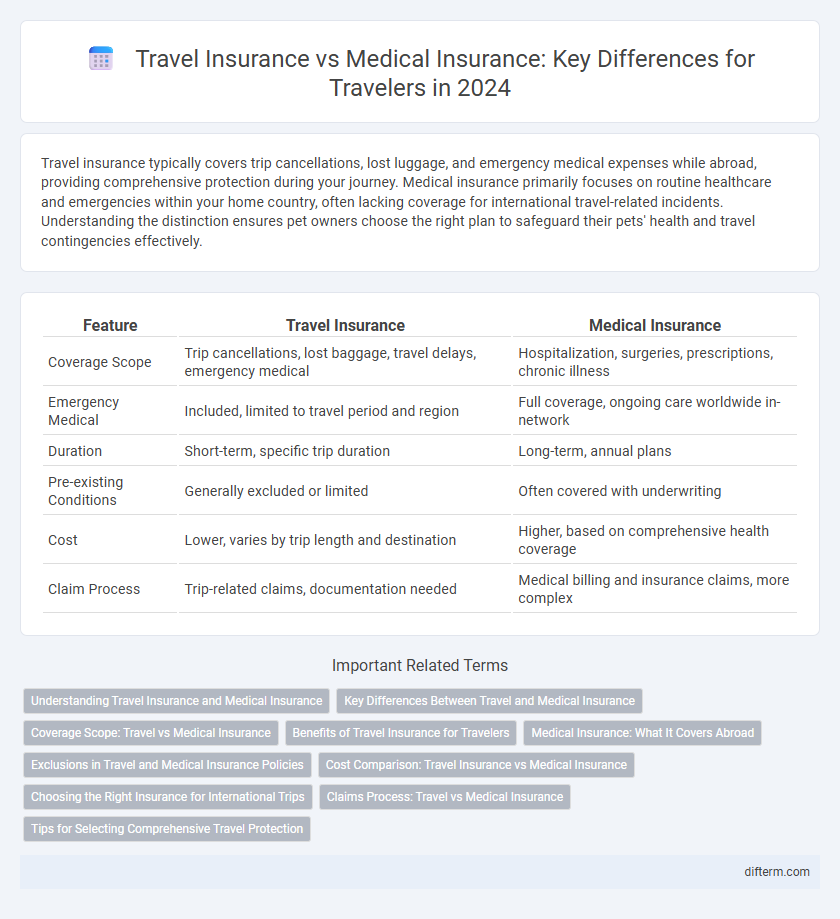

Travel insurance typically covers trip cancellations, lost luggage, and emergency medical expenses while abroad, providing comprehensive protection during your journey. Medical insurance primarily focuses on routine healthcare and emergencies within your home country, often lacking coverage for international travel-related incidents. Understanding the distinction ensures pet owners choose the right plan to safeguard their pets' health and travel contingencies effectively.

Table of Comparison

| Feature | Travel Insurance | Medical Insurance |

|---|---|---|

| Coverage Scope | Trip cancellations, lost baggage, travel delays, emergency medical | Hospitalization, surgeries, prescriptions, chronic illness |

| Emergency Medical | Included, limited to travel period and region | Full coverage, ongoing care worldwide in-network |

| Duration | Short-term, specific trip duration | Long-term, annual plans |

| Pre-existing Conditions | Generally excluded or limited | Often covered with underwriting |

| Cost | Lower, varies by trip length and destination | Higher, based on comprehensive health coverage |

| Claim Process | Trip-related claims, documentation needed | Medical billing and insurance claims, more complex |

Understanding Travel Insurance and Medical Insurance

Travel insurance provides coverage for trip cancellations, lost luggage, and travel-related emergencies, while medical insurance primarily covers healthcare expenses within your home country. Understanding the distinctions ensures travelers select appropriate policies that protect against unexpected medical costs abroad and other travel disruptions. Comprehensive travel insurance often includes medical coverage, emergency evacuation, and assistance services tailored for international travelers.

