A travel debit card allows direct access to funds from your bank account while traveling, offering convenience and security without carrying cash. Prepaid travel cards require upfront loading with a fixed amount, helping to control spending and avoid overdraft fees abroad. Both cards offer competitive exchange rates, but the choice depends on whether you prefer flexible access to your bank balance or budget management during travel.

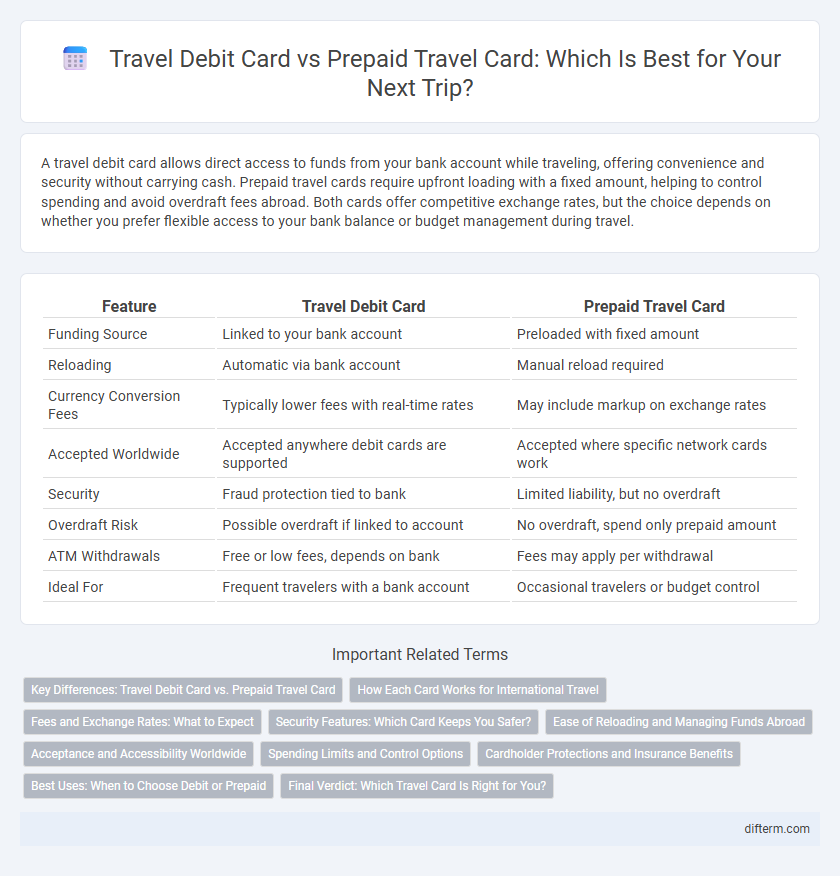

Table of Comparison

| Feature | Travel Debit Card | Prepaid Travel Card |

|---|---|---|

| Funding Source | Linked to your bank account | Preloaded with fixed amount |

| Reloading | Automatic via bank account | Manual reload required |

| Currency Conversion Fees | Typically lower fees with real-time rates | May include markup on exchange rates |

| Accepted Worldwide | Accepted anywhere debit cards are supported | Accepted where specific network cards work |

| Security | Fraud protection tied to bank | Limited liability, but no overdraft |

| Overdraft Risk | Possible overdraft if linked to account | No overdraft, spend only prepaid amount |

| ATM Withdrawals | Free or low fees, depends on bank | Fees may apply per withdrawal |

| Ideal For | Frequent travelers with a bank account | Occasional travelers or budget control |

Key Differences: Travel Debit Card vs. Prepaid Travel Card

Travel debit cards link directly to your bank account, allowing seamless access to funds with no need to preload money, while prepaid travel cards require loading a fixed amount before use. Travel debit cards typically offer real-time transaction monitoring and ATM withdrawals with lower fees, whereas prepaid cards can help control spending with a locked balance and often include protection against overspending. Both cards support multiple currencies, but prepaid cards usually provide better security against fraud since they are not tied to a bank account.

