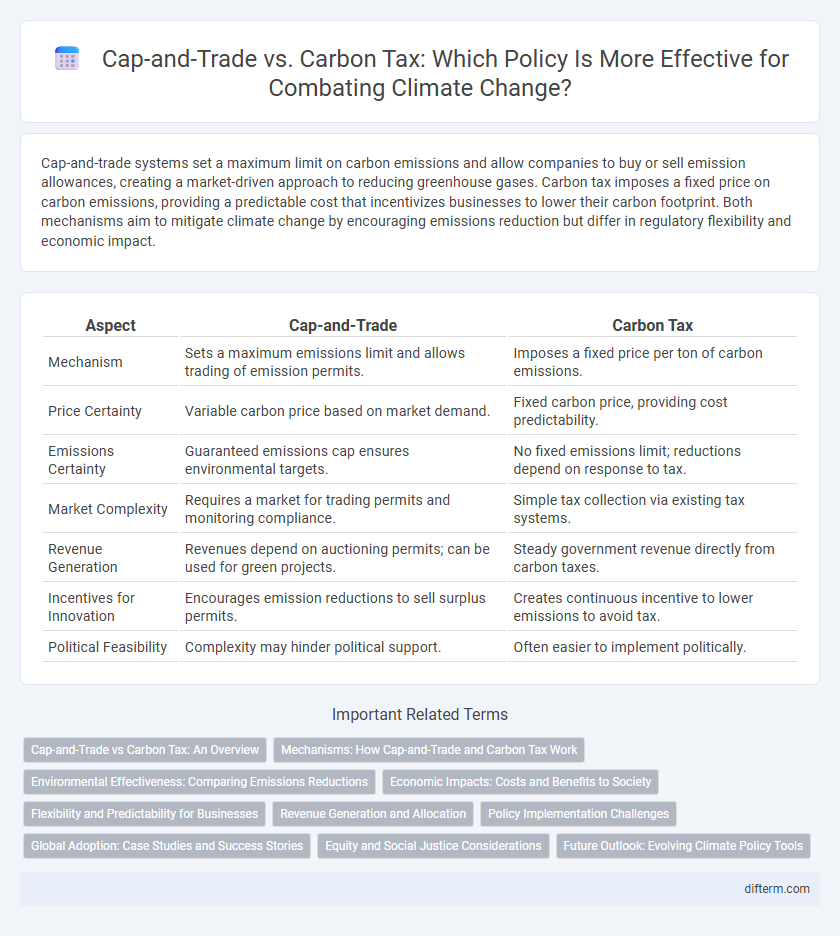

Cap-and-trade systems set a maximum limit on carbon emissions and allow companies to buy or sell emission allowances, creating a market-driven approach to reducing greenhouse gases. Carbon tax imposes a fixed price on carbon emissions, providing a predictable cost that incentivizes businesses to lower their carbon footprint. Both mechanisms aim to mitigate climate change by encouraging emissions reduction but differ in regulatory flexibility and economic impact.

Table of Comparison

| Aspect | Cap-and-Trade | Carbon Tax |

|---|---|---|

| Mechanism | Sets a maximum emissions limit and allows trading of emission permits. | Imposes a fixed price per ton of carbon emissions. |

| Price Certainty | Variable carbon price based on market demand. | Fixed carbon price, providing cost predictability. |

| Emissions Certainty | Guaranteed emissions cap ensures environmental targets. | No fixed emissions limit; reductions depend on response to tax. |

| Market Complexity | Requires a market for trading permits and monitoring compliance. | Simple tax collection via existing tax systems. |

| Revenue Generation | Revenues depend on auctioning permits; can be used for green projects. | Steady government revenue directly from carbon taxes. |

| Incentives for Innovation | Encourages emission reductions to sell surplus permits. | Creates continuous incentive to lower emissions to avoid tax. |

| Political Feasibility | Complexity may hinder political support. | Often easier to implement politically. |

Cap-and-Trade vs Carbon Tax: An Overview

Cap-and-trade programs set a maximum emission limit and allow companies to buy and sell permits, creating a market-driven approach to reduce greenhouse gases. Carbon taxes impose a fixed price on each ton of emitted CO2, providing predictable costs but uncertain emission reductions. Both mechanisms aim to lower carbon footprints, but cap-and-trade offers emission certainty while carbon taxes offer price certainty.

