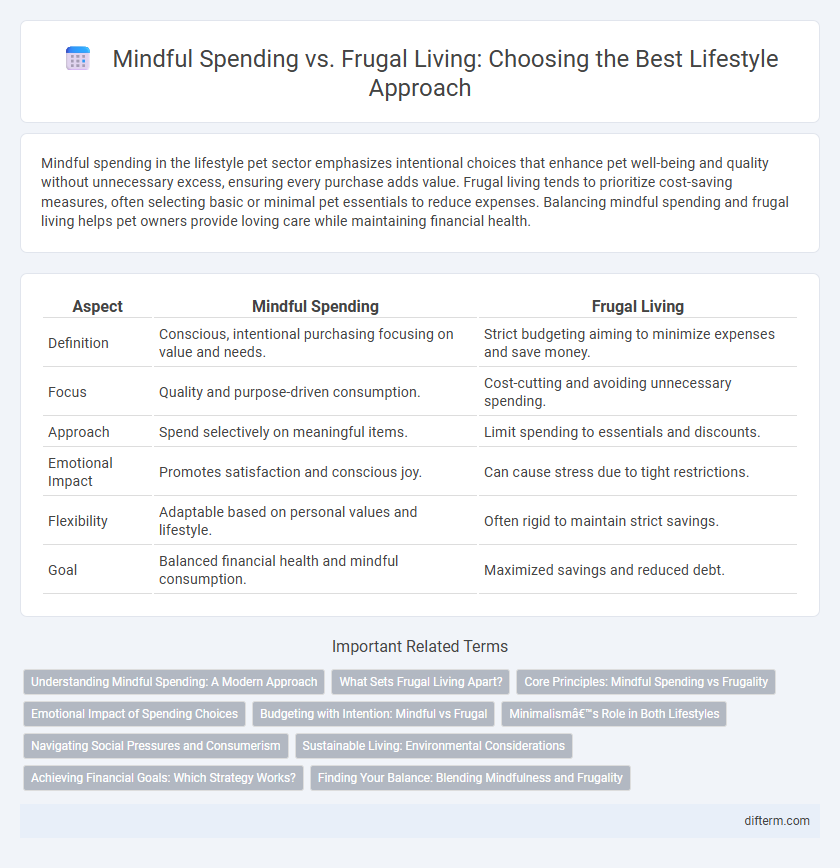

Mindful spending in the lifestyle pet sector emphasizes intentional choices that enhance pet well-being and quality without unnecessary excess, ensuring every purchase adds value. Frugal living tends to prioritize cost-saving measures, often selecting basic or minimal pet essentials to reduce expenses. Balancing mindful spending and frugal living helps pet owners provide loving care while maintaining financial health.

Table of Comparison

| Aspect | Mindful Spending | Frugal Living |

|---|---|---|

| Definition | Conscious, intentional purchasing focusing on value and needs. | Strict budgeting aiming to minimize expenses and save money. |

| Focus | Quality and purpose-driven consumption. | Cost-cutting and avoiding unnecessary spending. |

| Approach | Spend selectively on meaningful items. | Limit spending to essentials and discounts. |

| Emotional Impact | Promotes satisfaction and conscious joy. | Can cause stress due to tight restrictions. |

| Flexibility | Adaptable based on personal values and lifestyle. | Often rigid to maintain strict savings. |

| Goal | Balanced financial health and mindful consumption. | Maximized savings and reduced debt. |

Understanding Mindful Spending: A Modern Approach

Mindful spending involves making intentional purchasing decisions that align with personal values and long-term goals, fostering financial wellness without sacrificing quality of life. Unlike frugal living, which emphasizes strict cost-cutting and minimizing expenses, mindful spending prioritizes awareness and purpose behind each expense. This modern approach encourages consumers to evaluate the true value of their purchases, promoting sustainable habits and reducing impulsive buying.

What Sets Frugal Living Apart?

Frugal living emphasizes intentional resource management and long-term financial sustainability, distinguishing it from simple mindful spending which centers on moment-to-moment purchasing decisions. Key aspects include budgeting rigor, prioritizing value over cost, and minimizing waste to build financial stability and resilience. This lifestyle fosters a disciplined approach to expenses, focusing on essential needs and eliminating superfluous spending habits.

Core Principles: Mindful Spending vs Frugality

Mindful spending centers on intentionality, where each purchase aligns with personal values and long-term goals, fostering financial well-being without sacrificing quality of life. Frugality emphasizes minimizing expenses and maximizing savings through disciplined budgeting and cost-cutting, often prioritizing necessity over desire. Both approaches advocate for conscious financial decisions, but mindful spending balances enjoyment with responsibility, while frugality leans more towards austerity and resourcefulness.

Emotional Impact of Spending Choices

Mindful spending enhances emotional well-being by promoting intentional purchases aligned with personal values, reducing buyer's remorse and financial stress. Frugal living emphasizes saving money through minimalism and cost-cutting, which can occasionally lead to feelings of deprivation or restriction. Balancing mindful spending and frugality fosters a healthier emotional relationship with money, encouraging satisfaction and long-term financial stability.

Budgeting with Intention: Mindful vs Frugal

Budgeting with intention involves consciously allocating funds to prioritize needs, aligning spending habits with personal values, which defines mindful spending. Frugal living emphasizes minimizing expenses through strict cost-cutting measures to maximize savings and reduce waste. Both approaches enhance financial well-being, but mindful spending encourages purpose-driven choices, while frugality centers on economizing and restraint.

Minimalism’s Role in Both Lifestyles

Minimalism serves as a foundational principle in both mindful spending and frugal living by encouraging intentionality and conscious consumption to reduce unnecessary expenses. Emphasizing quality over quantity, minimalism helps individuals prioritize needs, align purchases with personal values, and avoid impulsive buying behaviors. By fostering simplicity and clarity, minimalism supports sustainable financial habits that enhance overall well-being and long-term financial stability.

Navigating Social Pressures and Consumerism

Mindful spending emphasizes intentional purchases aligned with personal values, contrasting with frugal living's strict budget constraints aimed at minimizing expenses. Navigating social pressures requires awareness of consumer-driven influences, enabling individuals to resist impulsive buying prompted by trends or peer expectations. Developing a conscious mindset around money fosters financial well-being while reducing susceptibility to consumerism's persuasive tactics.

Sustainable Living: Environmental Considerations

Mindful spending emphasizes conscious choices that reduce waste and support eco-friendly products, promoting sustainability through thoughtful consumption. Frugal living prioritizes minimizing expenses, often leading to reduced resource use and lower carbon footprints by reusing and repurposing items. Both approaches contribute to sustainable living by encouraging behaviors that lessen environmental impact and conserve natural resources.

Achieving Financial Goals: Which Strategy Works?

Mindful spending emphasizes intentional purchases aligned with personal values, enhancing overall satisfaction while avoiding unnecessary expenses. Frugal living focuses on strict budgeting and minimizing costs to accumulate savings quickly, often sacrificing some comforts. Achieving financial goals depends on balancing mindful spending to maintain motivation and frugality to ensure consistent progress toward long-term objectives.

Finding Your Balance: Blending Mindfulness and Frugality

Mindful spending emphasizes intentional purchases aligned with personal values, while frugal living focuses on minimizing expenses to maximize savings. Finding a balance involves evaluating needs versus wants and setting realistic budgets that support both financial health and overall well-being. This blended approach cultivates financial freedom without sacrificing quality of life or enjoyment.

mindful spending vs frugal living Infographic

difterm.com

difterm.com