Key Differences Between Travel and Medical Insurance

Travel insurance primarily covers trip-related risks such as trip cancellations, lost luggage, and travel delays, while medical insurance focuses on healthcare expenses like hospital stays, surgeries, and outpatient treatments. Travel insurance often includes emergency medical coverage abroad but usually at limited amounts, whereas comprehensive medical insurance provides extensive, ongoing coverage within the insured's home country. Understanding these key differences helps travelers select appropriate policies to protect both travel plans and health needs.

Coverage Scope: Travel vs Medical Insurance

Travel insurance provides broad coverage including trip cancellations, lost luggage, and emergency medical care abroad, while medical insurance primarily focuses on healthcare expenses within the insured's home country. Travel insurance offers protection for unexpected travel disruptions and medical emergencies during trips, whereas medical insurance does not typically cover international incidents or travel-related risks. Understanding the coverage scope differences helps travelers choose the appropriate plan to safeguard both their health and travel investments.

Benefits of Travel Insurance for Travelers

Travel insurance offers comprehensive coverage that includes trip cancellation, lost luggage, and emergency medical expenses, providing financial protection beyond standard medical insurance. It covers unexpected events such as trip interruptions, travel delays, and emergency evacuations, ensuring peace of mind during international trips. Many travel insurance policies also include 24/7 assistance services, helping travelers navigate medical emergencies and other crises efficiently.

Medical Insurance: What It Covers Abroad

Medical insurance abroad typically covers emergency medical treatment, hospitalization, doctor visits, surgeries, prescription medications, and sometimes mental health services. Coverage usually extends to accidents, sudden illness, and pre-existing condition emergencies but often excludes routine check-ups or elective procedures. It is essential to review policy limits, network restrictions, and pre-authorization requirements to ensure adequate protection while traveling internationally.

Exclusions in Travel and Medical Insurance Policies

Travel insurance often excludes pre-existing medical conditions, adventure sports injuries, and claims arising from pandemics or epidemics, while medical insurance typically omits coverage for treatments related to elective procedures, cosmetic surgeries, and experimental therapies. Travel insurance policies usually do not cover routine medical check-ups or long-term illnesses, whereas medical insurance excludes travel-specific risks such as trip cancellations, lost luggage, and emergency evacuations. Understanding the specific exclusions in each policy helps travelers select comprehensive protection tailored to both health needs and travel-related risks.

Cost Comparison: Travel Insurance vs Medical Insurance

Travel insurance typically offers broader coverage including trip cancellations, lost luggage, and emergency medical expenses, often at a lower cost compared to standalone medical insurance designed exclusively for health care. Medical insurance premiums tend to be higher due to comprehensive benefits focusing on extensive medical treatments and chronic condition management. Comparing costs, travel insurance provides a cost-effective solution for short-term international trips, while medical insurance is a more substantial investment intended for ongoing healthcare needs.

Choosing the Right Insurance for International Trips

Choosing the right insurance for international trips requires understanding the differences between travel insurance and medical insurance, as travel insurance typically covers trip cancellations, lost luggage, and emergency medical expenses, while medical insurance focuses solely on healthcare costs. International travel insurance often offers broader coverage, including evacuation and repatriation services, which are crucial when visiting countries with limited medical facilities. Evaluating your destination, trip duration, and existing health coverage helps ensure adequate protection against unforeseen travel risks.

Claims Process: Travel vs Medical Insurance

The claims process for travel insurance typically involves submitting documentation such as trip itineraries, receipts, and proof of travel-related incidents to the insurer for coverage of trip cancellations, delays, or lost luggage. Medical insurance claims require detailed medical reports, bills, and prescriptions to process reimbursements for healthcare services received during travel or at home. Understanding the specific claim requirements and timelines for both travel and medical insurance ensures faster approvals and reduces the risk of claim denials.

Tips for Selecting Comprehensive Travel Protection

Choose travel insurance policies that include robust coverage for medical emergencies, trip cancellations, and lost luggage to ensure comprehensive protection. Verify that the plan covers COVID-19 related expenses and pre-existing medical conditions for added security. Compare policy limits, exclusions, and customer reviews to find the best balance of cost and benefits tailored to your travel itinerary.

travel insurance vs medical insurance Infographic

difterm.com

difterm.com