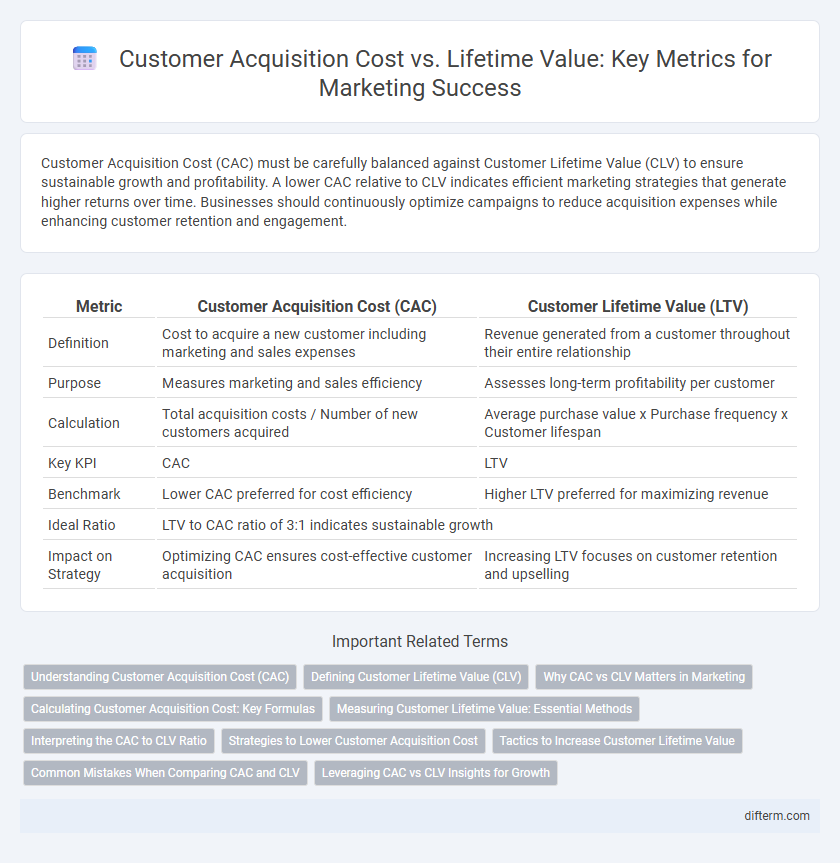

Customer Acquisition Cost (CAC) must be carefully balanced against Customer Lifetime Value (CLV) to ensure sustainable growth and profitability. A lower CAC relative to CLV indicates efficient marketing strategies that generate higher returns over time. Businesses should continuously optimize campaigns to reduce acquisition expenses while enhancing customer retention and engagement.

Table of Comparison

| Metric | Customer Acquisition Cost (CAC) | Customer Lifetime Value (LTV) |

|---|---|---|

| Definition | Cost to acquire a new customer including marketing and sales expenses | Revenue generated from a customer throughout their entire relationship |

| Purpose | Measures marketing and sales efficiency | Assesses long-term profitability per customer |

| Calculation | Total acquisition costs / Number of new customers acquired | Average purchase value x Purchase frequency x Customer lifespan |

| Key KPI | CAC | LTV |

| Benchmark | Lower CAC preferred for cost efficiency | Higher LTV preferred for maximizing revenue |

| Ideal Ratio | LTV to CAC ratio of 3:1 indicates sustainable growth | |

| Impact on Strategy | Optimizing CAC ensures cost-effective customer acquisition | Increasing LTV focuses on customer retention and upselling |

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures the total expenses incurred to attract and convert a new customer, including marketing, sales, and onboarding costs. Accurate calculation of CAC is critical for optimizing budget allocation and ensuring sustainable growth by comparing it to the customer Lifetime Value (LTV). Businesses with lower CAC relative to LTV achieve higher profitability and more effective marketing strategies.

