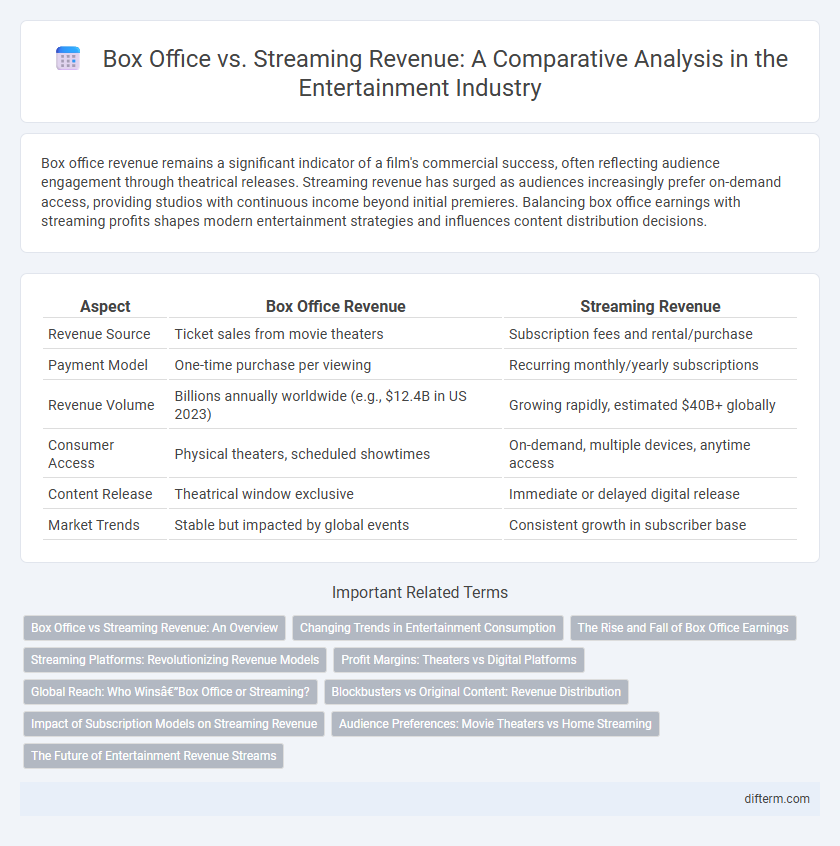

Box office revenue remains a significant indicator of a film's commercial success, often reflecting audience engagement through theatrical releases. Streaming revenue has surged as audiences increasingly prefer on-demand access, providing studios with continuous income beyond initial premieres. Balancing box office earnings with streaming profits shapes modern entertainment strategies and influences content distribution decisions.

Table of Comparison

| Aspect | Box Office Revenue | Streaming Revenue |

|---|---|---|

| Revenue Source | Ticket sales from movie theaters | Subscription fees and rental/purchase |

| Payment Model | One-time purchase per viewing | Recurring monthly/yearly subscriptions |

| Revenue Volume | Billions annually worldwide (e.g., $12.4B in US 2023) | Growing rapidly, estimated $40B+ globally |

| Consumer Access | Physical theaters, scheduled showtimes | On-demand, multiple devices, anytime access |

| Content Release | Theatrical window exclusive | Immediate or delayed digital release |

| Market Trends | Stable but impacted by global events | Consistent growth in subscriber base |

Box Office vs Streaming Revenue: An Overview

Box office revenue continues to dominate global entertainment earnings, generating over $42 billion worldwide in 2023, while streaming platforms collectively amassed approximately $35 billion. The theatrical experience drives higher per-viewer spending and exclusive releases, maintaining its status as a premium content showcase. Streaming services excel in subscription growth and long-term engagement, reshaping consumer habits with on-demand access and diverse content libraries.

