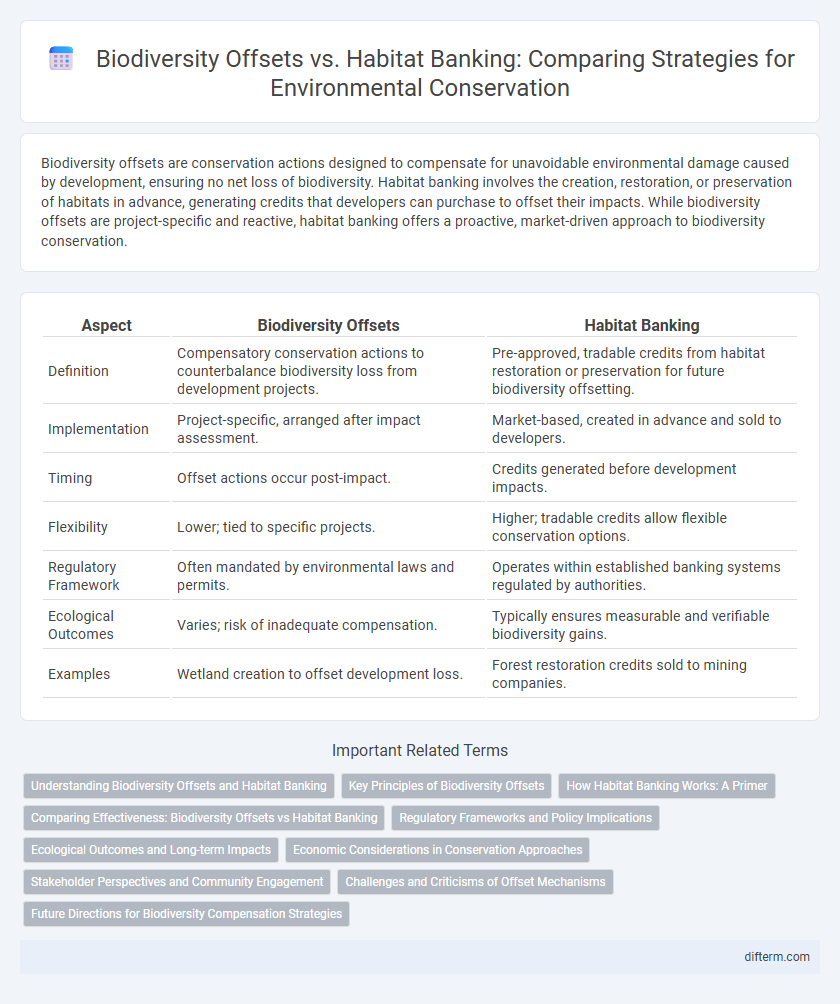

Biodiversity offsets are conservation actions designed to compensate for unavoidable environmental damage caused by development, ensuring no net loss of biodiversity. Habitat banking involves the creation, restoration, or preservation of habitats in advance, generating credits that developers can purchase to offset their impacts. While biodiversity offsets are project-specific and reactive, habitat banking offers a proactive, market-driven approach to biodiversity conservation.

Table of Comparison

| Aspect | Biodiversity Offsets | Habitat Banking |

|---|---|---|

| Definition | Compensatory conservation actions to counterbalance biodiversity loss from development projects. | Pre-approved, tradable credits from habitat restoration or preservation for future biodiversity offsetting. |

| Implementation | Project-specific, arranged after impact assessment. | Market-based, created in advance and sold to developers. |

| Timing | Offset actions occur post-impact. | Credits generated before development impacts. |

| Flexibility | Lower; tied to specific projects. | Higher; tradable credits allow flexible conservation options. |

| Regulatory Framework | Often mandated by environmental laws and permits. | Operates within established banking systems regulated by authorities. |

| Ecological Outcomes | Varies; risk of inadequate compensation. | Typically ensures measurable and verifiable biodiversity gains. |

| Examples | Wetland creation to offset development loss. | Forest restoration credits sold to mining companies. |

Understanding Biodiversity Offsets and Habitat Banking

Biodiversity offsets are conservation actions designed to compensate for residual environmental impacts by ensuring no net loss of biodiversity. Habitat banking involves creating, restoring, or preserving habitats in advance, generating credits that developers can purchase to offset ecological damage elsewhere. Both mechanisms promote sustainable development by balancing ecological preservation with economic growth through regulated compensation frameworks.

