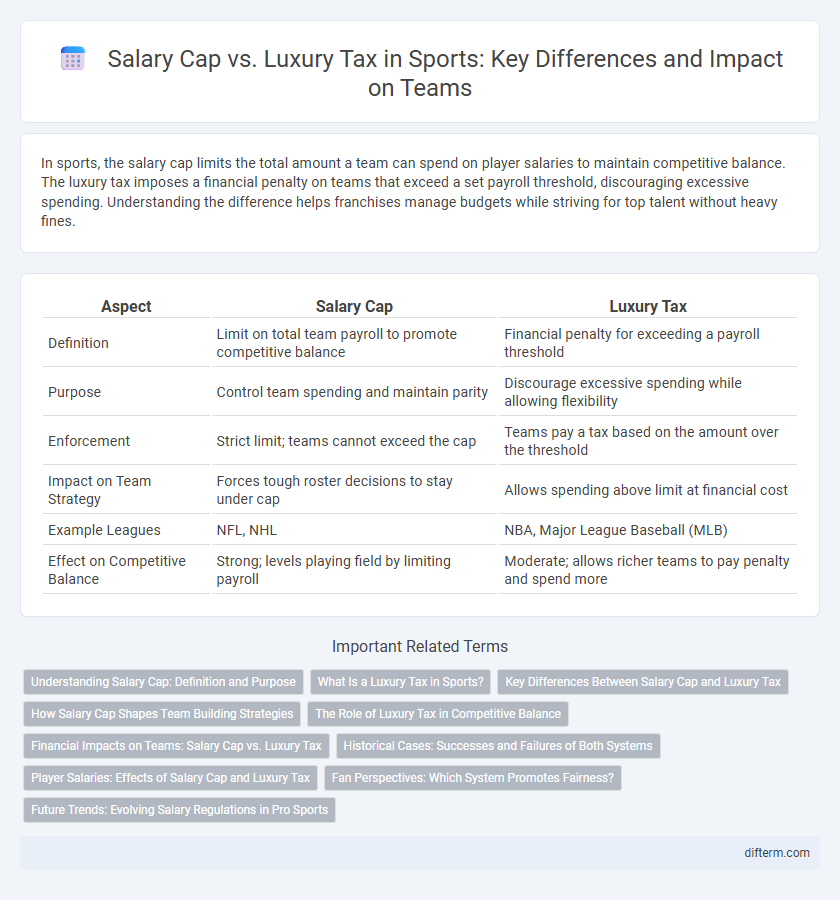

In sports, the salary cap limits the total amount a team can spend on player salaries to maintain competitive balance. The luxury tax imposes a financial penalty on teams that exceed a set payroll threshold, discouraging excessive spending. Understanding the difference helps franchises manage budgets while striving for top talent without heavy fines.

Table of Comparison

| Aspect | Salary Cap | Luxury Tax |

|---|---|---|

| Definition | Limit on total team payroll to promote competitive balance | Financial penalty for exceeding a payroll threshold |

| Purpose | Control team spending and maintain parity | Discourage excessive spending while allowing flexibility |

| Enforcement | Strict limit; teams cannot exceed the cap | Teams pay a tax based on the amount over the threshold |

| Impact on Team Strategy | Forces tough roster decisions to stay under cap | Allows spending above limit at financial cost |

| Example Leagues | NFL, NHL | NBA, Major League Baseball (MLB) |

| Effect on Competitive Balance | Strong; levels playing field by limiting payroll | Moderate; allows richer teams to pay penalty and spend more |

Understanding Salary Cap: Definition and Purpose

The salary cap is a league-imposed limit on the total amount teams can spend on player salaries, designed to promote competitive balance and financial stability within professional sports leagues. It ensures that wealthier franchises cannot monopolize top talent, fostering parity among teams. Understanding the salary cap's purpose helps fans and analysts evaluate team decisions on player acquisitions and roster management.

What Is a Luxury Tax in Sports?