Changing Trends in Entertainment Consumption

Box office revenue has traditionally dominated the entertainment industry, but streaming platforms are rapidly reshaping consumer behavior and revenue models. Data from 2023 shows global streaming revenue surpassing $70 billion, outpacing theatrical releases as audiences prefer on-demand access and diverse content libraries. This shift emphasizes how digital distribution and personalized viewing experiences drive evolving entertainment consumption trends.

The Rise and Fall of Box Office Earnings

Box office earnings experienced significant growth throughout the 20th century, driven by blockbuster hits and expanding global markets, reaching over $42 billion worldwide in 2019. The rise of streaming platforms such as Netflix, Disney+, and Amazon Prime dramatically shifted consumer behavior, causing a decline in traditional box office revenue by nearly 70% during the COVID-19 pandemic period. Despite this downturn, some studios are focusing on hybrid release models to balance box office sales with growing streaming subscription revenues, aiming to stabilize overall entertainment industry profits.

Streaming Platforms: Revolutionizing Revenue Models

Streaming platforms have revolutionized revenue models by generating over $85 billion globally in 2023, surpassing traditional box office earnings that stood at approximately $45 billion the same year. Subscription-based services like Netflix, Disney+, and Amazon Prime Video leverage data-driven personalization to increase user engagement and retention, significantly boosting lifetime customer value. This paradigm shift allows studios to monetize content through exclusive releases and global reach, redefining financial success metrics beyond the confines of theatrical box office sales.

Profit Margins: Theaters vs Digital Platforms

Profit margins for theaters typically range between 10-15%, constrained by high operational costs such as venue maintenance, staff, and film distribution fees. Digital streaming platforms often achieve profit margins exceeding 20%, driven by lower overhead expenses and scalable subscription models. The shift towards streaming revenue reflects higher profitability per dollar earned compared to traditional box office sales.

Global Reach: Who Wins—Box Office or Streaming?

Global box office revenue reached $42.5 billion in 2023, driven by blockbuster hits that attracted diverse international audiences to theaters. Streaming platforms generated an estimated $85 billion globally, leveraging subscription models and localized content to penetrate markets beyond traditional cinema reach. Despite cinemas' cultural appeal and event-driven releases, streaming's scalability and personalized access position it as the dominant force in worldwide entertainment consumption.

Blockbusters vs Original Content: Revenue Distribution

Blockbusters generate the majority of box office revenue, leveraging wide theatrical releases and global marketing to maximize ticket sales. Original content on streaming platforms drives subscription growth, contributing significantly to streaming revenue through exclusive releases and long-term audience retention. Revenue distribution increasingly favors streaming as consumers shift towards on-demand viewing, though theatrical blockbusters continue to dominate high-grossing revenue charts.

Impact of Subscription Models on Streaming Revenue

Subscription models have significantly boosted streaming revenue by providing steady, predictable income streams for platforms like Netflix and Disney+. This recurring revenue model encourages continuous content investment and subscriber retention, distinguishing streaming services from traditional box office earnings that rely heavily on one-time ticket sales. Consequently, subscription-based streaming services are reshaping entertainment revenue structures by prioritizing long-term consumer engagement over immediate box office performance.

Audience Preferences: Movie Theaters vs Home Streaming

Audience preferences reveal a shifting landscape where box office revenue experienced a decline of 15% in 2023, while streaming platforms surged with a 25% increase in subscription and rental income. Movie theaters retain appeal for blockbuster releases, drawing over 60% of viewers seeking immersive sound and large-format visuals. Home streaming services attract 70% of younger demographics, valuing convenience and access to diverse content libraries over the traditional theater experience.

The Future of Entertainment Revenue Streams

Streaming revenue surpasses box office earnings as global digital subscriptions exceed 1 billion in 2024, reshaping the entertainment industry's financial landscape. Film studios increasingly prioritize direct-to-streaming releases, leveraging data-driven content strategies to maximize subscriber retention and lifetime value. Hybrid distribution models combining theatrical releases with exclusive streaming windows optimize revenue streams, reflecting evolving consumer preferences for on-demand content.

box office vs streaming revenue Infographic

difterm.com

difterm.com