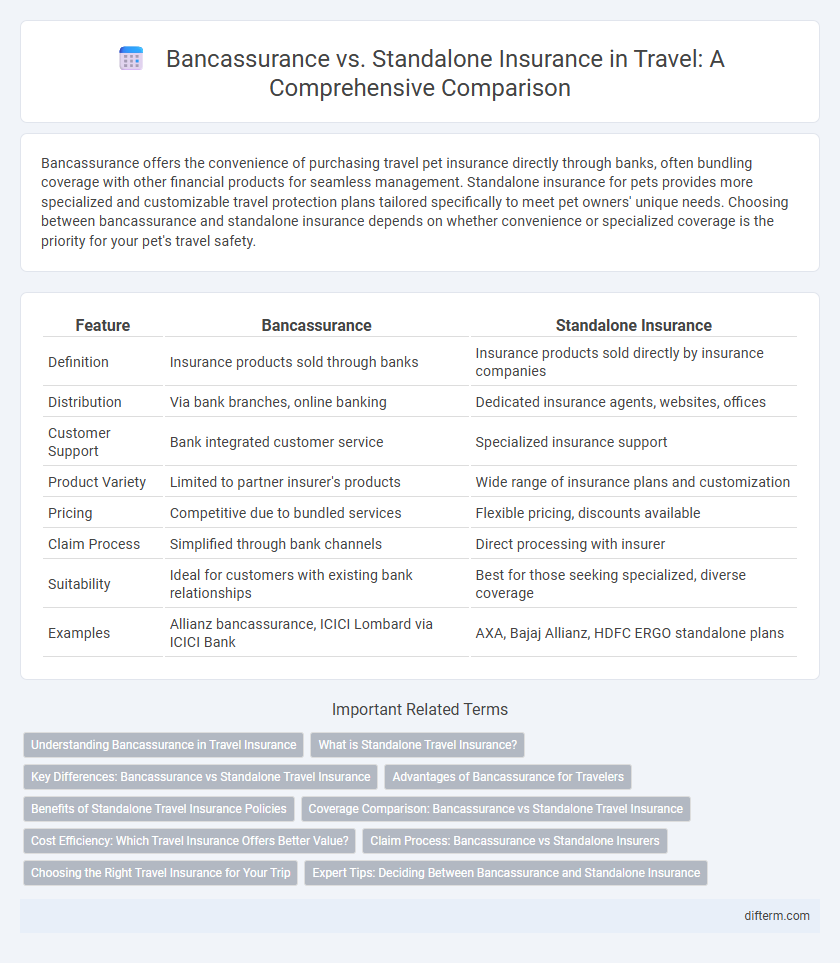

Bancassurance offers the convenience of purchasing travel pet insurance directly through banks, often bundling coverage with other financial products for seamless management. Standalone insurance for pets provides more specialized and customizable travel protection plans tailored specifically to meet pet owners' unique needs. Choosing between bancassurance and standalone insurance depends on whether convenience or specialized coverage is the priority for your pet's travel safety.

Table of Comparison

| Feature | Bancassurance | Standalone Insurance |

|---|---|---|

| Definition | Insurance products sold through banks | Insurance products sold directly by insurance companies |

| Distribution | Via bank branches, online banking | Dedicated insurance agents, websites, offices |

| Customer Support | Bank integrated customer service | Specialized insurance support |

| Product Variety | Limited to partner insurer's products | Wide range of insurance plans and customization |

| Pricing | Competitive due to bundled services | Flexible pricing, discounts available |

| Claim Process | Simplified through bank channels | Direct processing with insurer |

| Suitability | Ideal for customers with existing bank relationships | Best for those seeking specialized, diverse coverage |

| Examples | Allianz bancassurance, ICICI Lombard via ICICI Bank | AXA, Bajaj Allianz, HDFC ERGO standalone plans |

Understanding Bancassurance in Travel Insurance

Bancassurance in travel insurance integrates insurance products with banking services, allowing customers to purchase travel insurance directly through their banks, enhancing convenience and trust. This model leverages the bank's existing customer base and distribution network, often resulting in competitive premiums and streamlined claim processes. Unlike standalone insurance providers, bancassurance offers bundled financial services, simplifying protection for travelers while benefiting from the bank's regulatory framework and customer service infrastructure.

