Biodiversity offsetting involves compensating for environmental damage by creating or restoring habitats elsewhere, whereas biodiversity banking allows landowners to earn credits for conservation efforts that can be sold to developers needing to offset their own impacts. Both strategies aim to balance development with ecological preservation, but biodiversity banking provides a market-driven approach that incentivizes long-term habitat protection. Effective implementation of these tools requires rigorous monitoring to ensure genuine biodiversity gains and avoid net loss.

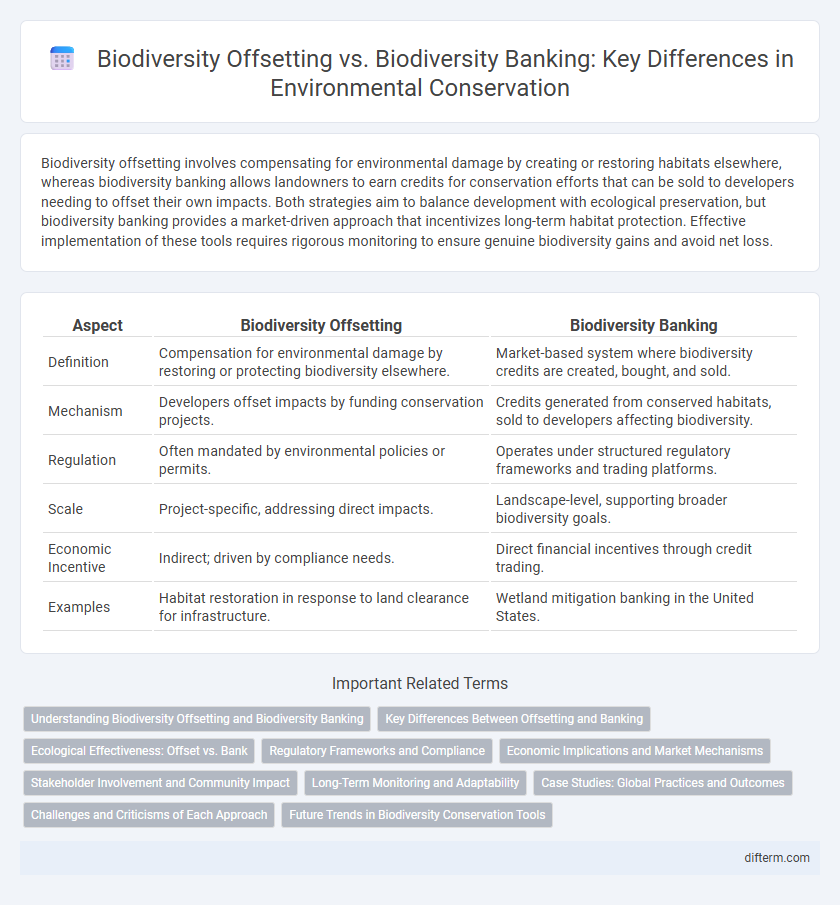

Table of Comparison

| Aspect | Biodiversity Offsetting | Biodiversity Banking |

|---|---|---|

| Definition | Compensation for environmental damage by restoring or protecting biodiversity elsewhere. | Market-based system where biodiversity credits are created, bought, and sold. |

| Mechanism | Developers offset impacts by funding conservation projects. | Credits generated from conserved habitats, sold to developers affecting biodiversity. |

| Regulation | Often mandated by environmental policies or permits. | Operates under structured regulatory frameworks and trading platforms. |

| Scale | Project-specific, addressing direct impacts. | Landscape-level, supporting broader biodiversity goals. |

| Economic Incentive | Indirect; driven by compliance needs. | Direct financial incentives through credit trading. |

| Examples | Habitat restoration in response to land clearance for infrastructure. | Wetland mitigation banking in the United States. |

Understanding Biodiversity Offsetting and Biodiversity Banking

Biodiversity offsetting involves compensating for environmental damage by creating or restoring habitats to achieve no net loss of biodiversity, while biodiversity banking establishes a market-based system where credits generated from conserved areas can be bought and sold to offset ecological impacts. Both strategies aim to balance development with conservation, but biodiversity banking provides a regulated framework that quantifies and standardizes ecological credits for better accountability. Understanding these mechanisms is crucial for implementing effective conservation policies that integrate economic incentives with biodiversity preservation.

