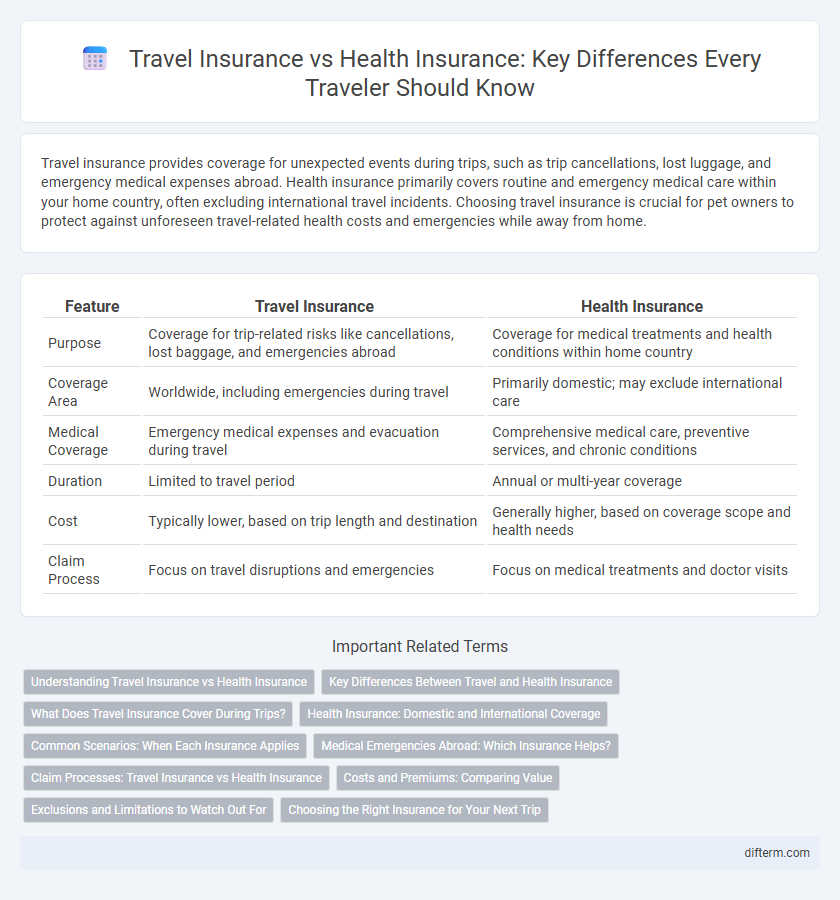

Travel insurance provides coverage for unexpected events during trips, such as trip cancellations, lost luggage, and emergency medical expenses abroad. Health insurance primarily covers routine and emergency medical care within your home country, often excluding international travel incidents. Choosing travel insurance is crucial for pet owners to protect against unforeseen travel-related health costs and emergencies while away from home.

Table of Comparison

| Feature | Travel Insurance | Health Insurance |

|---|---|---|

| Purpose | Coverage for trip-related risks like cancellations, lost baggage, and emergencies abroad | Coverage for medical treatments and health conditions within home country |

| Coverage Area | Worldwide, including emergencies during travel | Primarily domestic; may exclude international care |

| Medical Coverage | Emergency medical expenses and evacuation during travel | Comprehensive medical care, preventive services, and chronic conditions |

| Duration | Limited to travel period | Annual or multi-year coverage |

| Cost | Typically lower, based on trip length and destination | Generally higher, based on coverage scope and health needs |

| Claim Process | Focus on travel disruptions and emergencies | Focus on medical treatments and doctor visits |

Understanding Travel Insurance vs Health Insurance

Travel insurance covers unexpected events during trips, such as trip cancellations, lost luggage, and emergency medical expenses abroad, providing financial protection tailored to travel risks. Health insurance primarily focuses on routine medical care, hospital visits, and ongoing health management within your home country, often lacking comprehensive coverage for international incidents. Understanding these distinctions ensures travelers select appropriate coverage to safeguard both their health and travel investments effectively.