What is Standalone Travel Insurance?

Standalone travel insurance provides coverage exclusively for travel-related risks such as trip cancellations, medical emergencies, lost luggage, and travel delays. Unlike bancassurance, which bundles insurance with banking products, standalone policies offer specialized protection tailored to travelers' unique needs and often include customizable options for international health coverage, trip interruption, and emergency evacuation. Travelers benefit from dedicated claims service and flexible policy terms designed specifically for travel contingencies.

Key Differences: Bancassurance vs Standalone Travel Insurance

Bancassurance travel insurance is typically offered through a bank, bundling insurance products with banking services, providing convenience and sometimes lower premiums due to partnerships. Standalone travel insurance is purchased directly from an insurance provider, offering more tailored coverage options and greater flexibility in policy customization. Key differences include distribution channels, pricing strategies, and the extent of coverage customization available to travelers.

Advantages of Bancassurance for Travelers

Bancassurance offers travelers convenient access to insurance products directly through their bank, simplifying the purchase process and enhancing financial security during trips. It provides tailored travel insurance solutions that often come with competitive premiums and seamless integration with existing banking services. Travelers benefit from bundled offers, efficient claims handling, and centralized customer support, ensuring a hassle-free insurance experience.

Benefits of Standalone Travel Insurance Policies

Standalone travel insurance policies offer comprehensive coverage tailored specifically to travel-related risks such as trip cancellations, medical emergencies abroad, lost luggage, and travel delays. These policies provide greater flexibility in choosing coverage limits, deductibles, and add-ons like adventure sports protection or rental car damage. Compared to bancassurance products, standalone plans often deliver more specialized customer service and quicker claims processing focused exclusively on travel needs.

Coverage Comparison: Bancassurance vs Standalone Travel Insurance

Bancassurance travel insurance often provides bundled coverage options integrated with banking products, offering convenience but sometimes limited benefits compared to standalone travel insurance. Standalone travel insurance typically delivers more comprehensive coverage, including higher medical reimbursements, trip cancellation, and baggage loss protection tailored to specific travel needs. Travelers prioritizing extensive coverage and customizable plans usually benefit more from standalone policies than bancassurance offerings.

Cost Efficiency: Which Travel Insurance Offers Better Value?

Bancassurance travel insurance often provides better cost efficiency due to bundled services and lower administrative fees compared to standalone insurance policies. Standalone travel insurance may offer more customizable coverage but usually comes at a higher premium, reducing overall value. Analyzing factors like premium costs, coverage limits, and claims process efficiency reveals bancassurance as a more budget-friendly option for most travelers.

Claim Process: Bancassurance vs Standalone Insurers

The claim process in bancassurance typically offers a streamlined experience due to the integration between banks and insurance providers, allowing for faster verification and disbursal. Standalone insurers often provide more specialized claim handling with direct customer interaction but may involve longer processing times due to separate protocols. Policyholders should evaluate the trade-off between convenience in bancassurance claims and the potentially more tailored service from standalone insurance companies.

Choosing the Right Travel Insurance for Your Trip

Choosing the right travel insurance involves comparing bancassurance policies offered through banks with standalone insurance plans tailored specifically for travelers. Bancassurance often provides convenience and bundled financial benefits, while standalone travel insurance delivers specialized coverage such as trip cancellation, medical emergencies, and lost luggage. Evaluating policy limits, exclusions, and claim processes ensures travelers secure the most comprehensive protection for their specific itinerary and risk profile.

Expert Tips: Deciding Between Bancassurance and Standalone Insurance

Evaluating travel insurance options requires understanding the distinct advantages of bancassurance and standalone insurance products. Bancassurance offers convenience through integrated banking services and potentially lower premiums due to bundled offers, while standalone insurance policies provide specialized coverage tailored specifically for travelers, often with broader options and enhanced claim support. Expert decision-making hinges on prioritizing personalized coverage needs, claim process ease, and overall cost-effectiveness aligned with individual travel plans.

bancassurance vs standalone insurance Infographic

difterm.com

difterm.com