Key Differences Between Offsetting and Banking

Biodiversity offsetting involves compensating for environmental damage by creating or restoring habitats elsewhere, typically on a project-by-project basis, while biodiversity banking establishes a market-based system where conservation credits are generated and traded to ensure long-term ecological balance. Offsetting often addresses specific, localized impacts directly linked to development activities, whereas banking provides a more scalable and flexible approach with pre-approved conservation areas generating credits in advance. The key difference lies in timing and scale: offsetting reacts to immediate impacts, whereas banking anticipates future needs, promoting strategic habitat preservation through regulated credit systems.

Ecological Effectiveness: Offset vs. Bank

Biodiversity offsetting often faces challenges in achieving true ecological effectiveness due to the complexity of replicating diverse habitats and species interactions lost at impact sites. Biodiversity banking, by contrast, tends to secure more scientifically verified, measurable conservation outcomes through predetermined credits tied to specific ecological values, ensuring better permanence and accountability. Metrics such as habitat quality, species diversity, and ecosystem functionality show greater consistency and reliability in biodiversity banks than in ad hoc offset projects.

Regulatory Frameworks and Compliance

Biodiversity offsetting operates within strict regulatory frameworks that mandate developers to compensate for environmental damage by creating equivalent natural habitats, ensuring compliance with national conservation laws. Biodiversity banking involves the creation of tradable credits governed by established compliance mechanisms that facilitate monitoring, reporting, and adherence to biodiversity protection standards. Regulatory frameworks for both approaches emphasize transparent impact assessments and enforceable mitigation commitments to maintain biodiversity integrity.

Economic Implications and Market Mechanisms

Biodiversity offsetting involves compensatory conservation activities funded by developers to balance environmental impacts, creating direct economic costs tied to project approvals. Biodiversity banking establishes tradable credits generated from preserved or restored habitats, fostering market mechanisms that incentivize private investment and enhance liquidity in conservation funding. Both systems impact land values and require regulatory frameworks to ensure ecological equivalency and financial transparency in transactions.

Stakeholder Involvement and Community Impact

Biodiversity offsetting often involves direct negotiation with affected stakeholders, ensuring local community concerns and traditional knowledge influence project design and implementation. Biodiversity banking typically engages a broader range of stakeholders through regulatory frameworks, facilitating transparent transactions that incentivize conservation while mitigating environmental liabilities. Both approaches shape community impact by balancing development needs with ecological preservation, yet banking provides more structured opportunities for long-term local benefits and stakeholder participation in biodiversity markets.

Long-Term Monitoring and Adaptability

Biodiversity offsetting requires long-term monitoring to ensure environmental goals are met and habitats are effectively restored, often involving adaptive management strategies to address unforeseen ecological changes. Biodiversity banking establishes credit systems backed by rigorous, ongoing ecological assessments, enabling more structured adaptability through standardized monitoring protocols. Both approaches emphasize sustained ecosystem integrity but differ in flexibility and financial mechanisms for long-term conservation outcomes.

Case Studies: Global Practices and Outcomes

Biodiversity offsetting and biodiversity banking are implemented globally with varying outcomes; in Australia, biodiversity banking has successfully incentivized habitat conservation by allowing developers to purchase credits from preserved ecosystems, promoting measurable ecological gains. In contrast, the United Kingdom's biodiversity offsetting has faced challenges in ensuring equivalence and long-term sustainability, leading to mixed results in habitat restoration efforts. Case studies reveal that biodiverse banking's market-driven approach tends to deliver more consistent conservation outcomes when supported by rigorous regulatory frameworks and transparent monitoring.

Challenges and Criticisms of Each Approach

Biodiversity offsetting faces challenges such as difficulties in accurately measuring ecological value and the risk of permitting harmful development by assuming offsets compensate adequately. Biodiversity banking, while offering a market-based solution, encounters criticisms over regulatory complexity, potential inequities in habitat valuation, and the risk of habitat loss if credits are overissued. Both approaches struggle with ensuring no net loss of biodiversity, addressing temporal delays in conservation benefits, and maintaining transparency and accountability in ecological outcomes.

Future Trends in Biodiversity Conservation Tools

Biodiversity offsetting is evolving towards more stringent regulatory frameworks that emphasize measurable ecological outcomes and community involvement. Biodiversity banking, leveraging market-based mechanisms, is advancing with technological integration such as GIS mapping and blockchain to ensure transparency and efficiency in tradeable conservation credits. Future trends predict increased convergence of these tools, promoting adaptive management strategies that align economic incentives with long-term ecosystem resilience.

biodiversity offsetting vs biodiversity banking Infographic

difterm.com

difterm.com