Travel rewards cards offer points and miles that can be redeemed for flights, hotels, and travel experiences, maximizing benefits for frequent travelers. Cash back cards provide straightforward financial returns on everyday purchases, giving flexibility without restrictions tied to travel. Choosing between the two depends on whether you prioritize travel savings or versatile cash rewards for general spending.

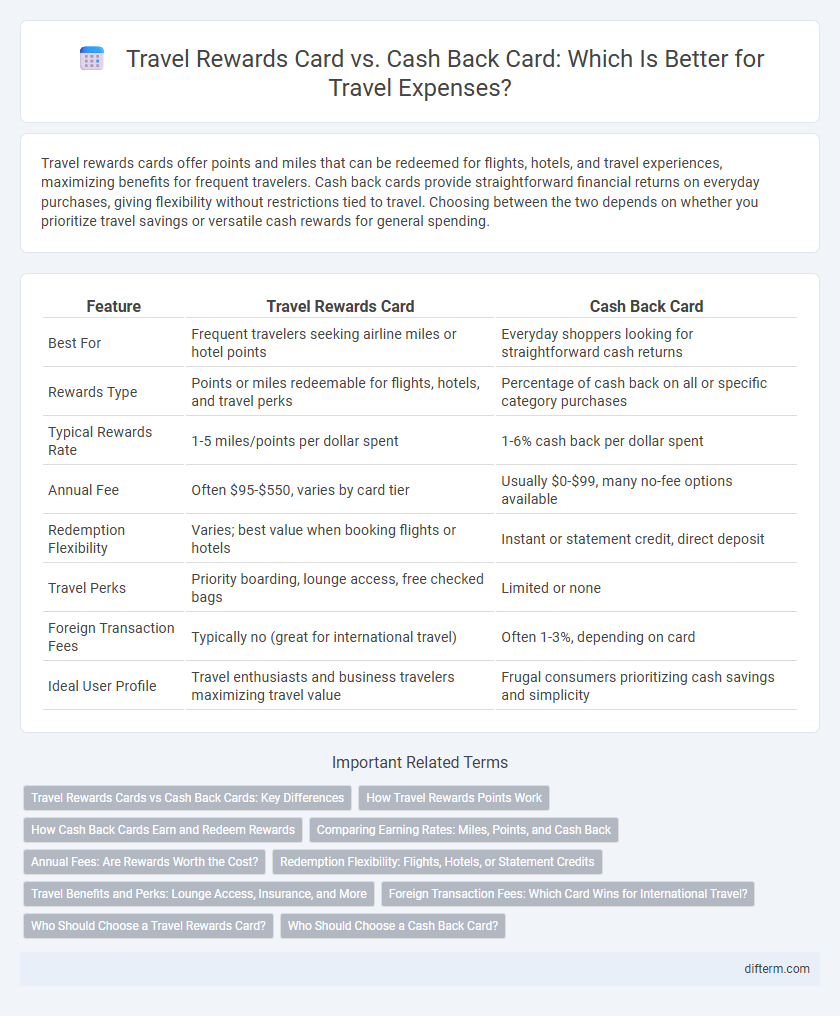

Table of Comparison

| Feature | Travel Rewards Card | Cash Back Card |

|---|---|---|

| Best For | Frequent travelers seeking airline miles or hotel points | Everyday shoppers looking for straightforward cash returns |

| Rewards Type | Points or miles redeemable for flights, hotels, and travel perks | Percentage of cash back on all or specific category purchases |

| Typical Rewards Rate | 1-5 miles/points per dollar spent | 1-6% cash back per dollar spent |

| Annual Fee | Often $95-$550, varies by card tier | Usually $0-$99, many no-fee options available |

| Redemption Flexibility | Varies; best value when booking flights or hotels | Instant or statement credit, direct deposit |

| Travel Perks | Priority boarding, lounge access, free checked bags | Limited or none |

| Foreign Transaction Fees | Typically no (great for international travel) | Often 1-3%, depending on card |

| Ideal User Profile | Travel enthusiasts and business travelers maximizing travel value | Frugal consumers prioritizing cash savings and simplicity |

Travel Rewards Cards vs Cash Back Cards: Key Differences

Travel rewards cards offer points or miles redeemable for flights, hotels, and other travel expenses, often including perks like priority boarding and travel insurance. Cash back cards provide straightforward percentage returns on purchases, enhancing everyday spending value without travel-specific benefits. Choosing between them depends on whether you prioritize maximizing travel-related savings or flexible cash returns for general expenses.

