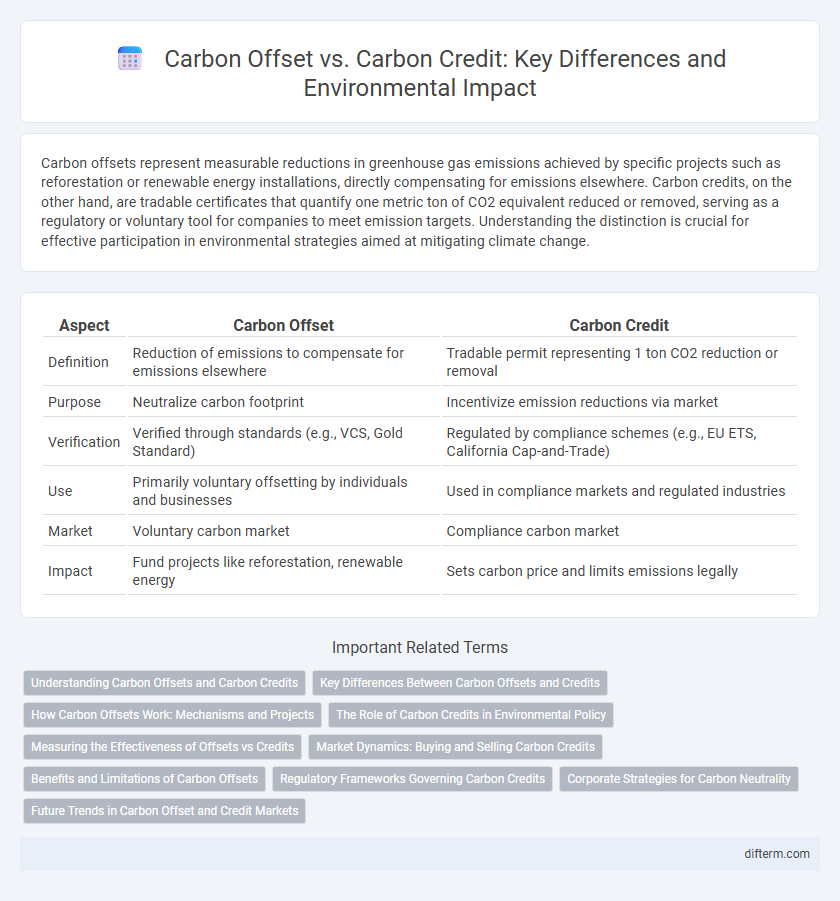

Carbon offsets represent measurable reductions in greenhouse gas emissions achieved by specific projects such as reforestation or renewable energy installations, directly compensating for emissions elsewhere. Carbon credits, on the other hand, are tradable certificates that quantify one metric ton of CO2 equivalent reduced or removed, serving as a regulatory or voluntary tool for companies to meet emission targets. Understanding the distinction is crucial for effective participation in environmental strategies aimed at mitigating climate change.

Table of Comparison

| Aspect | Carbon Offset | Carbon Credit |

|---|---|---|

| Definition | Reduction of emissions to compensate for emissions elsewhere | Tradable permit representing 1 ton CO2 reduction or removal |

| Purpose | Neutralize carbon footprint | Incentivize emission reductions via market |

| Verification | Verified through standards (e.g., VCS, Gold Standard) | Regulated by compliance schemes (e.g., EU ETS, California Cap-and-Trade) |

| Use | Primarily voluntary offsetting by individuals and businesses | Used in compliance markets and regulated industries |

| Market | Voluntary carbon market | Compliance carbon market |

| Impact | Fund projects like reforestation, renewable energy | Sets carbon price and limits emissions legally |

Understanding Carbon Offsets and Carbon Credits

Carbon offsets represent verified reductions in greenhouse gas emissions from projects such as reforestation or renewable energy, allowing individuals or companies to compensate for their own emissions. Carbon credits function as tradable certificates that quantify one metric ton of CO2 equivalent reduced or removed from the atmosphere, often generated through carbon offset projects. Understanding the distinction helps in effective climate strategies by recognizing that offsets are the environmental actions behind the credits, while credits facilitate market-based carbon trading.