Key Differences Between Travel and Health Insurance

Travel insurance primarily covers trip cancellations, lost luggage, and emergency medical expenses abroad, while health insurance focuses on comprehensive medical care and preventative services within the policyholder's home country. Travel insurance policies typically offer short-term coverage for unexpected incidents during a trip, whereas health insurance provides ongoing protection for chronic conditions, routine check-ups, and hospital stays. Medical evacuation and emergency assistance are often included in travel insurance but rarely covered under standard health insurance plans.

What Does Travel Insurance Cover During Trips?

Travel insurance typically covers trip cancellations, lost luggage, and emergency medical expenses incurred abroad, including hospital stays and ambulance services. It also provides coverage for trip interruption, travel delays, and evacuation due to natural disasters or political unrest. Medical coverage under travel insurance often extends beyond what standard health insurance offers by including emergency evacuation and repatriation.

Health Insurance: Domestic and International Coverage

Health insurance offers critical protection both domestically and internationally, covering medical expenses that may arise during travel within or outside your home country. Unlike travel insurance, which primarily focuses on trip cancellations, lost luggage, and short-term medical emergencies, health insurance provides comprehensive, ongoing coverage for a wide range of medical treatments and hospital stays. Ensuring your health insurance includes international coverage is essential for accessing quality healthcare and avoiding exorbitant out-of-pocket costs abroad.

Common Scenarios: When Each Insurance Applies

Travel insurance applies primarily during trips abroad, covering unexpected events such as trip cancellations, lost luggage, or emergency medical treatment related to accidents or illnesses occurring while traveling. Health insurance generally covers routine medical care and treatment within the insured's home country, including chronic condition management, preventive care, and non-travel-related emergencies. In scenarios like sudden illness or injury on vacation, travel insurance provides immediate emergency medical coverage, whereas health insurance handles ongoing healthcare needs at home.

Medical Emergencies Abroad: Which Insurance Helps?

Travel insurance specifically covers medical emergencies abroad by providing access to emergency medical treatment, evacuation, and repatriation costs that health insurance typically excludes outside your home country. Health insurance often lacks international coverage or offers limited benefits, leaving travelers vulnerable to high medical expenses during overseas emergencies. Choosing travel insurance ensures comprehensive protection for unexpected health crises while traveling.

Claim Processes: Travel Insurance vs Health Insurance

Travel insurance claim processes typically require documentation of trip details, proof of losses, and timely submission to address specific travel-related incidents like trip cancellations or lost luggage. Health insurance claims focus on medical records, treatment bills, and pre-authorization for hospital visits, emphasizing coverage for illness or injury incurred during travel. Understanding the distinct requirements and timelines for each insurance type ensures smoother reimbursement and fewer delays.

Costs and Premiums: Comparing Value

Travel insurance premiums are typically lower than health insurance costs due to their short-term coverage and specific trip-related risks, such as trip cancellation or lost luggage. Health insurance premiums tend to be higher because they cover extensive medical care over longer periods, including chronic conditions and preventive services. Evaluating the value of each depends on the traveler's health needs, trip duration, and potential medical expenses abroad.

Exclusions and Limitations to Watch Out For

Travel insurance often excludes coverage for pre-existing medical conditions, high-risk activities, and pandemics, whereas health insurance may not cover medical emergencies abroad or evacuation costs. Travelers should scrutinize policy limits on emergency medical expenses, trip cancellations, and lost baggage to avoid unexpected out-of-pocket expenses. Understanding differences in exclusions like war zones, mental health treatment, and adventure sports is crucial to selecting adequate protection.

Choosing the Right Insurance for Your Next Trip

Choosing the right insurance for your next trip involves understanding the distinct benefits of travel insurance versus health insurance. Travel insurance covers trip cancellations, lost luggage, and emergency evacuations, while health insurance typically focuses on medical expenses and ongoing care. Analyzing your destination, trip duration, and health coverage gaps helps determine which policy safeguards your travel investment and well-being most effectively.

travel insurance vs health insurance Infographic

difterm.com

difterm.com