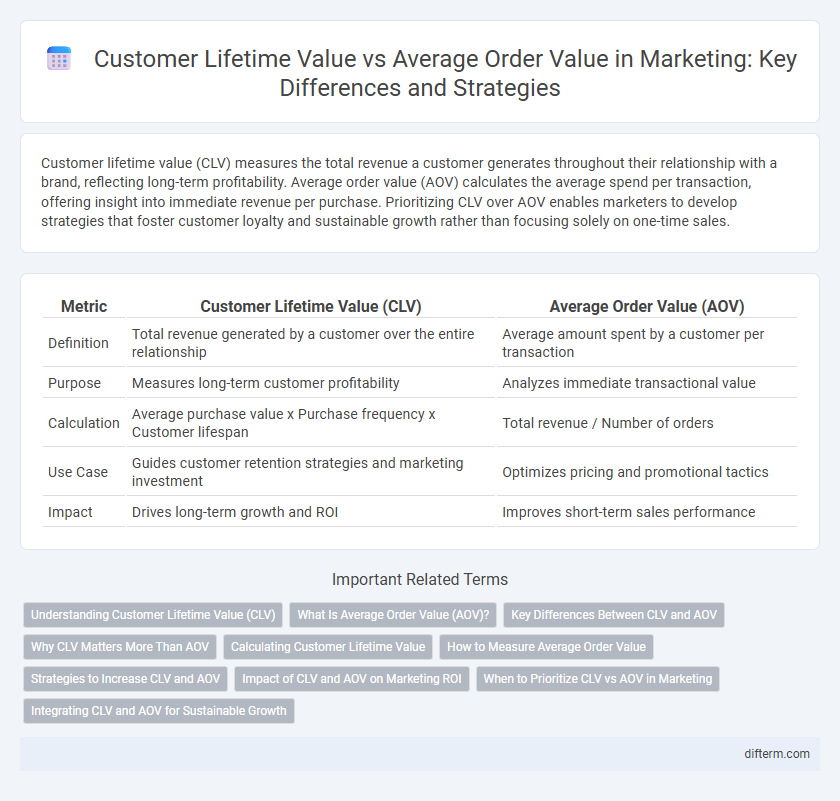

Customer lifetime value (CLV) measures the total revenue a customer generates throughout their relationship with a brand, reflecting long-term profitability. Average order value (AOV) calculates the average spend per transaction, offering insight into immediate revenue per purchase. Prioritizing CLV over AOV enables marketers to develop strategies that foster customer loyalty and sustainable growth rather than focusing solely on one-time sales.

Table of Comparison

| Metric | Customer Lifetime Value (CLV) | Average Order Value (AOV) |

|---|---|---|

| Definition | Total revenue generated by a customer over the entire relationship | Average amount spent by a customer per transaction |

| Purpose | Measures long-term customer profitability | Analyzes immediate transactional value |

| Calculation | Average purchase value x Purchase frequency x Customer lifespan | Total revenue / Number of orders |

| Use Case | Guides customer retention strategies and marketing investment | Optimizes pricing and promotional tactics |

| Impact | Drives long-term growth and ROI | Improves short-term sales performance |

Understanding Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) measures the total revenue a business can expect from a single customer over the entirety of their relationship, offering deeper insights than Average Order Value (AOV), which calculates revenue per transaction. Understanding CLV enables marketers to allocate resources effectively by identifying high-value customers and tailoring retention strategies. Accurate CLV analysis drives long-term profitability by emphasizing customer loyalty and repeat purchase behavior rather than one-time sales.

What Is Average Order Value (AOV)?

Average Order Value (AOV) measures the average amount spent by customers per transaction, calculated by dividing total revenue by the number of orders. This key marketing metric helps businesses understand purchasing behavior and optimize pricing, promotions, and product offerings to increase revenue. Tracking AOV alongside Customer Lifetime Value (CLV) provides insights into both short-term sales performance and long-term customer profitability.

Key Differences Between CLV and AOV

Customer Lifetime Value (CLV) measures the total revenue a business can expect from a single customer throughout their relationship, while Average Order Value (AOV) calculates the average amount spent per transaction. CLV emphasizes long-term profitability and customer retention strategies, whereas AOV focuses on immediate sales performance and transaction size. Understanding the key differences between CLV and AOV enables marketers to optimize marketing campaigns and allocate resources effectively for sustainable growth.

Why CLV Matters More Than AOV

Customer Lifetime Value (CLV) matters more than Average Order Value (AOV) because CLV measures total revenue a customer generates over their entire relationship with a brand, informing long-term growth strategies. Unlike AOV, which only captures single transaction size, CLV helps marketers optimize retention, personalized marketing, and customer segmentation for sustainable profitability. Prioritizing CLV enables businesses to allocate resources effectively, improve customer loyalty, and forecast future revenue more accurately.

Calculating Customer Lifetime Value

Calculating Customer Lifetime Value (CLV) involves estimating the total revenue a customer generates throughout their relationship with a brand, factoring in average purchase value, purchase frequency, and customer retention rate. Unlike Average Order Value (AOV), which measures revenue per transaction, CLV provides deeper insight into long-term profitability and informs marketing budget allocation. Precise CLV calculations enable targeted customer segmentation, optimized acquisition strategies, and enhanced retention efforts that drive sustainable growth.

How to Measure Average Order Value

Measuring Average Order Value (AOV) involves dividing the total revenue generated by the number of orders placed within a specific period. Tracking AOV helps marketers understand customer purchasing behavior and optimize pricing strategies to increase revenue per transaction. Using e-commerce analytics tools, businesses can segment AOV by customer demographics or marketing channels for targeted growth opportunities.

Strategies to Increase CLV and AOV

Increasing Customer Lifetime Value (CLV) and Average Order Value (AOV) requires targeted strategies such as personalized marketing campaigns, loyalty programs, and product bundling to encourage repeat purchases and higher spending per transaction. Implementing upselling and cross-selling techniques, along with subscription models, can significantly boost AOV while enhancing ongoing customer engagement. Leveraging customer data analytics enables businesses to identify high-value segments and tailor offers that maximize both CLV and AOV for long-term revenue growth.

Impact of CLV and AOV on Marketing ROI

Customer lifetime value (CLV) offers a long-term perspective on customer profitability, guiding marketers to allocate budgets toward high-value segments for sustained growth. Average order value (AOV) directly influences short-term revenue by encouraging strategies such as upselling and cross-selling, which increase transaction size. Balancing CLV and AOV optimizes marketing ROI by combining customer retention efforts with tactics that maximize each purchase's immediate revenue impact.

When to Prioritize CLV vs AOV in Marketing

Prioritize Customer Lifetime Value (CLV) when aiming to build long-term customer relationships and maximize revenue from repeat purchases, especially in subscription-based or loyalty-driven businesses. Focus on Average Order Value (AOV) during short-term campaigns or product launches where increasing immediate transaction size is crucial for boosting revenue quickly. Evaluating business goals and sales cycles helps determine whether enhancing CLV or optimizing AOV delivers the best marketing ROI.

Integrating CLV and AOV for Sustainable Growth

Integrating Customer Lifetime Value (CLV) and Average Order Value (AOV) enables marketers to develop targeted strategies that maximize revenue over the long term while optimizing each transaction's profitability. Leveraging analytics to align CLV with AOV helps identify high-value customer segments and tailor personalized marketing efforts that boost repeat purchases and increase order sizes. This combined approach drives sustainable growth by balancing acquisition costs and customer retention investments, ensuring higher returns on marketing spend.

Customer lifetime value vs average order value Infographic

difterm.com

difterm.com