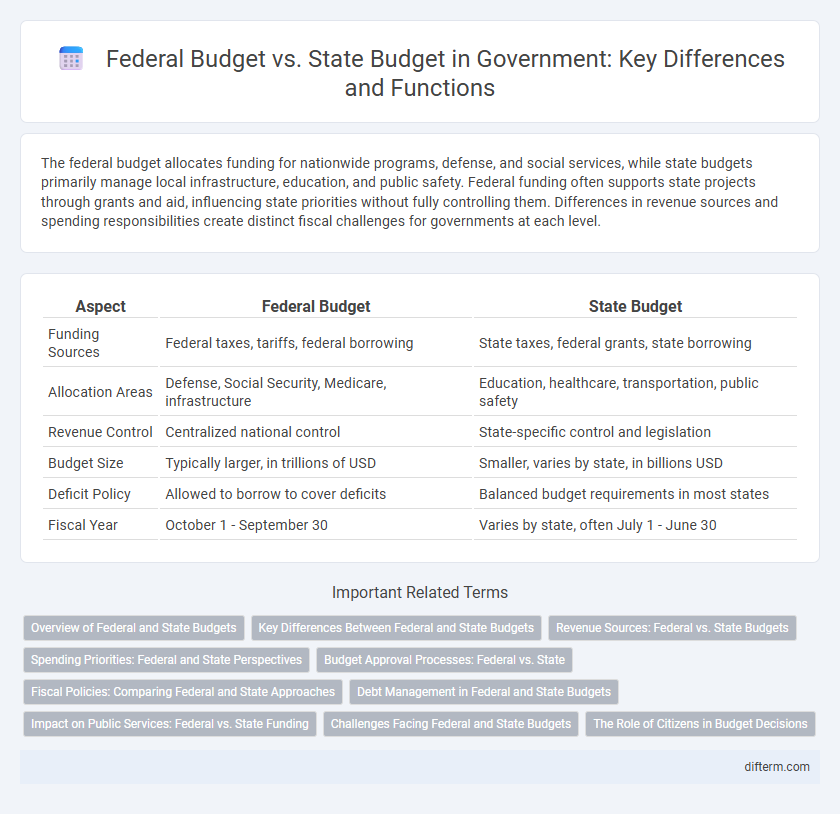

The federal budget allocates funding for nationwide programs, defense, and social services, while state budgets primarily manage local infrastructure, education, and public safety. Federal funding often supports state projects through grants and aid, influencing state priorities without fully controlling them. Differences in revenue sources and spending responsibilities create distinct fiscal challenges for governments at each level.

Table of Comparison

| Aspect | Federal Budget | State Budget |

|---|---|---|

| Funding Sources | Federal taxes, tariffs, federal borrowing | State taxes, federal grants, state borrowing |

| Allocation Areas | Defense, Social Security, Medicare, infrastructure | Education, healthcare, transportation, public safety |

| Revenue Control | Centralized national control | State-specific control and legislation |

| Budget Size | Typically larger, in trillions of USD | Smaller, varies by state, in billions USD |

| Deficit Policy | Allowed to borrow to cover deficits | Balanced budget requirements in most states |

| Fiscal Year | October 1 - September 30 | Varies by state, often July 1 - June 30 |

Overview of Federal and State Budgets

The federal budget allocates funds for national defense, social security, and healthcare programs, with revenues primarily from income and corporate taxes. State budgets focus on local priorities such as education, transportation, and public safety, funded mainly through sales taxes, property taxes, and federal grants. Federal budgets often involve larger deficits and debt levels, while state budgets must typically be balanced annually to meet legal requirements.

Key Differences Between Federal and State Budgets

Federal budgets are comprehensive financial plans managed by the national government, encompassing defense, social security, and interstate infrastructure, funded primarily through income and corporate taxes. State budgets, controlled by individual states, focus on local priorities like education, public safety, and transportation, financed mainly through sales taxes, property taxes, and federal grants. Unlike federal budgets that can run deficits and borrow extensively, many state budgets are mandated to be balanced annually, reflecting differing fiscal policies and responsibilities.

Revenue Sources: Federal vs. State Budgets

Federal budgets primarily rely on income taxes, payroll taxes, and corporate taxes as their major revenue sources, generating funds to support nationwide programs and defense. State budgets depend more heavily on sales taxes, property taxes, and federal grants, reflecting localized revenue generation and funding priorities for education, transportation, and public safety. The divergence in revenue structures underscores the differing fiscal responsibilities and economic policies between federal and state governments.

Spending Priorities: Federal and State Perspectives

Federal budgets prioritize national defense, social security, and infrastructure projects, allocating a significant portion to entitlement programs and federal grants. State budgets focus more on education, public safety, and transportation, with spending closely tied to local needs and revenue sources like sales and property taxes. The divergence in spending priorities reflects the distinct roles of federal and state governments in managing public services and economic development.

Budget Approval Processes: Federal vs. State

The federal budget approval process involves a complex sequence of proposals, congressional reviews, and presidential signatures, often spanning several months and subject to political negotiations. State budget approval timelines and procedures vary significantly by state, with many requiring balanced budgets and legislative approval, sometimes including public referendums or governor veto power. Differences in constitutional mandates and fiscal policies shape the distinct budget approval frameworks at federal and state levels, impacting the allocation and prioritization of funding.

Fiscal Policies: Comparing Federal and State Approaches

Federal fiscal policy leverages broad taxation and spending programs to influence the national economy, focusing on macroeconomic stabilization, social welfare, and defense funding. State budgets prioritize localized revenue sources such as sales and property taxes, addressing region-specific needs like education and infrastructure within federal guidelines. Differences in fiscal capacity and policy objectives shape how federal and state governments implement taxation and expenditure to manage economic growth and public services.

Debt Management in Federal and State Budgets

Federal budget debt management involves issuing Treasury securities to finance deficits, leveraging a unified national credit system that benefits from broad fiscal capacity and monetary policy tools. State budget debt management is constrained by balanced budget requirements and often relies on issuing municipal bonds, which are subject to credit ratings and voter approval, limiting states' flexibility in borrowing. Effective debt management at both levels requires strategic planning to balance fiscal responsibility with economic growth, ensuring long-term sustainability of public finances.

Impact on Public Services: Federal vs. State Funding

Federal budgets allocate substantial funds to nationwide programs such as Social Security, Medicare, and infrastructure projects, ensuring consistent service levels across states. State budgets focus on localized needs, funding public education, local law enforcement, and transportation systems tailored to community priorities. Variations in funding between federal and state sources directly affect the quality, accessibility, and scope of public services delivered to citizens.

Challenges Facing Federal and State Budgets

Federal budgets often face challenges related to managing national debt, balancing defense spending, and addressing entitlement program costs, which demand significant allocations. State budgets struggle with limited revenue sources and mandates from the federal government, complicating efforts to fund education, healthcare, and infrastructure. Both levels face unpredictability in tax revenues due to economic fluctuations, requiring careful fiscal management to maintain essential public services.

The Role of Citizens in Budget Decisions

Citizens influence both federal and state budgets through public consultations, voting on budget allocations, and participation in town hall meetings, ensuring government accountability and transparency. Public input helps prioritize spending on essential services like education, healthcare, and infrastructure, reflecting community needs and values. Engagement in budget decisions fosters democratic governance by empowering citizens to shape fiscal policies that impact local and national development.

federal budget vs state budget Infographic

difterm.com

difterm.com