Defining Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) represents the total revenue a business expects from a single customer over the entire duration of their relationship. This metric integrates purchase frequency, average transaction value, and customer retention rates to quantify profitability. Understanding CLV helps marketers allocate budgets efficiently by highlighting the long-term value generated beyond initial acquisition costs.

Why CAC vs CLV Matters in Marketing

Customer Acquisition Cost (CAC) and Lifetime Value (CLV) are critical metrics for assessing marketing efficiency and profitability. A well-balanced CAC to CLV ratio ensures sustainable growth by optimizing spending on acquiring customers relative to the revenue they generate over time. Marketers use this ratio to allocate budgets effectively, improve targeting strategies, and enhance customer retention efforts.

Calculating Customer Acquisition Cost: Key Formulas

Calculating Customer Acquisition Cost (CAC) involves dividing total marketing and sales expenses by the number of new customers acquired during a specific period. The primary formula is CAC = Total Marketing Costs + Sales Costs / Number of New Customers Acquired, which helps businesses determine the efficiency of their marketing strategies. Accurate CAC calculation enables marketers to optimize budget allocation and improve customer acquisition profitability.

Measuring Customer Lifetime Value: Essential Methods

Measuring Customer Lifetime Value (CLV) involves analyzing purchase frequency, average transaction value, and customer retention rates to predict future revenue from each customer. Techniques such as cohort analysis, predictive modeling, and historical data evaluation provide accurate insights into customer profitability over time. Understanding CLV helps optimize Customer Acquisition Cost (CAC) by targeting high-value segments and improving marketing ROI.

Interpreting the CAC to CLV Ratio

The CAC to CLV ratio measures the efficiency of customer acquisition by comparing the cost to acquire a customer against the revenue generated throughout their relationship. A ratio below 1 indicates unsustainable spending, while a ratio above 3 suggests potential underinvestment in growth opportunities. Optimizing this ratio guides marketing strategies to balance acquisition expenses with long-term profitability, ensuring scalable business growth.

Strategies to Lower Customer Acquisition Cost

Lowering Customer Acquisition Cost (CAC) involves targeted strategies such as optimizing digital advertising campaigns through precise audience segmentation and leveraging data analytics to improve conversion rates. Implementing referral programs and enhancing content marketing efforts increase organic traffic, reducing dependency on paid channels. Additionally, nurturing leads with personalized email marketing and improving website user experience can significantly decrease CAC while maintaining or increasing Lifetime Value (LTV).

Tactics to Increase Customer Lifetime Value

Increasing Customer Lifetime Value (CLV) involves personalized marketing campaigns tailored to customer behavior and preferences, leveraging data analytics to identify high-value segments and optimize retention strategies. Implementing loyalty programs and subscription models encourages repeat purchases and long-term engagement, boosting overall revenue per customer. Enhancing customer support through multi-channel communication and proactive service reduces churn rates, directly impacting profitability and maximizing CLV relative to Customer Acquisition Cost (CAC).

Common Mistakes When Comparing CAC and CLV

Common mistakes when comparing Customer Acquisition Cost (CAC) and Lifetime Value (CLV) include overlooking the accurate calculation periods, leading to skewed ROI assessments. Marketers often ignore the impact of churn rates and average customer lifespan, which significantly affect CLV estimations. Failing to segment customers by behavior or acquisition channel results in generalized metrics that hinder targeted marketing strategies.

Leveraging CAC vs CLV Insights for Growth

Leveraging insights from Customer Acquisition Cost (CAC) and Lifetime Value (CLV) drives strategic marketing investments, ensuring more efficient budget allocation for maximum returns. Analyzing the CAC to CLV ratio enables businesses to identify the most profitable customer segments and optimize acquisition strategies accordingly. Prioritizing customers with higher CLV relative to CAC supports sustainable growth and long-term revenue maximization.

Customer Acquisition Cost vs Lifetime Value Infographic

difterm.com

difterm.com