Choosing frugal pet care emphasizes smart spending on quality food, preventive healthcare, and durable toys, ensuring long-term savings without compromising the pet's well-being. Being cheap often means cutting corners with low-quality products that can lead to higher veterinary costs and reduced pet happiness. Frugality balances cost and care, fostering a healthy and joyful lifestyle for pets.

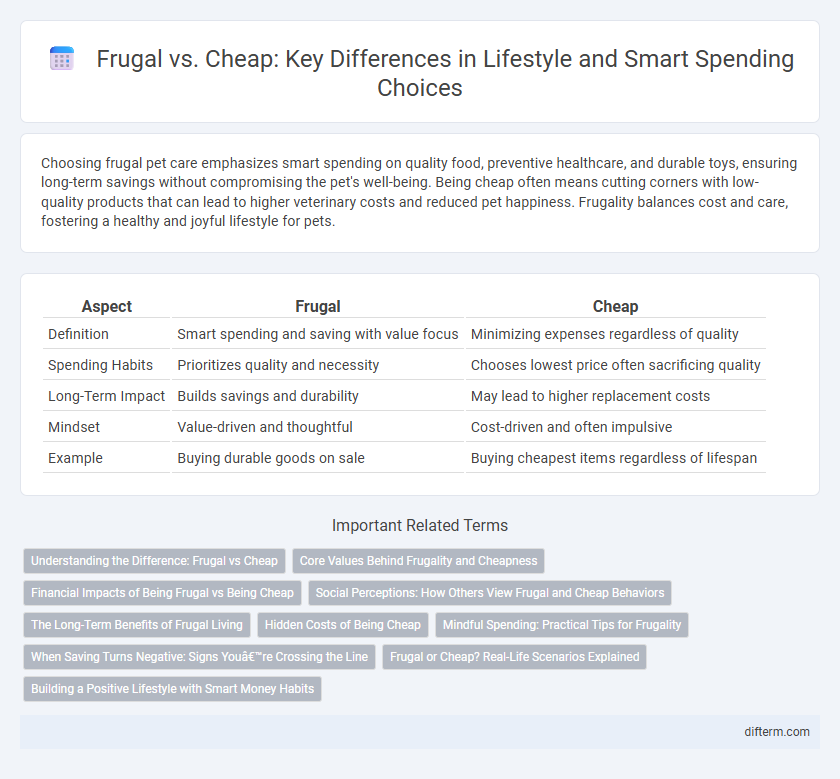

Table of Comparison

| Aspect | Frugal | Cheap |

|---|---|---|

| Definition | Smart spending and saving with value focus | Minimizing expenses regardless of quality |

| Spending Habits | Prioritizes quality and necessity | Chooses lowest price often sacrificing quality |

| Long-Term Impact | Builds savings and durability | May lead to higher replacement costs |

| Mindset | Value-driven and thoughtful | Cost-driven and often impulsive |

| Example | Buying durable goods on sale | Buying cheapest items regardless of lifespan |

Understanding the Difference: Frugal vs Cheap

Frugal individuals prioritize value and make mindful spending choices that maximize long-term benefits and quality, while being cheap often means prioritizing saving money at the expense of quality or ethical considerations. Frugality involves strategic budgeting and investing in durable goods, whereas cheapness might lead to poor decisions like purchasing low-quality products that require frequent replacements. Understanding this distinction helps cultivate sustainable habits that balance cost-efficiency with responsible consumption.

Core Values Behind Frugality and Cheapness

Frugality centers on intentional spending and long-term value, prioritizing quality, sustainability, and mindful consumption aligned with personal and environmental values. Cheapness often emphasizes immediate cost savings without considering durability, ethics, or the overall impact on well-being and resources. Understanding these core differences helps cultivate a lifestyle rooted in thoughtful financial choices and meaningful resource management.

Financial Impacts of Being Frugal vs Being Cheap

Frugality emphasizes intentional spending and long-term savings, leading to improved financial health and wealth accumulation by prioritizing value over cost. Conversely, being cheap often sacrifices quality and experiences, potentially resulting in higher expenses due to frequent replacements or missed opportunities. Understanding the financial impacts of frugality versus cheapness helps individuals make smarter money decisions that promote sustainability and stability.

Social Perceptions: How Others View Frugal and Cheap Behaviors

Frugal behavior is often perceived positively as a sign of financial responsibility and smart decision-making, earning respect for mindful spending and long-term planning. Cheap behavior, however, can be seen negatively, suggesting stinginess or lack of generosity that may lead to social isolation or judgment. Understanding these social perceptions helps individuals balance saving money while maintaining healthy relationships and a positive reputation.

The Long-Term Benefits of Frugal Living

Frugal living emphasizes mindful spending and prioritizing value, which leads to substantial long-term savings and financial security. Unlike cheapness, which often sacrifices quality, frugality encourages investing in durable goods and experiences that provide lasting satisfaction. Embracing frugal habits promotes sustainable wealth accumulation and reduces financial stress over time.

Hidden Costs of Being Cheap

Choosing cheap products often results in hidden costs such as lower quality, reduced durability, and frequent replacements, which increase overall expenses over time. Frugal living emphasizes mindful spending on quality items that last longer, saving money and resources in the long run. Understanding the difference between frugality and cheapness helps optimize budget without compromising value or sustainability.

Mindful Spending: Practical Tips for Frugality

Mindful spending emphasizes intentional choices that align with long-term financial goals, distinguishing frugality from mere cheapness. Prioritizing value over cost, frugal individuals invest in quality essentials and avoid impulsive buying, which prevents wasteful expenses. Tracking budgets, comparing prices thoughtfully, and embracing minimalism help cultivate sustainable saving habits without sacrificing well-being.

When Saving Turns Negative: Signs You’re Crossing the Line

Recognizing the difference between frugal and cheap is essential to maintaining a healthy lifestyle, as frugality emphasizes smart, intentional saving without sacrificing quality or well-being. When saving money leads to negative impacts such as damaged relationships, poor health, or increased stress, it signals crossing the line into unhealthy cheapness. Key signs include avoiding necessary expenses, obsessing over minimal discounts, and compromising on essential needs, ultimately undermining long-term happiness and financial stability.

Frugal or Cheap? Real-Life Scenarios Explained

Frugal living emphasizes mindful spending and prioritizing value, contrasting sharply with cheapness, which often sacrifices quality to save money. Real-life scenarios reveal that frugal individuals invest in durable goods and experiences that enhance long-term satisfaction, while cheap choices frequently lead to frequent replacements and dissatisfaction. Embracing frugality leads to sustainable savings and improved lifestyle quality, making it a more balanced approach than simply being cheap.

Building a Positive Lifestyle with Smart Money Habits

Frugal living emphasizes mindful spending and prioritizing value over cost, encouraging individuals to invest in quality and long-term benefits rather than opting for the cheapest options. Smart money habits involve budgeting, saving consistently, and making intentional financial decisions that align with personal goals. Embracing frugality fosters financial stability and a positive lifestyle by reducing unnecessary expenses and maximizing resource efficiency.

Frugal vs Cheap Infographic

difterm.com

difterm.com