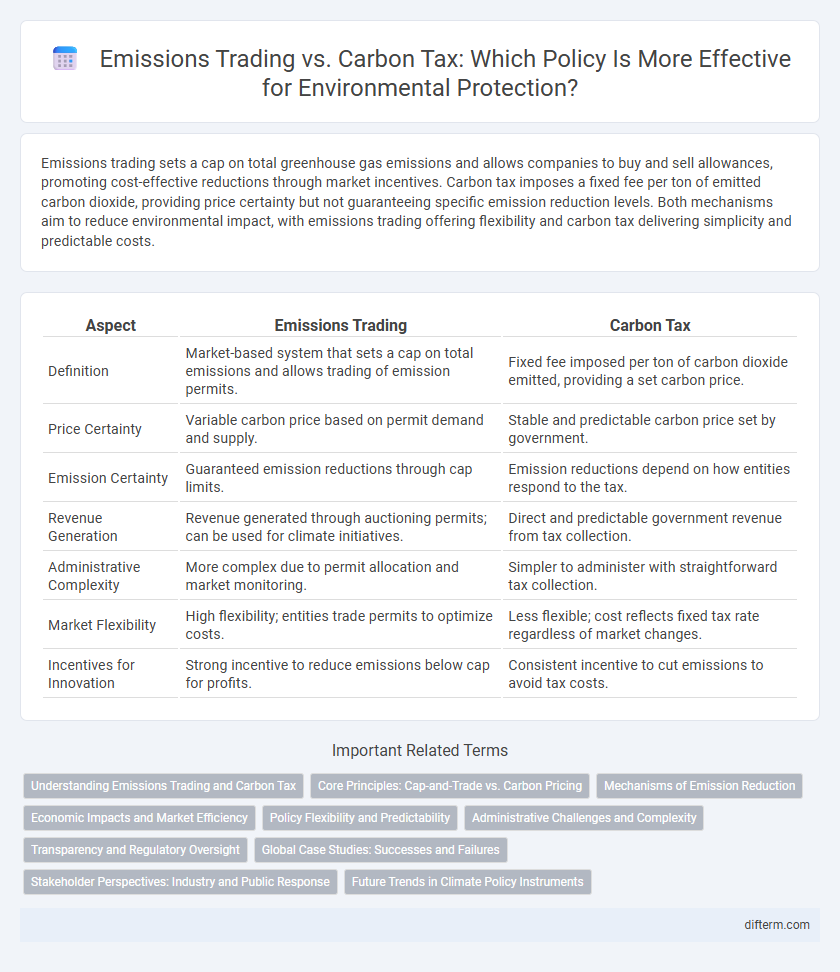

Emissions trading sets a cap on total greenhouse gas emissions and allows companies to buy and sell allowances, promoting cost-effective reductions through market incentives. Carbon tax imposes a fixed fee per ton of emitted carbon dioxide, providing price certainty but not guaranteeing specific emission reduction levels. Both mechanisms aim to reduce environmental impact, with emissions trading offering flexibility and carbon tax delivering simplicity and predictable costs.

Table of Comparison

| Aspect | Emissions Trading | Carbon Tax |

|---|---|---|

| Definition | Market-based system that sets a cap on total emissions and allows trading of emission permits. | Fixed fee imposed per ton of carbon dioxide emitted, providing a set carbon price. |

| Price Certainty | Variable carbon price based on permit demand and supply. | Stable and predictable carbon price set by government. |

| Emission Certainty | Guaranteed emission reductions through cap limits. | Emission reductions depend on how entities respond to the tax. |

| Revenue Generation | Revenue generated through auctioning permits; can be used for climate initiatives. | Direct and predictable government revenue from tax collection. |

| Administrative Complexity | More complex due to permit allocation and market monitoring. | Simpler to administer with straightforward tax collection. |

| Market Flexibility | High flexibility; entities trade permits to optimize costs. | Less flexible; cost reflects fixed tax rate regardless of market changes. |

| Incentives for Innovation | Strong incentive to reduce emissions below cap for profits. | Consistent incentive to cut emissions to avoid tax costs. |

Understanding Emissions Trading and Carbon Tax

Emissions trading, also known as cap-and-trade, sets a maximum limit on greenhouse gas emissions and allows companies to buy and sell emission allowances, incentivizing reductions where they are most cost-effective. Carbon tax directly imposes a fixed price per ton of emitted carbon dioxide, providing certainty on costs but less flexibility in emission reductions. Understanding the differences between these market-based mechanisms is crucial for policymakers aiming to balance economic efficiency and environmental goals.