Key Principles of Biodiversity Offsets

Biodiversity offsets are conservation activities designed to compensate for residual environmental impacts, ensuring no net loss or net gain of biodiversity through measurable outcomes. Key principles include transparency, like clear accounting of biodiversity losses and gains, and adherence to the mitigation hierarchy, prioritizing avoidance and minimization before offsetting. Effective offsets require rigorous monitoring, long-term management, and stakeholder engagement to secure ecological equivalence and durability of conservation benefits.

How Habitat Banking Works: A Primer

Habitat banking involves the creation, restoration, or enhancement of natural habitats to compensate for adverse environmental impacts caused by development projects. Developers purchase credits from habitat banks, where conservation activities are managed and monitored to ensure ecological equivalence and permanence. This market-based mechanism promotes biodiversity conservation by allowing flexible, scalable offsets aligned with regulatory standards and landscape-level planning.

Comparing Effectiveness: Biodiversity Offsets vs Habitat Banking

Biodiversity offsets and habitat banking both aim to counterbalance environmental damage by protecting or restoring ecosystems, yet habitat banking tends to be more effective due to its market-based approach and scalability. Biodiversity offsets often face challenges in ensuring equivalency and long-term sustainability, whereas habitat banking provides pre-approved conservation sites with verified ecological value, reducing project-specific risks and delays. Empirical studies indicate that habitat banking generates higher-quality habitat gains and enhances landscape connectivity more consistently than traditional biodiversity offset schemes.

Regulatory Frameworks and Policy Implications

Biodiversity offsets and habitat banking operate under distinct regulatory frameworks that shape their implementation and effectiveness in conservation policy. Biodiversity offsets typically require developers to compensate for ecological damage by restoring or protecting biodiversity elsewhere, guided by stringent environmental regulations and offset ratios to ensure no net loss. In contrast, habitat banking allows for the creation and sale of conservation credits from restored habitats, providing a market-driven approach regulated through standardized assessment protocols and compliance with national or regional conservation laws.

Ecological Outcomes and Long-term Impacts

Biodiversity offsets aim to compensate for environmental damage by creating or restoring habitats elsewhere, but their ecological outcomes often vary due to inconsistent monitoring and enforcement. Habitat banking offers a more structured approach, generating credits from restored or conserved habitats that are rigorously audited, which improves long-term ecological effectiveness and accountability. Long-term impacts of habitat banking tend to be more positive as it promotes habitat connectivity and landscape-scale conservation, reducing biodiversity loss over time.

Economic Considerations in Conservation Approaches

Biodiversity offsets and habitat banking are economic instruments designed to balance development impacts with conservation goals, where offsets typically involve once-off, negotiated compensation projects while habitat banking offers pre-certified credits for habitat restoration or preservation. The market-based nature of habitat banking often provides greater economic efficiency by enabling developers to purchase credits from third-party sellers, fostering scalability and cost predictability. Economic considerations also include transaction costs, regulatory certainty, and long-term maintenance funding, with habitat banking generally reducing administrative burdens compared to bespoke biodiversity offset agreements.

Stakeholder Perspectives and Community Engagement

Biodiversity offsets often face criticism from local communities for limited stakeholder involvement and potential displacement, whereas habitat banking typically integrates transparent stakeholder engagement through predefined credit systems. Effective community engagement in habitat banking fosters trust and equitable benefit-sharing, addressing concerns around ecological impact and compensation. Stakeholder perspectives reveal that habitat banking's structured approach enables better monitoring and accountability compared to the more variable implementation of biodiversity offsets.

Challenges and Criticisms of Offset Mechanisms

Biodiversity offsets face challenges such as ensuring genuine ecological equivalence and preventing net loss of species diversity, often criticized for enabling continued habitat destruction rather than true conservation. Habitat banking struggles with transparency and accountability, risking speculative trading that may not deliver promised restoration outcomes. Both mechanisms are challenged by difficulties in measuring complex ecosystem values and ensuring long-term management and monitoring.

Future Directions for Biodiversity Compensation Strategies

Future biodiversity compensation strategies emphasize integrating habitat banking with adaptive management to enhance ecosystem resilience and restore degraded landscapes efficiently. Promoting transparent, science-based metrics for biodiversity offsets will improve accountability and long-term ecological outcomes. Leveraging emerging technologies, such as remote sensing and AI-driven monitoring, will refine habitat quality assessments and support dynamic offsetting frameworks.

biodiversity offsets vs habitat banking Infographic

difterm.com

difterm.com