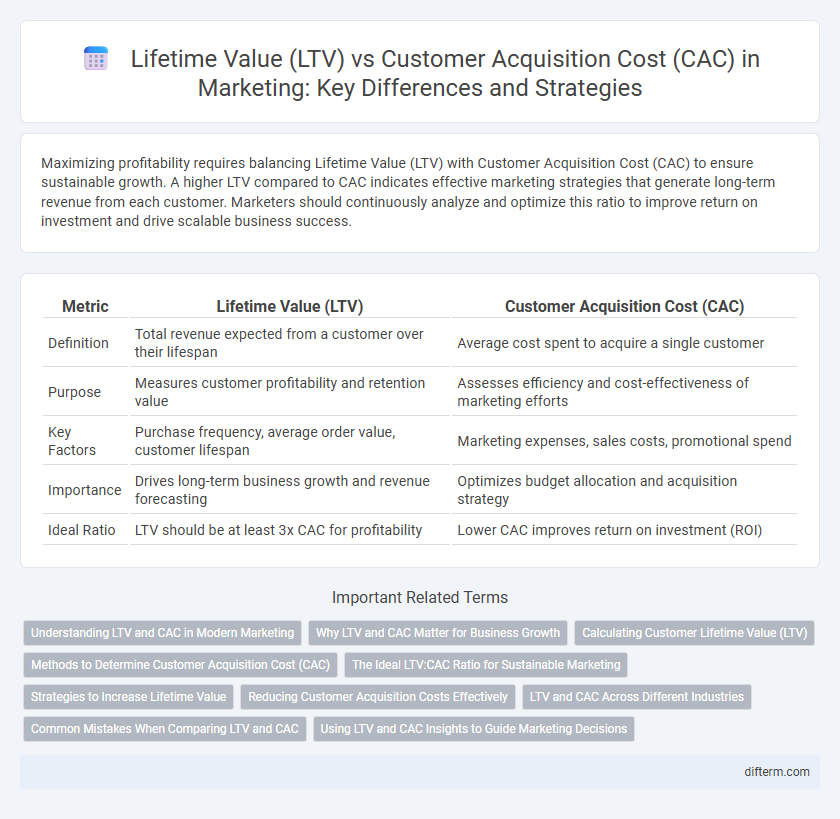

Maximizing profitability requires balancing Lifetime Value (LTV) with Customer Acquisition Cost (CAC) to ensure sustainable growth. A higher LTV compared to CAC indicates effective marketing strategies that generate long-term revenue from each customer. Marketers should continuously analyze and optimize this ratio to improve return on investment and drive scalable business success.

Table of Comparison

| Metric | Lifetime Value (LTV) | Customer Acquisition Cost (CAC) |

|---|---|---|

| Definition | Total revenue expected from a customer over their lifespan | Average cost spent to acquire a single customer |

| Purpose | Measures customer profitability and retention value | Assesses efficiency and cost-effectiveness of marketing efforts |

| Key Factors | Purchase frequency, average order value, customer lifespan | Marketing expenses, sales costs, promotional spend |

| Importance | Drives long-term business growth and revenue forecasting | Optimizes budget allocation and acquisition strategy |

| Ideal Ratio | LTV should be at least 3x CAC for profitability | Lower CAC improves return on investment (ROI) |

Understanding LTV and CAC in Modern Marketing

Understanding lifetime value (LTV) and customer acquisition cost (CAC) is crucial for optimizing marketing ROI and driving sustainable growth. LTV quantifies the total revenue a customer generates throughout their relationship with a brand, while CAC measures the expenses incurred to acquire a new customer. Balancing a high LTV relative to CAC ensures profitability, guiding data-driven marketing strategies and budget allocation in competitive markets.

Why LTV and CAC Matter for Business Growth

Lifetime value (LTV) measures the total revenue generated from a customer over their entire relationship with a business, while customer acquisition cost (CAC) represents the investment required to acquire that customer. Understanding the LTV to CAC ratio is essential for sustainable business growth, as it ensures that the revenue earned justifies the marketing and sales expenses. Businesses that maintain a high LTV compared to a low CAC can optimize profitability and allocate resources more efficiently for long-term success.

