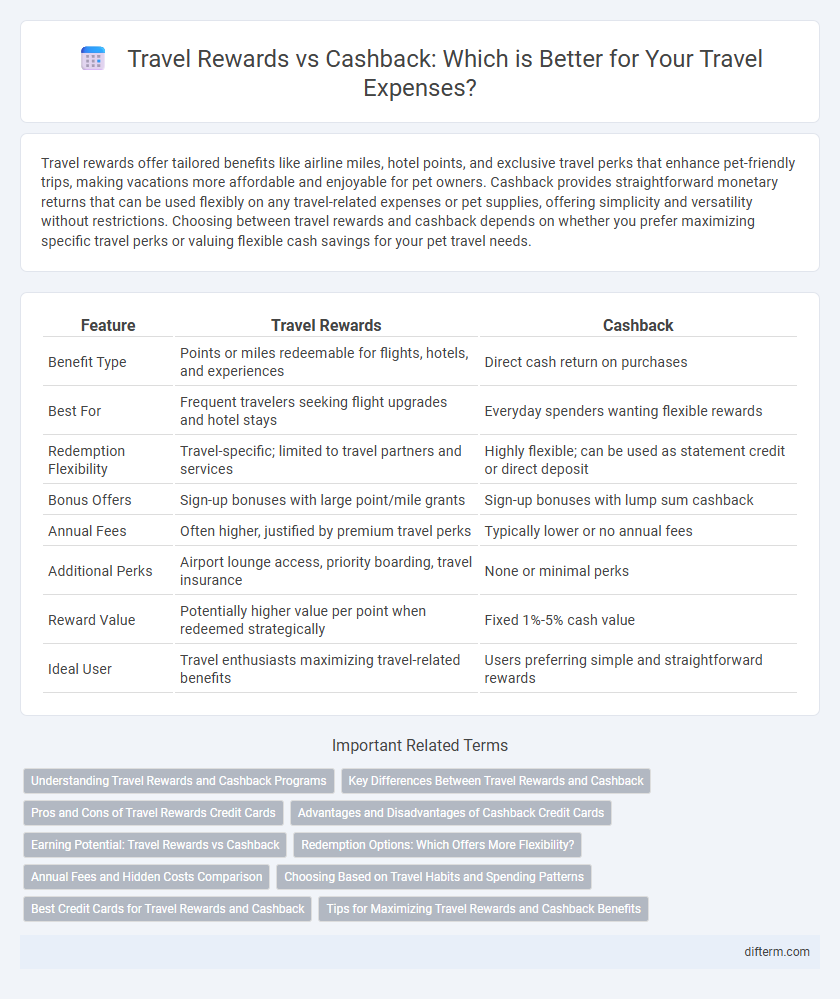

Travel rewards offer tailored benefits like airline miles, hotel points, and exclusive travel perks that enhance pet-friendly trips, making vacations more affordable and enjoyable for pet owners. Cashback provides straightforward monetary returns that can be used flexibly on any travel-related expenses or pet supplies, offering simplicity and versatility without restrictions. Choosing between travel rewards and cashback depends on whether you prefer maximizing specific travel perks or valuing flexible cash savings for your pet travel needs.

Table of Comparison

| Feature | Travel Rewards | Cashback |

|---|---|---|

| Benefit Type | Points or miles redeemable for flights, hotels, and experiences | Direct cash return on purchases |

| Best For | Frequent travelers seeking flight upgrades and hotel stays | Everyday spenders wanting flexible rewards |

| Redemption Flexibility | Travel-specific; limited to travel partners and services | Highly flexible; can be used as statement credit or direct deposit |

| Bonus Offers | Sign-up bonuses with large point/mile grants | Sign-up bonuses with lump sum cashback |

| Annual Fees | Often higher, justified by premium travel perks | Typically lower or no annual fees |

| Additional Perks | Airport lounge access, priority boarding, travel insurance | None or minimal perks |

| Reward Value | Potentially higher value per point when redeemed strategically | Fixed 1%-5% cash value |

| Ideal User | Travel enthusiasts maximizing travel-related benefits | Users preferring simple and straightforward rewards |

Understanding Travel Rewards and Cashback Programs

Travel rewards programs offer points or miles that can be redeemed for flights, hotel stays, and other travel-related expenses, providing targeted benefits for frequent travelers. Cashback programs provide a percentage of money back on purchases, offering a more flexible but less travel-specific benefit compared to travel rewards. Evaluating factors such as redemption options, earning rates, and annual fees helps travelers choose between maximizing travel rewards and gaining straightforward cashback savings.