Key Differences Between Carbon Offsets and Credits

Carbon offsets represent measurable reductions in greenhouse gas emissions from projects like reforestation or renewable energy, directly compensating for emissions elsewhere. Carbon credits are tradable permits that allow the holder to emit a specific amount of carbon dioxide, serving as a regulatory compliance mechanism within cap-and-trade systems. Unlike offsets, credits are issued by regulatory bodies and have a fixed emission reduction value, while offsets can originate from voluntary initiatives with diverse project types.

How Carbon Offsets Work: Mechanisms and Projects

Carbon offsets function by funding projects that reduce or remove greenhouse gas emissions, such as reforestation, renewable energy installations, or methane capture initiatives. Each carbon offset represents a specific amount of CO2 equivalent reduced or sequestered, enabling individuals or companies to compensate for their emissions by supporting verified environmental projects. These mechanisms are distinct from carbon credits, which involve regulated market compliance and emission trading under cap-and-trade systems.

The Role of Carbon Credits in Environmental Policy

Carbon credits function as tradable permits representing the right to emit one metric ton of CO2, enabling governments and organizations to regulate and cap overall emissions effectively. These credits incentivize emission reductions by allowing entities to finance sustainable projects that absorb or reduce greenhouse gases, thus aligning economic activities with environmental goals. Integrating carbon credits into environmental policy promotes market-driven approaches to achieving national and international climate targets, fostering innovation in clean technologies and conservation efforts.

Measuring the Effectiveness of Offsets vs Credits

Measuring the effectiveness of carbon offsets involves assessing the actual reduction in greenhouse gas emissions achieved through specific projects, such as reforestation or renewable energy installations, verified by standards like the Gold Standard or Verified Carbon Standard (VCS). Carbon credits represent tradable certificates tied to one metric ton of CO2 equivalent reduced or avoided, but their effectiveness depends on third-party validation, additionality, and permanence criteria to ensure genuine environmental impact. Accurate measurement requires transparent reporting, rigorous monitoring, and addressing potential issues such as leakage and double counting to maintain the integrity of both offsets and credits in climate mitigation efforts.

Market Dynamics: Buying and Selling Carbon Credits

Carbon credits represent tradable certificates that permit the emission of a specific amount of carbon dioxide, forming the basis of regulated carbon markets where companies buy and sell these credits to meet emission reduction targets. Carbon offsets differ as projects independently reduce, avoid, or capture emissions, generating credits that companies purchase to voluntarily balance out their carbon footprint. Market dynamics for carbon credits are driven by government regulations, corporate sustainability commitments, and fluctuating demand and supply, influencing pricing and liquidity in global cap-and-trade systems.

Benefits and Limitations of Carbon Offsets

Carbon offsets reduce net greenhouse gas emissions by funding projects like reforestation and renewable energy, promoting environmental sustainability and corporate social responsibility. They offer a practical solution for individuals and companies to compensate for unavoidable emissions but depend on rigorous verification to ensure actual emission reductions. Limitations include potential delays in environmental impact, risk of double counting, and reliance on market mechanisms that may not address the root causes of carbon emissions.

Regulatory Frameworks Governing Carbon Credits

Regulatory frameworks governing carbon credits establish standardized criteria for issuing, trading, and verifying credits to ensure transparency and prevent double counting in carbon offset markets. These frameworks often involve national and international bodies such as the Verified Carbon Standard (VCS) and the Clean Development Mechanism (CDM), providing legal backing and credibility to carbon credit transactions. Stringent compliance requirements and reporting mechanisms are integral to maintaining the integrity and environmental effectiveness of carbon credit systems.

Corporate Strategies for Carbon Neutrality

Corporations aiming for carbon neutrality often differentiate between carbon offsets and carbon credits to optimize their environmental strategies. Carbon offsets represent verified emission reduction projects that companies invest in to compensate for their own emissions, while carbon credits are tradable permits allowing firms to emit a specific amount of greenhouse gases within regulatory limits. Integrating both tools enables businesses to meet sustainability goals, comply with regulations, and enhance corporate social responsibility effectively.

Future Trends in Carbon Offset and Credit Markets

Emerging trends in carbon offset and credit markets highlight increased integration of blockchain technology to enhance transparency and traceability of carbon credits. Regulatory frameworks worldwide are evolving to standardize methodologies, ensuring higher credibility and market stability. Growth in corporate net-zero commitments drives demand for innovative, nature-based solutions that offer measurable and verifiable carbon reductions.

carbon offset vs carbon credit Infographic

difterm.com

difterm.com