Calculating Customer Lifetime Value (LTV)

Calculating Customer Lifetime Value (LTV) involves estimating the total revenue a business can expect from a single customer throughout their entire relationship. Key factors include average purchase value, purchase frequency, and customer lifespan, which when multiplied together, provide a comprehensive LTV figure. Accurate LTV calculation enables marketers to compare it effectively against Customer Acquisition Cost (CAC) for optimizing budgets and maximizing profitability.

Methods to Determine Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is calculated by dividing total marketing and sales expenses by the number of new customers acquired during a specific period. Methods to determine CAC include analyzing digital advertising spend, tracking sales team costs, and attributing expenses from multiple channels such as content marketing, email campaigns, and social media promotions. Accurate CAC measurement requires integrating data from CRM systems, marketing automation platforms, and finance records to capture all relevant costs associated with customer acquisition.

The Ideal LTV:CAC Ratio for Sustainable Marketing

The ideal Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio for sustainable marketing typically ranges from 3:1, indicating that the revenue generated from a customer should be three times the cost of acquiring them. Ratios below 3:1 may signal inefficient marketing spend, while ratios significantly above 3:1 could suggest underinvestment in growth opportunities. Maintaining an optimal LTV:CAC ratio ensures profitability, supports scalable customer acquisition strategies, and drives long-term business sustainability.

Strategies to Increase Lifetime Value

Maximizing Lifetime Value (LTV) involves implementing personalized marketing campaigns that boost customer engagement and encourage repeat purchases. Offering loyalty programs and subscription models enhances customer retention, thereby increasing overall revenue per customer. Leveraging data analytics to identify high-value segments enables targeted strategies that improve customer satisfaction and extend the duration of the customer relationship.

Reducing Customer Acquisition Costs Effectively

Reducing customer acquisition costs (CAC) effectively involves optimizing marketing channels and targeting high-converting audience segments to maximize return on investment. Leveraging data analytics and automation enables precise budget allocation, minimizing wasted spend and improving customer lifetime value (LTV) ratios. Focusing on retention strategies and personalized experiences enhances LTV, ensuring acquisition efforts remain cost-efficient and sustainable.

LTV and CAC Across Different Industries

Lifetime Value (LTV) and Customer Acquisition Cost (CAC) ratios vary significantly across industries, impacting marketing strategy efficiency and budget allocation. Industries like SaaS typically exhibit high LTV due to recurring revenue models, justifying higher CAC investments, whereas retail often faces lower LTV and must maintain tighter CAC controls to ensure profitability. Understanding these variations allows marketers to tailor customer acquisition efforts and forecast long-term revenue based on industry-specific retention and cost dynamics.

Common Mistakes When Comparing LTV and CAC

Misinterpreting the timeframe when calculating Lifetime Value (LTV) leads to inaccurate assessments, as LTV should reflect the entire duration a customer generates revenue, not just initial periods. Overlooking indirect costs in Customer Acquisition Cost (CAC) calculations, such as marketing overhead and sales expenses, results in underestimated CAC values that distort profitability analysis. Comparing mismatched LTV and CAC metrics without aligning their respective time horizons or cost inclusions often causes erroneous decisions in marketing budget allocation.

Using LTV and CAC Insights to Guide Marketing Decisions

Analyzing Lifetime value (LTV) in relation to customer acquisition cost (CAC) enables marketers to optimize budget allocation by identifying the most profitable customer segments. A high LTV to CAC ratio indicates sustainable growth potential, guiding strategic investments in targeting and retention initiatives. Leveraging these metrics helps in refining marketing campaigns to enhance return on investment and maximize long-term revenue.

Lifetime value (LTV) vs customer acquisition cost (CAC) Infographic

difterm.com

difterm.com