Key Differences Between Travel Rewards and Cashback

Travel rewards offer points or miles redeemable for flights, hotel stays, and other travel-related expenses, providing targeted benefits for frequent travelers. Cashback provides a percentage of spending returned as cash, usable anywhere without restrictions, making it more flexible but less specialized. The key difference lies in travel rewards' exclusive benefits tied to travel spending versus cashback's broad usability and simplicity.

Pros and Cons of Travel Rewards Credit Cards

Travel rewards credit cards offer the advantage of earning points or miles redeemable for flights, hotel stays, and exclusive travel experiences, providing significant value for frequent travelers. These cards often include perks such as priority boarding, travel insurance, and no foreign transaction fees, enhancing convenience and savings while abroad. However, high annual fees and complex redemption processes can outweigh benefits for occasional travelers who might prefer simpler cashback rewards.

Advantages and Disadvantages of Cashback Credit Cards

Cashback credit cards offer straightforward rewards by providing a fixed percentage of cash back on every purchase, making them ideal for travelers seeking immediate savings and flexible redemption options. They typically have fewer restrictions compared to travel rewards cards, allowing cashback to be used for travel expenses, statement credits, or everyday purchases without blackout dates or limited airline partnerships. However, cashback cards may offer lower overall value for frequent travelers compared to specialized travel rewards cards that provide enhanced benefits like airport lounge access, travel insurance, and bonus miles.

Earning Potential: Travel Rewards vs Cashback

Travel rewards programs often provide higher earning potential through points or miles that can be redeemed for flights, hotel stays, and exclusive experiences, typically offering value beyond their face amount. Cashback rewards offer straightforward returns, usually between 1% to 5%, but may lack the enhanced value of travel rewards when redeemed strategically. Evaluating spending habits and travel frequency is essential to maximize benefits, as travel rewards tend to deliver greater value for frequent travelers compared to generic cashback options.

Redemption Options: Which Offers More Flexibility?

Travel rewards provide greater flexibility in redemption options, allowing users to book flights, hotels, car rentals, and experiences with points or miles across multiple airline and hotel loyalty programs. Cashback rewards offer straightforward value that can be applied as statement credits, deposits, or direct purchases but may lack the diverse travel-related redemptions that travel rewards programs facilitate. Frequent travelers benefit more from travel rewards due to the ability to transfer points to partner programs and leverage varied travel redemptions for maximum value.

Annual Fees and Hidden Costs Comparison

Travel rewards credit cards often come with higher annual fees compared to cashback cards, but they offer greater value through airline perks, lounge access, and bonus miles. Cashback cards typically have minimal or no annual fees, appealing to casual spenders seeking straightforward savings without complex restrictions. Hidden costs such as foreign transaction fees, blackout dates, and redemption limitations can reduce the overall benefits of travel rewards cards, making it essential to carefully assess these factors before committing.

Choosing Based on Travel Habits and Spending Patterns

Travel rewards maximize value for frequent flyers and hotel stayers by offering points redeemable for flights, upgrades, and accommodations, aligning with regular travel habits. Cashback rewards benefit those with varied spending patterns, providing straightforward savings that can be used flexibly without travel restrictions. Analyzing personal travel frequency and monthly expenses helps determine whether travel rewards or cashback cards deliver better overall financial benefits.

Best Credit Cards for Travel Rewards and Cashback

Best credit cards for travel rewards offer points or miles redeemable for flights, hotel stays, and exclusive travel perks, maximizing value for frequent travelers. Cashback credit cards provide straightforward savings by returning a percentage of each purchase, appealing to those seeking flexible rewards without travel restrictions. Comparing top cards like Chase Sapphire Preferred for travel rewards and Citi Double Cash for cashback helps travelers align their spending habits with the most beneficial rewards structure.

Tips for Maximizing Travel Rewards and Cashback Benefits

Maximize travel rewards and cashback benefits by strategically using credit cards that offer high reward rates on travel-related purchases such as flights, hotels, and car rentals. Combine travel rewards programs with cashback offers to double-dip on savings and points accumulation, ensuring you redeem rewards for flights or hotel stays at optimal values. Monitor promotional periods and leverage category bonuses, paying attention to expiration dates to avoid losing accumulated points or cashback.

travel rewards vs cashback Infographic

difterm.com

difterm.com