A luxury tax in sports is a financial penalty imposed on teams that exceed a league's designated salary cap, designed to promote competitive balance by discouraging excessive spending on player salaries. Unlike a hard salary cap, which strictly limits total payroll, the luxury tax allows teams to surpass the limit but taxes the excess amount, with rates that often increase progressively for repeat offenders. This system generates revenue for the league and redistributes funds to smaller-market teams, maintaining parity and fostering a fairer competitive environment.

Key Differences Between Salary Cap and Luxury Tax

The salary cap imposes a strict limit on a team's total player payroll, ensuring competitive balance by preventing wealthier teams from accumulating excessive talent. In contrast, the luxury tax allows teams to exceed a predetermined payroll threshold but penalizes them financially with escalating tax rates based on their overage amount. While the salary cap enforces hard spending limits, the luxury tax acts as a financial disincentive without restricting roster spending outright.

How Salary Cap Shapes Team Building Strategies

Salary cap enforces a strict limit on total player salaries, compelling teams to prioritize cost-effective talent acquisition and foster balanced rosters. Luxury tax, while allowing teams to exceed the cap, imposes financial penalties that shape decisions on signing star players versus developing bench depth. This economic framework drives strategic roster construction to optimize performance while managing financial sustainability.

The Role of Luxury Tax in Competitive Balance

The luxury tax serves as a financial deterrent for teams that exceed the salary cap, promoting competitive balance by discouraging excessive spending on player salaries. By imposing penalties on high-spending teams, it helps level the playing field, allowing smaller-market franchises to remain competitive. This system indirectly controls payroll inflation while maintaining team investment in talent acquisition.

Financial Impacts on Teams: Salary Cap vs. Luxury Tax

Salary caps strictly limit total player salaries, promoting team parity but forcing franchises to make strategic roster decisions within tight financial constraints. Luxury tax thresholds impose penalties on teams that exceed set payroll limits, creating significant financial burdens that can deter excessive spending while allowing more flexibility than salary caps. These financial mechanisms both aim to maintain competitive balance but influence team budgeting strategies differently, with salary caps enforcing hard limits and luxury taxes imposing punitive costs for overspending.

Historical Cases: Successes and Failures of Both Systems

Historical cases in sports reveal that salary caps have successfully maintained competitive balance and prevented team monopolies, such as the NBA's implementation leading to more evenly matched rosters since 1984. In contrast, luxury tax systems, like MLB's, have seen mixed results where teams like the New York Yankees faced significant financial penalties but continued to dominate, raising questions about the tax's deterrent effect. Examining these systems highlights that salary caps enforce stricter financial equality, while luxury taxes allow wealthy franchises to absorb penalties but can still reduce extreme spending disparities.

Player Salaries: Effects of Salary Cap and Luxury Tax

Player salaries are directly influenced by salary caps, which set a strict limit on total team payroll, ensuring competitive balance by preventing wealthier teams from overspending on talent. The luxury tax imposes a financial penalty on teams exceeding the salary cap, deterring excessive spending while still allowing flexibility in player acquisitions. Both mechanisms impact roster construction, contract negotiations, and competitive dynamics across professional sports leagues.

Fan Perspectives: Which System Promotes Fairness?

Fans often debate whether salary caps or luxury taxes create a fairer playing field in sports leagues. Salary caps limit total team spending, promoting parity by preventing wealthier teams from outspending rivals, while luxury taxes allow high spenders but impose financial penalties to discourage excessive spending. Many supporters argue salary caps enhance competitive balance more effectively, whereas luxury taxes may still enable richer franchises to maintain dominance.

Future Trends: Evolving Salary Regulations in Pro Sports

Pro sports leagues are increasingly adjusting salary cap structures and luxury tax thresholds to maintain competitive balance and financial sustainability. Emerging trends emphasize flexible caps tied to league revenues and escalating luxury tax penalties to deter excessive spending. These evolving salary regulations aim to promote parity among teams while incentivizing prudent financial management in the long term.

salary cap vs luxury tax Infographic

difterm.com

difterm.com