Mechanisms: How Cap-and-Trade and Carbon Tax Work

Cap-and-trade sets a maximum emissions cap and allows companies to buy and sell emission allowances, creating a market-driven approach to reduce greenhouse gases. Carbon tax directly imposes a fixed price per ton of carbon emissions, providing economic incentives to lower fossil fuel use. Both mechanisms aim to internalize the environmental cost of carbon but differ in flexibility and price certainty.

Environmental Effectiveness: Comparing Emissions Reductions

Cap-and-trade programs set a firm emissions limit, ensuring total greenhouse gas reductions align with climate targets, whereas carbon tax offers predictable pricing but uncertain emission outcomes. Empirical data from the EU Emissions Trading System demonstrates substantial decreases in CO2 levels, highlighting cap-and-trade's direct environmental effectiveness. Carbon taxes, like those implemented in Sweden, achieve steady emission declines but may require periodic adjustments to meet ambitious reduction goals.

Economic Impacts: Costs and Benefits to Society

Cap-and-trade systems create a market for carbon allowances, enabling cost-effective emissions reductions through trading while providing revenue for clean energy investments. Carbon taxes deliver price certainty and predictability by setting a fixed cost per ton of CO2 emitted, encouraging businesses and consumers to reduce emissions efficiently. Both mechanisms incentivize innovation and pollution reduction, but cap-and-trade may generate variable compliance costs, whereas carbon taxes offer steady fiscal revenue that can be redistributed to offset economic burdens.

Flexibility and Predictability for Businesses

Cap-and-trade systems offer businesses flexibility by allowing companies to buy and sell emission allowances, adapting to fluctuating costs while maintaining a fixed overall emission limit. Carbon taxes provide greater price predictability, enabling firms to forecast costs and invest confidently in emission-reduction technologies. Both mechanisms balance economic efficiency and environmental goals, but cap-and-trade emphasizes emissions certainty, whereas carbon taxes emphasize cost certainty.

Revenue Generation and Allocation

Cap-and-trade systems generate revenue through the auctioning of emission permits, which can be allocated to renewable energy projects, climate adaptation, and social equity programs. Carbon taxes provide a predictable revenue stream collected directly from emitters based on carbon content, allowing governments to fund clean energy investments, public transportation, and climate resilience initiatives. Both mechanisms incentivize emissions reductions while creating financial resources for sustainable development and environmental protection.

Policy Implementation Challenges

Cap-and-trade systems face challenges such as setting accurate emissions caps, preventing market manipulation, and ensuring transparent allowance allocation. Carbon taxes struggle with determining optimal price levels that effectively reduce emissions without harming economic growth, while also addressing public and political resistance. Both policies require robust monitoring, verification mechanisms, and clear regulatory frameworks to ensure successful implementation and environmental impact.

Global Adoption: Case Studies and Success Stories

Several countries like Sweden and Canada have successfully implemented carbon taxes resulting in significant emissions reductions and economic growth. The European Union's Emissions Trading System (EU ETS), a leading cap-and-trade program, covers over 11,000 power stations and industrial plants, driving a 35% decline in emissions from 2005 levels. Case studies from California's cap-and-trade market show a 19% decrease in greenhouse gas emissions while maintaining GDP growth, highlighting effective global adoption of market-based climate policies.

Equity and Social Justice Considerations

Cap-and-trade systems can create equity challenges by allowing wealthier companies to purchase emission permits, potentially burdening lower-income communities with localized pollution. Carbon taxes offer more predictable costs and can be designed with rebates or dividends to offset impacts on vulnerable populations, promoting social justice by directly redistributing revenues. Incorporating equity considerations into both policies requires careful design to ensure fair distribution of benefits and burdens across all socioeconomic groups.

Future Outlook: Evolving Climate Policy Tools

Cap-and-trade systems are expected to evolve with enhanced market flexibility and stricter emissions caps to meet net-zero targets by 2050. Carbon taxes will likely increase in rate and scope, incentivizing broader adoption of renewable energy and carbon capture technologies. Integration of digital monitoring and real-time data analysis will improve transparency and enforcement, driving more effective climate policy outcomes.

cap-and-trade vs carbon tax Infographic

difterm.com

difterm.com