How Travel Rewards Points Work

Travel rewards points accumulate through purchases made on travel rewards cards, allowing users to redeem them for flights, hotel stays, and car rentals at discounted rates or for free. These points often earn higher value when redeemed through specific travel partners or loyalty programs, providing greater flexibility compared to cash back cards. Travel rewards cards may also offer bonuses such as airport lounge access, travel insurance, and priority boarding, enhancing the overall travel experience beyond simple monetary returns.

How Cash Back Cards Earn and Redeem Rewards

Cash back cards earn rewards by offering a percentage of each purchase back as cash, often ranging from 1% to 5%, depending on the spending category. Cardholders can redeem these rewards as statement credits, direct deposits, or gift cards, providing versatile options for maximizing savings. Frequent use of cash back cards on everyday expenses results in consistent, easy-to-use rewards, ideal for travelers prioritizing straightforward earning and redemption.

Comparing Earning Rates: Miles, Points, and Cash Back

Travel rewards cards often provide higher earning rates in miles or points, typically offering 2 to 5 miles per dollar spent on travel-related purchases, optimizing rewards for flights and hotels. Cash back cards generally provide a straightforward return of 1% to 3% on all purchases, with some offering elevated rates in specific categories like dining or groceries, making them versatile but less specialized for travel. Comparing earning rates reveals travel rewards cards deliver more value for frequent travelers through point redemption flexibility and bonus multipliers, while cash back cards suit those seeking simplicity and consistent returns across everyday spending.

Annual Fees: Are Rewards Worth the Cost?

Travel rewards cards often come with higher annual fees but offer valuable perks like airport lounge access, free checked bags, and bonus points on travel purchases that can easily offset the cost for frequent travelers. Cash back cards typically have lower or no annual fees, providing straightforward cash rewards without travel-specific benefits, making them ideal for budget-conscious users. Evaluating your spending habits and travel frequency helps determine if the higher annual fee of a travel rewards card delivers enough value compared to the simplicity and savings of a cash back card.

Redemption Flexibility: Flights, Hotels, or Statement Credits

Travel rewards cards offer greater redemption flexibility, allowing points to be used directly for flights, hotels, or transferred to airline and hotel loyalty programs for enhanced value. Cash back cards provide straightforward statement credits or cash deposits, which can be applied universally but often lack the premium travel perks and transfer options. Choosing a travel rewards card maximizes benefits for frequent travelers seeking to optimize redemptions across various travel expenses.

Travel Benefits and Perks: Lounge Access, Insurance, and More

Travel rewards cards typically offer premium benefits like airport lounge access, comprehensive travel insurance, and priority boarding, enhancing overall travel convenience and comfort. Cash back cards focus on straightforward rewards with less emphasis on travel-specific perks, often lacking access to lounges or travel insurance coverage. Choosing a travel rewards card maximizes value for frequent travelers through perks such as trip cancellation insurance, rental car coverage, and exclusive partner discounts.

Foreign Transaction Fees: Which Card Wins for International Travel?

Travel rewards cards often waive foreign transaction fees, making them ideal for international travel expenses and currency exchanges without extra costs. Cash back cards typically charge a foreign transaction fee ranging from 1% to 3%, which accumulates quickly and reduces overall savings during overseas spending. Choosing a travel rewards card with zero foreign transaction fees maximizes your purchasing power and enhances your global travel experience.

Who Should Choose a Travel Rewards Card?

Frequent travelers and airline or hotel loyalty program members should choose a travel rewards card to maximize points and enjoy perks like priority boarding, free checked bags, and airport lounge access. Those who spend heavily on flights, accommodations, or travel-related expenses benefit most from elevated earning rates and travel credits offered by these cards. Travel rewards cards are ideal for individuals seeking to offset travel costs and gain exclusive experiences rather than simple cash rebates.

Who Should Choose a Cash Back Card?

Frequent shoppers and everyday spenders benefit most from cash back cards since they offer straightforward rewards on a wide range of purchases without the need to manage travel-related redemptions. Individuals who prefer flexible, no-hassle rewards that can be redeemed for cash, statement credits, or gift cards find cash back cards ideal. Those focused on maximizing value from groceries, gas, and general expenses rather than travel perks should prioritize cash back cards for consistent returns.

travel rewards card vs cash back card Infographic

difterm.com

difterm.com