Core Principles: Cap-and-Trade vs. Carbon Pricing

Emissions trading operates on a cap-and-trade system that sets a maximum limit on total greenhouse gas emissions, allowing companies to buy and sell emission permits within this cap to incentivize reductions. Carbon tax imposes a direct price on carbon emissions, charging emitters a fixed fee per ton of CO2 released, providing price certainty but not guaranteeing emissions reductions. Cap-and-trade ensures environmental certainty by capping total emissions, while carbon pricing offers economic predictability through stable costs per unit of emission.

Mechanisms of Emission Reduction

Emissions trading, also known as cap-and-trade, establishes a market for carbon allowances, enabling companies to buy or sell permits based on their emissions, driving cost-effective reductions through market flexibility. Carbon tax directly sets a fixed price on carbon emissions, incentivizing emitters to reduce pollution to avoid higher costs without a trading system. Both mechanisms aim to lower greenhouse gas emissions but differ in predictability and economic dynamics, with emissions trading focusing on emission caps and carbon tax emphasizing price certainty.

Economic Impacts and Market Efficiency

Emissions trading systems create a market-driven approach that incentivizes businesses to reduce carbon emissions cost-effectively by setting a cap and allowing the trade of allowances, enhancing market efficiency through price discovery. Carbon taxes provide predictable costs for emitters, fostering investment in green technologies but may lack the flexibility to achieve specific emission targets as efficiently as trading schemes. Both mechanisms impact economic behavior differently: emissions trading can lead to volatile carbon prices affecting business planning, while carbon taxes offer revenue stability that can fund sustainable projects or offset economic impacts.

Policy Flexibility and Predictability

Emissions trading systems provide policy flexibility by allowing market forces to set carbon prices, enabling businesses to choose cost-effective emissions reductions. Carbon taxes offer higher predictability with fixed prices, giving companies clear signals for long-term investment planning. Balancing these approaches can optimize environmental outcomes and economic efficiency.

Administrative Challenges and Complexity

Emissions trading schemes involve complex monitoring, reporting, and verification systems to ensure accurate tracking of carbon allowances, often requiring extensive administrative resources. Carbon taxes offer a more straightforward regulatory framework with fixed pricing but face challenges in setting optimal tax levels and managing political resistance. Both approaches demand robust institutional capacity to enforce compliance and adjust mechanisms in response to market or environmental changes.

Transparency and Regulatory Oversight

Emissions trading systems provide transparency through publicly accessible registries and real-time market data, allowing regulators to monitor allowance allocations and trading activities effectively. Carbon taxes offer straightforward regulatory oversight with fixed rates set by policy, enabling clear revenue tracking but less dynamic adjustment to emissions fluctuations. Both frameworks require robust monitoring and reporting mechanisms to ensure compliance and prevent market manipulation or tax evasion.

Global Case Studies: Successes and Failures

Emissions trading systems (ETS) in the European Union successfully reduced carbon emissions by 35% since 2005 through a cap-and-trade model that incentivizes companies to lower pollution. Conversely, Australia's carbon tax, introduced in 2012 and repealed in 2014, struggled due to political opposition and limited long-term incentives, leading to minimal emissions decline. In contrast, California's combined approach of a strict cap with carbon pricing under its ETS framework has proven effective, reducing greenhouse gas emissions by 15% while fostering clean energy investments.

Stakeholder Perspectives: Industry and Public Response

Industries generally favor emissions trading schemes for their flexibility and potential to generate revenue through carbon credit sales, while some sectors express concerns about market volatility and regulatory complexity. The public response to carbon taxes is mixed, with support rooted in the policy's transparency and predictable pricing, yet opposition arises from fears of increased energy costs and economic burden on low-income households. Stakeholder engagement highlights the need for balanced frameworks that address industry competitiveness and social equity in climate policy.

Future Trends in Climate Policy Instruments

Future trends in climate policy instruments indicate a growing preference for hybrid approaches combining emissions trading systems (ETS) with carbon taxes to enhance flexibility and economic efficiency. Innovations in emissions trading include dynamic cap adjustments and sectoral expansions, allowing more precise emissions reductions aligned with net-zero targets. Carbon taxes are expected to stabilize at economically impactful rates, reinforcing market signals while integrating with broader international climate agreements to ensure coordinated global action.

emissions trading vs carbon tax Infographic

difterm.com

difterm.com