How Each Card Works for International Travel

Travel debit cards connect directly to your bank account, allowing you to withdraw local currency at ATMs and make purchases abroad using funds you already have, with exchange rates typically set by your bank. Prepaid travel cards require you to load a fixed amount of money before traveling, providing better control over spending and reduced risk of overspending or fraud, while often offering competitive exchange rates and fixed fees. Both cards support international travel convenience, but travel debit cards offer seamless access to your existing funds, whereas prepaid cards function like reloadable wallets for managing travel budgets.

Fees and Exchange Rates: What to Expect

Travel debit cards typically offer lower fees and more competitive exchange rates since they are directly linked to your bank account, allowing real-time currency conversion. Prepaid travel cards often have fixed fees for loading and reloading funds, as well as less favorable exchange rates due to predetermined currency conversion at the time of purchase. Understanding the fee structures and daily exchange rate fluctuations is crucial to optimizing travel expenses and avoiding unexpected costs.

Security Features: Which Card Keeps You Safer?

Travel debit cards offer robust security features such as real-time transaction alerts, EMV chip technology, and zero liability protection for fraudulent charges, making them a reliable choice for secure spending abroad. Prepaid travel cards provide enhanced control by allowing users to load a fixed amount, limiting exposure to potential loss and often including multi-currency support with encrypted transactions. Both card types include PIN protection and fraud monitoring, but prepaid cards typically reduce risks by isolating funds from your primary bank account.

Ease of Reloading and Managing Funds Abroad

Prepaid travel cards often require manual reloading through online accounts or physical reload points, which can be time-consuming and sometimes inconvenient when abroad. Travel debit cards linked directly to a bank account allow seamless fund management and instant access to money via ATMs or online transfers, enhancing ease of use during international travel. Managing funds with a travel debit card enables real-time monitoring and flexible reloading options, making it more efficient for frequent travelers.

Acceptance and Accessibility Worldwide

Travel debit cards are widely accepted at millions of locations globally, including ATMs and point-of-sale terminals, offering seamless access to local currency without currency exchange fees charged by some prepaid cards. Prepaid travel cards provide controlled spending limits and are accepted at many merchants and ATMs worldwide but may have restrictions or fees in certain countries due to limited network partnerships. Choosing between the two depends on the traveler's need for universal acceptance and the convenience of accessing funds with minimal charges.

Spending Limits and Control Options

Travel debit cards offer direct access to funds in your linked bank account, typically with higher spending limits and real-time transaction monitoring for precise control. Prepaid travel cards require pre-loading funds and often restrict spending to the preloaded amount, providing enhanced budget management and fraud protection through limited exposure. Both card types feature customizable spending controls via mobile apps, but prepaid cards excel in limiting overspending and simplifying expense tracking during travel.

Cardholder Protections and Insurance Benefits

Travel debit cards offer direct access to your bank account with standard fraud protection under banking regulations, while prepaid travel cards provide limited liability for unauthorized transactions but are not linked to your main account, reducing overall risk exposure. Prepaid travel cards often include travel-specific insurance benefits such as trip cancellation, lost luggage coverage, and emergency assistance, features generally absent in travel debit cards. Cardholder protections on prepaid cards typically extend to disputes and fraud claims with dedicated customer service tailored for travelers, enhancing security and peace of mind during international trips.

Best Uses: When to Choose Debit or Prepaid

Travel debit cards are ideal for frequent travelers who prefer direct access to their checking account funds with low or no fees for ATM withdrawals abroad. Prepaid travel cards suit budget-conscious tourists looking to control spending and avoid overspending by loading a fixed amount before the trip. Choosing between debit and prepaid travel cards depends on factors such as payment security preferences, ease of reload, associated fees, and travel destinations.

Final Verdict: Which Travel Card Is Right for You?

Choosing between a travel debit card and a prepaid travel card depends on your spending habits and destination preferences. Travel debit cards offer direct access to your bank funds with fewer fees and wide acceptance, ideal for frequent travelers who want convenience and protection. Prepaid travel cards provide controlled spending limits and enhanced security, making them suitable for budget-conscious travelers or those heading to high-risk areas.

travel debit card vs prepaid travel card Infographic

difterm.com

difterm.com